Greg Dalton: Today on Climate One we’re discussing the fracking boom that is fundamentally changing the way America powers its economy. I'm Greg Dalton. Welcome everyone.

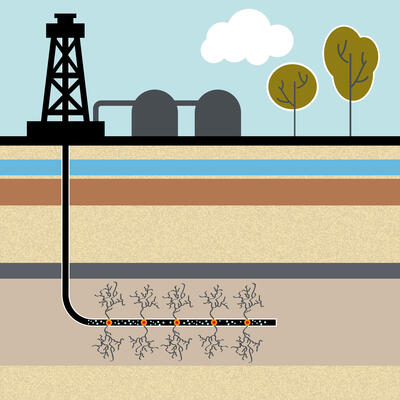

Most new oil and gas wells in this country are drilled using hyrdraulic fracturing, the injection of a cocktail of water and chemicals at high pressure to release bubbles of oil or gas trapped in shale rock. Thanks to fracking, America is awash in cheap natural gas and is poised to become the world’s largest petroleum producer next year. That would have been unthinkable just a few years ago. Fracking advocates say that when it's done properly, it will boost our economy and help fight climate disruption. Detractors say it could poison precious groundwater supplies and it fracks natural gas, it’s not as climate friendly as it's made out to be. Over the next hour, we’ll look at the economic and environmental impact of fracking in California and across the country.

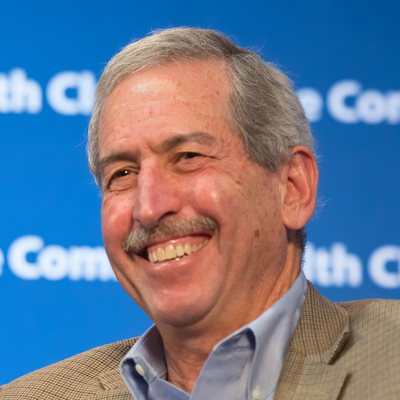

Joining our live audience at the Commonwealth Club in San Francisco, we’re pleased to have with us three experts.

Russell Gold is a reporter in Austin with the Wall Street Journal and author of

The Boom: How Fracking Ignited the American Energy Revolution and Changed the World.

Trevor Houser is a partner with the Rhodium Group and co-author of

Fueling Up: The Economic Implications of America's Oil & Gas Boom. And

Mark Zoback is a professor of geophysics at Stanford and was a member of the Secretary of Energy’s Committee on Shale Gas Development from 2011 to 2012. Please welcome them to Climate One.

[Applause]

Russell Gold, tell us about the father of fracking, Edward Roberts.

Russell Gold: Well, when I first started covering the industry 10 years ago, my sense of oil and gas discoveries was sort of what I had seen in the movies. The gusher going up and people dancing. There will be blood or James Dean and giant. And it took me a little while to realize that that's sort of the exception to the rule. And the real history of petroleum exploration is not the wild cutters drilling a well off somewhere and getting lucky. It's drilling a well and forcing your will onto the rocks, making the rocks do what you want, cracking and fracking them.

And I was really amazed to discover that back in the 1860’s, just a few years after the first well, the famous Drake Well was drilled in Western Pennsylvania, that this whole business of creating fractures in the wells begun. And it starts with Colonel Roberts, Edward Roberts, who was – the story as he tells it, he was in the Civil War. He was a colonel for the Union. And he got in trouble for being drunk on Dress Parade. And he was waiting for his court-martial. And, of course, they needed troops, they needed – they were fighting a war at the time. So right in the middle of this they said, “Well, we haven’t come up with a decision what we’re going to do with you yet. So in the meantime go to Fredericksburg.” So he takes his troops to Fredericksburg. And the Battle of Fredericksburg was an incredibly bloody battle especially for the Union. The Union was in the low area of the Confederacy. The Confederate troops were in a high area. And they were raining shales down on the union. So Colonel Roberts was sitting there, he was trapped. And he noticed that when shales fell onto ground, they exploded in one way. But when they fell into this ditch with water, the weight of the water would temp down the explosion and the explosion would tend to go out. And he thought to himself “This could actually have some real implications.”

So after the Battle of Fredericksburg, he actually is court-martialed. He leaves the military and he goes out to Western Pennsylvania and he convinces people that this new drilling that's going on, if they would just put one of his torpedoes, he called them torpedoes, down at the bottom of a well, fill it up with water, and then activate the torpedo, it would create a fracture because back then if you drill the well, you could come inches away from an oil sim and it will be a dry well. But if you explode this bomb at the bottom of a well, you would create these new fractures and maybe it would hit an oil sim. And lo and behold, he starts doing this. And as it turns out, this is incredibly successful.

And even though everyone remembers Colonel Drake who drilled the first well, Colonel Drake ends up penniless, pretty much living on the streets of New York before he's given a stipend from the State of Pennsylvania. Colonel Roberts who invents the torpedo ends up one of the richest man in the United States partially by suing anyone who tried to copy his invention [laughter]. So the history of sort of man’s dominion over rock, trying to drill a well but then do something with the rock goes back to the beginning. And then you have this middle period, really right about 1901. Spindletop was discovered in Texas. That's the era of the gusher. But there are not that many giant oil reservoirs where you can sink a well and the oil comes flying up.

And right about the middle of the century you still have some wild cutters they are mostly gather around Houston. But you have this interesting gentleman named George Mitchell, son of Greek immigrants, and he is one of the first wild cutters, so to speak, who is no longer going to just try to go off and find the oil. He is more interested in fracking. Can we use modern science to make better wells? And he learns about fracking because at this time fracking is starting to come back, the big giant gushers are gone. And he leases a bunch of land north of Fort Worth and is making good wells. And he's doing an early stage of fracking at that time, much smaller than what we have today, and is making these wells work. But each time he drills down there, he realizes that underlying the oil reservoir he's shooting for is another rock, very dense shale rock, and the tools show gas, each time you go in there, there's gas that's being shown. So he, for 16 years, from 1982 to 1998, says to his company “Go and try to figure out how to open up that shale, how to make a good well into that shale. It doesn’t matter if you can't do it. It's all right. We’re just going to do a few wells a year.”

And for 16 years he plods along and basically has one failure after another. He's learning a little bit. Sometimes he gets a little oil and gas out. It's mostly gas up there. And then in 1998 one of his young engineers tries a new form of doing this, a lot more water, a lot more pressure, and is by far and away the best well they've done in 16 years. And that turns the corner. So 1998, all of a sudden the industry begins to figure out that they can use water with chemicals added to slicken it and lots of pressure to break open these incredibly dense shales. And so the final person, really, who changes fracking and makes fracking what we know of today…

Greg Dalton: I'm sorry. George Mitchell ends up a billionaire too.

Russell Gold: Thank you. George Mitchell ends up a billionaire. He sells his company to Devon, does incredibly well. And I should mention, he's actually a fascinating character because he is – you don’t think about this – you don’t think a Houston oil man would be both liberal and an incredible adherent of sustainability but he is. He falls under the sway of Buckminster Fuller. Basically after he makes enough money, he's no longer scrapping by, his mind begins to wander. And he starts getting interested in all sorts of things. He funds sustainability studies at the National Academy of Sciences. And there's Dennis Meadows who writes Limits to Growth, one of the early books on that. So he's fascinated about that but he never pursues renewable energy. He really believes natural gas is the right fuel.

And then just to finish this off, so the industry figures out we can use fracking to get some of these gas. And it's really about 2003-2004 that an Oklahoma businessman named Aubrey McClendon, who’s running Chesapeake Energy, adopts this. And his great contribution to this is money. He knows how to work Wall Street. And he goes to Wall Street and gets billions of dollars of funding and starts leasing up everything he can find above the shale.

So he takes it from one shale in Fort Worth, and all of a sudden, he leads the charge. And by the time he's done, about 2010-2011, Chesapeake Energy owns or has leases to drawing land the size of Kentucky. And this is amazing because back when he starts in 2003, Chesapeake Energy was nothing. It was basically in bankruptcy. An incredible story. He doesn’t make much money. He's constantly borrowing money to get bigger and bigger. I mean, this is a growth story. And McClendon sort of a fascinating character, he's very much a capitalist at heart, very much materialist. At one point his wine collection ran to 70 pages. He actually got in trouble and had to use it to get a loan. So we know that his wine collection ran to 70 single space pages.

Really, the best way to describe them and what he did with the fracking revolution is he put his foot on the accelerator and mashed down. And the industry which maybe was going a 30 or 40 miles an hour, about 2005-2006-2007 starts going 80 to 90 miles an hour. Everyone was forced to catch up with them. And that's why in some ways this energy boom happens too quickly because he's got money coming in from Wall Street, they’ve got the technology in place, and they just go to town. And it's not just Chesapeake. There are about maybe a dozen companies that are caught in his slipstream and figured if we can't lease quickly, we've got to match him because if we don’t, Chesapeake is going to lease this land and all the shale and they're going to start doing it. And so that's really when we get to 2009-2010 and people started talking about fracking, some of the environmental issues, by that point the industry is going 80 miles an hour leasing, moving as quickly as they can and fracking every well that they have. And they have discovered shales.

And shales when fracked will provide oil and natural gas depending on where you are. There's just an abundance of energy available. People thought that the United States was tapped out. After 2006-2007, that whole narrative changes. There's more energy than we frankly know what to do with right now.

Greg Dalton: And the energy that we thought we were importing now we’re thinking about exporting.

Mark Zoback, how has this changed the energy landscape in the country and why do you think it's good for America, this fracking boom that

Russell Gold just described?

Mark Zoback: Well, it's often referred to as the shale gas revolution. And these shales were known for years. They are the source rocks for all hydrocarbons. And what George Mitchell demonstrated, as Russell said, was the ability to use horizontal drilling and multistage hydraulic fracturing to extract hydrocarbons from rocks that are intrinsically a thousand times less permeablethan limestone? That's how low the permeability isand it was really quite miraculous. Most people thought he couldn’t do it and he was wasting his time.

Now, we have an abundance of natural gas. Gas prices are very low. In fact, in many places you can't afford to produce gas prices at the current sales price. And so what happened is the same technology has shifted to other known reservoirs, in this case, their oil reservoirs, low quality oil reservoirs, again, that have been known forever but were simply uneconomic. So last year in the Permian Basin near Midland, Texas, 6,000 wells were drilled into well-known formations that had wells drilled previously but you basically couldn't make any economic sense out of it. And now you can. And so what's happened is the revolution had two phases; first, abundant natural gas and it's replacing coal which is certainly good for the environment in lots of different ways from CO2 to mercury to the other socks and knocks particulate matter that has to be disposed off.

So natural gas has had a huge impact there. And now what the oil is doing is simply replacing imported oil, and that's why our oil production is going up is we’re simply producing oil from long known but previously uneconomic reservoirs.

Greg Dalton: Trevor Houser, is this a positive story? Is there a dark side to this? Do you agree that this is primarily a positive story, the natural gas boom?

Trevor Houser: I mean, for the economy it's certainly been positive over the past few years. The oil and gas boom kind of works on the U.S. economy in a couple of different ways. All of this increase in production leads to investment and exploration investment and well completions equates demand for everything from steel pipe to trucks, to compressors. And that has fairly significant economic benefits not just in the communities in which the production is occurring but in communities that produce goods that supply that production.

And then in the case of natural gas, the reduction in prices leaves households with more discretionary money, it reduces cost for businesses. So those two things kind of work on the economy in the same way that economic stimulus package does. So the Recovery Act in 2009 combined infrastructure investment piece and a tax cut piece. And that's kind of similar to the way that the oil and gas boom is working on the U.S. economy today. There's an infrastructure investment equivalent which is upstream oil and gas production, and a tax cut equivalent in the form of lower energy prices. And indeed when we crunch the numbers, it looks like the magnitude of the economic impact of the oil and gas boom over the past few years has been about the same as the Recovery Act was.

Greg Dalton: You say it's about a third of a percent of economic growth.

Trevor Houser: Right. So instead of growing it 2.6% per year, we grow it 2.8% or 2.9% a year. So it's certainly helpful.

I mean, this is tough economic times. Every couple basis points of additional economic growth we can get is great. Where folks go awry is extrapolating these current trends into the future and saying that this is going to be a long-term transformative event for the economy as a whole. The reason why stimulus works is when it's applied in a point where your economy is below full employment. So you’ll have workers that don’t have jobs and need jobs, you have capital that's sitting on the side lines, there's not enough demand. And that's why the oil and gas boom is increasing economic growth today. As the economy returns back to full employment, all of that investment in the oil and gas sector is competing for capital with other sectors of the economy. Jobs created in the oil and gas sector are not completely additional jobs to the economy. There are jobs that would have occurred somewhere else. And so that's when you start to get winners as well as losers.

So for example, if I was to go to North Dakota today, to Williston, North Dakota, kind of ground zero of the shale oil boom or tied oil as it's called boom, and I decided I wanted to setup a company manufacturing Barbie Dolls or t-shirts, something like that, I'm going to have to pay $130,000 a year for a secretary. Hotel rooms are going to be $400 a night. I'm not going to be a very competitive t-shirt manufacturer because it just makes more sense to produce oil and gas if you're on Williston and that, what you see happening in a microcosm happens at a national level as our economy starts to recover where less of the investment that's occurring in oil and gas is additional. So this is very different than the IT boom. People are comparing the oil and gas revolution to the IT revolution, that it will fundamentally transform the economy.The reason that the IT revolution transformed the U.S. economic growth was not because of an increase in sales of computers. It was because of the productivity improvements that that enabled as companies throughout the economy applied IT.

So if I was UPS and logistics, by applying IT in my business, I was able to do logistics cheaper and more efficiently. Energy has done that in the past when we went from wood to coal in the late 1800s. Coal was a more useful type of energy. It enabled new types of economic activity. We couldn't have had the Industrial Revolution if all we had was wood. It's just not dense enough. Likewise, when we went from coal to electricity in the early 1900s, electricity was more useful. It enabled new types of economic activity. What we’re talking about today is not a new and more useful type of energy. It's the same energy, it's just cheaper. And that's a benefit but it's a one-off shock. It doesn’t translate it into a sustained improvement in the rate of economic growth.

Greg Dalton: Is the gas boom going to create manufacturing? I guess maybe you've answered this. The statement that's out there is it's going to lower energy cost, bring jobs back onto American shores.

Russell Gold, is it going to be a renaissance in American manufacturing or is it going to be very fleeting as

Trevor Houser just presented.

Russell Gold: No. There clearly is investment going on particularly in places like the Gulf Coast to build more petrochemicals manufacturing. And these are investments that once they're made will stick around for many years because you sunk the capital on it. It's very easy to overstate how much investment there will be but there will be investment. There will be some sort of a manufacturing rebound frankly because if you're looking at doing some sort of manufacturing in the United States which uses a lot of energy, you can buy natural gas in the United States, near Louisiana for $4 to $5. You go to Europe, you're going to pay $10 to $12. You go to Asia, you're going to pay $15 or $16. It suddenly becomes more attractive to do that kind of manufacturing in the United States. So we’re seeing some of those investments go on. There actually was a plastics plant that was in Louisiana, and it was literally about 10 years ago, crated up and moved to Trinidad and Tobago which has very cheap natural gas.

And they're now building a new facility, very similar, in the same place in Louisiana. I mean, that's just one anecdote but it sort of shows you the kind of thinking and investment that's going on.

Greg Dalton: But

Mark Zoback, couldn't this be a short term boom and we end up with polluted water and some long term problems that in the end are more complicated and more expensive to fix than this kind of short term rush we get in the economy?

Mark Zoback: Well, there's no question that drilling whether you're horizontal drilling for gas or oil is a large scale industrial process. And if it's not done right, there are all sorts of things that can go wrong. Now, fracking gets a lot of attention. It's something easy for people to remember. It's a catchy term. It's scary. It's high pressure, involves chemicals that are hard to pronounce and harder to understand. But in fact fracking isn’t the problem. The real problem is well construction. And if you do a good job of building a well – and we know how to build wells – if we do a good job of well construction, we really can prevent the kinds of problems we should worry about below the earth’s surface, and that is the leakage that could contaminate aquifers that could leak gas to the atmosphere and obviate the benefit of using natural gas instead of coal, for example, for greenhouse gas emissions.

So there are all sorts of issues both above ground. The act of doing this is very invasive. Lots of trucks, lots of people, lots of activity in communities that are not necessarily used to these kinds of activities. So it's an invasive act and it can be a problematic act. We’re drilling tens of thousands of wells if it's not done properly. I think we know how to do it and we know what regulations should be. We simply need to regulate this industrial process as we regulate other industrial processes or the harm will outweigh the benefits.

Greg Dalton: And why should the American public trust the industry to do this correctly after the Deepwater Horizon and other disasters when they're cutting corners and if they think the regulators aren’t watching? Why should we trust the companies to do this right?

Mark Zoback: Well, I think the public has every reason to be skeptical. There's a large scale profit motive that's driving what happens in the field. And in the oil and gas business, the expense is really the expense of drilling wells. That expense dwarfs everything else on the balance sheet. And so if you're not acting with best practice and doing things right and cutting corners, you can save money. And so what we need is a vigorous enforced regulatory system to make sure that we get the bad actors out of the game and we let the more reputable companies proceed to develop the resource in responsible manner.

Russell Gold: There's another point that was made. We are producing a lot more oil in the United States and importing a lot less from West Africa. We thought we were going to become an importer of natural gas. Now we’re not. Having traveled to many oil and gas fields around the world, I have a lot more confidence that oil and gas drilling could be done right in the United States where people are paying attention, where there are regulators – could be stronger, I agree with Mark, where there are community activists paying attention to what's going on.

One of the really amazing things about this energy boom is that it is quite literally happening in our backyards. This is not an energy boom that's happening above the Arctic Circle in Alaska or way off in Gulf of Mexico over the horizon. This is happening in county after county in many places. And while that is intrusive and while we are talking about an industrial process, if we’re not doing it here in the United States, it's going to be done somewhere else. And I think that there's a real opportunity to figure out how to build the wells correctly and make sure they're done – how to eliminate natural gas leaking out of these wells which will accelerate climate change.

We have a real opportunity. And as long as the world is using fossil fuels and uses an incredible amount to power the modern economy – this is an opportunity to do it right in the United States, and then to export that knowledge and that knowhow to other places around the world.

Greg Dalton: Mark Zoback, you said the more reputable companies should do this better, should be trusted more. But before the Deepwater Horizon, BP was a more reputable company. They were the model oil company beyond petroleum. And then we've seen what they've done. So does a bigger brand necessarily lead to more responsible action?

Mark Zoback: Not necessarily. I think in general, the bigger companies do a better job and that's because they have a longer view. They're going to be in the game for a long time. And when things go wrong, there's somebody to sue, quite frankly. And they have expertise. Smaller companies sort of get in and out fast. And if they can get in and out fast and cut a few corners, they will, and then they turn the assets over to some other company and they go on to the next thing. So I do think the bigger companies are, in general, far more committed to doing it right.

The Deepwater Horizon was a startling example of doing things wrong. And it was a big company. And the Exxon Valdez hit the rocks. And Exxon and BP are, in general, good companies but good companies sometimes do bad things. And we need a vigorous regulatory system. We have to have the right regulations in place and they have to be enforced. And unless that's true, you only have – do airlines want planes to crash? Of course not but we also have an FAA and a very vigorous inspection and regulation process to go along with what the companies are doing on their own. And you need both to move forward.

Russell Gold: Can I give you a very specific example, follow up on that? After the Deepwater Horizon, the federal government wised up and realized that it had one government agency that was both charged with regulating and making sure that offshore drillers weren’t cutting corners, were doing things right. But the same agency was supposed to be leasing and generating money for the government. And they realized you can't have both a cheerleader and a watchdog under the same roof.

Greg Dalton: And they were literally in bed with industry, I mean literally.

Russell Gold: Yes. There was that instance where there was some hanky-panky. So they split that up. You now have two agencies in the federal government; one that's charged with leasing and generating some revenue, and the other that's charged with being out there, taking helicopters and inspecting. They are now in the states – I cannot – there may be a state that does it like this, which splits it up. Most states don’t. Most states, Texas, North Dakota, still have the watchdog and the cheerleader under the same roof. So that lesson has not been learned.

Greg Dalton: Let's talk about another state example. Colorado is one of the key fracking states. Recently the Environmental Defense Fund got together with energy suppliers to do some emissions controls. Three cities in Colorado ban fracking. There may be a statewide ban on fracking on the November ballot, the same time there’ll be a Democratic governor on that ballot, Governor Hickenlooper. So

Russell Gold, you're nearby. What does Colorado say to you in terms of a national bellweather, what might or might not happen in terms of state regulation on fracking? There are political fights that are happening.

Russell Gold: Yes, I know. It's the most interesting state to watch right now in terms of the politics of it. Governor Hickenlooper, a Democrat, as you mentioned, a former – he's a geologist. He was in the industry then he became a brewer and so he's been very involved with liquids.

Greg Dalton: He knows liquids, yes.

[Laughter]

Russell Gold: He knows liquids, yes. He’s staked out the position that you can do this right. You can have the economic benefits of drilling but at the same time you can make sure that the industry is doing things right. And he, right now, is very much leading that charge.

He got cooperation from the three big oil and gas companies in the state to try to do green completions, in other words to complete the well in a way that captures more of the pollutants that come out and can be carcinogens. But he has not convinced a lot of people right now. And there really is that backslash. As you mentioned, three communities, two of them on the front range, one in Fort Collins which voted to ban fracking. It's very easy to say “We don’t want this on our backyard. We don’t want fracking.” Governor Hickenlooper, I think, is taking out a much trickier terrain which to say “We can do it and we can do it in a way which is not particularly obtrusive.” But at the same time, industry really needs to be involved.

There's an interesting example. Last summer a rig shows up right at the foot of a driveway of a homeowner outside of Boulder, sets up, making all sorts of noise, lights. I mean, not doing – there are some basic things you can do. Put up sound walls so it's quieter. You can turn the lights in so it's not blaring at the neighbors. As it turns out, this neighbor was a member of Congress. Jared Polis, he's one of the richest people in Congress, caused a huge ruckus. And it just sort of drove home. This was a small company, back to your point, that not all of these companies are doing the right thing and that they're no off focused on this question of how do we live with the company. How do we become a good community neighbor? And that's really driving the politics right now in Colorado. And I think Governor – I don’t have a prediction but I think Governor Hickenlooper, he either solves it and becomes a national figure or he goes back to brewing beer.

Russell Gold: In my book I write about sort of another lesson here. A small company in – a Denver company that was operating in Pennsylvania drills a well and they completed it, they're getting ready to hook it up, and someone comes out notices, I think it rained the night before, that there are some bubbles coming up into this water there. So they call in and the company comes. And there's clearly a leak through the cement. So something was wrong with this well. They, to their credit, throw everything they can. They stopped everything. They spent several hundred thousand dollars on every conceivable tool that the oil industry has in its tool bag to figure out where the leak is in the cement.

So there, you give them credits, small company doing the right thing. The problem was they couldn't figure it out. Even the best tools that were available couldn't figure out exactly where the leak was and they couldn't figure out how to repair it. So that's another problem. Even when you have a company that's committed to doing the right thing, you're talking about operating miles under ground, it's difficult to see, you have to infer what's going on. You can't always get it right.

Greg Dalton: And

Russell Gold, where you live in Texas, there's fracking going on, water intensive process in some drought stricken counties. How are people fracking – and cattlemen are being hurt when there's such a big drought.

Russell Gold: It's a rule of capture in Texas. If you get the water, you get to use it. There's no regulation that try to divide it up and say, “Okay. Well, this much for agriculture, this much for oil and gas.” And that actually has presented a problem. Oil and gas have so much money that they can outbid everyone else. There is a movement right now mostly being led by companies to use brackish water, to figure out the chemistry so that right now mostly it's freshwater that's being used. And frankly the reason freshwater is being used is that that's where they figured out the chemistry for it. It's not because freshwater necessarily is that much better. So they're trying to figure out can we use this aquifers, brackish salty aquifers that aren’t good for drinking, aren’t good for cattle. Can we figure out how to use that to do fracking? And from what I understand, progress is slow but it's encouraging. So hopefully there's going to be – when we have this conversation again in two or three years, that portable water won't be used anymore. They'll be using water that they can't use.

Greg Dalton: Mark Zoback, waterless fracking, other kinds of – can fracking become cleaner through technological innovation?

Mark Zoback: Well, first is move away from freshwater, as Russell was saying. There really are no impediments to that. If you think about an offshore drilling platform, we've all seen photos of them, they don’t drill those wells with freshwater. They don’t frack those wells with freshwater.

The industry knows how to work with saltwater and they should. So in areas where water is scarce, there should simply be a movement to brackish and saline water. It's notable technology, it's used all the time. There are alternatives to using water at all. Nitrogen is being used as a frack fluid. CO2 is being used a frack fluid. And there are real advantages. And that's being seriously looked at right now. While we have too much CO2 in the atmosphere, it's actually hard to get. If you are actually a driller and you were fracking the well and you wanted to frack with CO2, it's harder to get and more expensive to pay for CO2 to do it but there are actually advantages to using CO2. So we may well see more of that as supplies of CO2 can be made available to the people in the field when they need it.

Greg Dalton: Mark Zoback is a professor of geophysics at Stanford University. We’re talking about fracking at Climate One. Our other guests today are

Trevor Houser, author of

Fueling Up, and

Russell Gold, a Wall Street Journal reporter and author of

The Boom: How Fracking Ignited the American Energy Revolution and Changed the World. I'm Greg Dalton.

Trevor Houser, let's pick up on that carbon dioxide. How much credit can natural gas claim for reduced emissions of carbon pollution in the United States?

Trevor Houser: Well, definitely it gets some credit. So where we’re at today, at the end of 2012, the U.S. carbon dioxide emissions were down 12% relative to 2005 levels. I had the pleasure or displeasure of being a climate change negotiator for the U.S. in Copenhagen in 2009. And if you had told me in 2009 that we would be 12% below 2005 levels without passing cap and trade legislation, I would have danced a jig. Now, most of the reasons why emissions fell so fast was the economy collapsed.

And that's why emissions declined so rapidly in Europe over the past five to six years as well. But the carbon intensity of our energy also declined. And natural gas played an important role in that alongside increased growth in renewables. Now, that doesn’t include methane emissions. If emission of methane which is another potent greenhouse gas, if methane is natural gas, if it's combusted, it turns into carbon dioxide which is actually not as bad for the climate as if it's just vented into the air as methane. That's worse for the climate. So there's a lot of debate about how much of that methane is being leaked into the atmosphere. The current EPA level estimates, the total greenhouse gas impact of natural gas for power generation is considerably better than coal. If we find out that those methane emissions are considerably higher than the EPA estimates, then that balance…

Greg Dalton: And some people think that's really the case.

Trevor Houser: Some people think that's the case. The factor that people don’t take into account though in looking at natural gas’ role in reducing emissions directly is that when natural gas got a lot cheaper, people started using more of it. They didn’t just use more of it in the power sector, they used more of it in other parts of the economy as well. This is known as the rebound effect. People talk about this in the context of energy efficiency all the time, that if you guy a more efficient appliance, you're probably going to use it more. If you improve the efficiency of your house, you're going to heat it more. And that offset some of the gains from just improving energy efficiency.

The rebound effect applies to fuels as well. If energy gets cheaper, we use more of it. When natural gas got cheaper, we used more of it. And so that mitigated some of the climate benefit of that switch from coal to gas. In terms of other pollutants which Mark mentioned, sulfur dioxide and mercury, the benefit of that switch from cold and natural gas that we we've seen over the past five years has been dramatic in terms of reducing air pollutants that cause respiratory problems or mental problems in children in the case of mercury.

Greg Dalton: So has the gas been oversold in some respects in terms of its climate benefits?

Trevor Houser: So the climate consequences of the gas boom have been oversold by environmentalist. The climate benefits of the gas boom have been oversold by the industry. So same as the economic story. The economic benefits have been oversold by the industry. And the economic cost had been oversold by environmental groups. That's the point we make in our book. Taking that middle road makes for a very un-provocative book to read [laughter] saying it's not as good as you think, it's not as bad as you think. It's kind of somewhere in the middle. It doesn’t sell copies but I think that's about where we are.

On that, it's been good for the climate. That's my view. Now, if we find out fugitive emissions are higher, that could change a little bit. But it hasn’t been wildly good and it's certainly isn’t sufficient. So we saw a shift in coal generation in the U.S. from a peak of 50% for the past two decades, half of our electricity come from coal. Natural gas prices fall from $15 per MMBtu to $2 per MMBtu in April of 2012. And the share of coal and power generation goes from 50% to 33%, lowest it's been in decades. And that delivered a lot of the reduction in CO2 emissions.

Natural gas prices are no longer $2. They got up to $6, actually, in January when weather got particularly nasty out east. And we've seen coal share power generation increase. Coal is back at 40-42% of power generation. So in terms of future emission reductions, cheap natural gas alone isn’t going to get us very far. We've gotten as much of the reduction in the U.S. emissions as we’re going to get from low cost natural gas. What cheap natural gas does, and let me end on this, is it makes the cost of climate policy much less. So we can now reduce emissions through things like EPA regulations on existing power plants, state portfolio standards, carbon taxes. The cost of all of those policies just got cut in half because of natural gas.

Greg Dalton: Russell Gold, I want you to get into this. I have a quote that agrees with what

Trevor Houser was saying. This is John Hofmeister, former president of Shell Oil Companies, saying “Natural gas is helpful but it is not a solution. It is half the carbon of oil or coal but it is not a solution unto itself. Is that fair?”

Russell Gold: No. Absolutely. One of the things I say about this energy boom is that it's a great opportunity for us to think about what happens in 20 or 30 years because that's what we really need to be looking at is this is a revolution of our energy landscape so the question is where do we want to take it. Where do we want to end up in 30 years when all of a sudden all this natural gas we found, we've drilled and fracked and gotten out and all of a sudden gas prices gone back up? And it's fascinating, these renewable portfolio standards or these state standards, and California is obviously in front of the nation on this that want to get to 30% or 40% renewables on the power grid.

Well, one of the things that's been amazing is that every state that's put one of this in, there hasn’t been a single rollback. There hasn’t been a single state legislation which said, “You know what? Maybe that 20% of wind and solar we wanted is costing us a little too much. Let's go back down to 10%.” And Trevor, you make that point. I think one of the reasons is because we haven’t had a pressure from high priced power because we have natural gas. And that's a really important point which is forgotten. We’re growing solar and wind very quickly, double digit year over year growth. And I think one of the – you could argue we could be going faster but we’re growing very fast right now, and natural gas is enabling that.

And what's more – people often don’t talk about this. We are at – I think Texas the other day, which has a lot of wind power, had 29% at one point. That’s a record, 29% of the power in ERCOT which is the primary Texas power grid, from wind for about one hour but that was a record. It was a record for the United States, renewable energy. Well, how do we get to 20 and 30 and 40%, which is where I think most people feel we should go, without wrecking the economy? And frankly, how do we do it with a mix of power sources?

Well, natural gas turns out to be very good at powering up and powering down quickly when the wind stops blowing and all of a sudden you need a lot of power to balance the grid. Coal is not particularly good. Nuclear, you don’t want to do that. Whether we do it with a coal plant, you'll wear out the coal plant. So one of the benefits of natural gas that can't be overstated because I think it's very important is that it's a very good fuel for bringing more and more renewables on to the grid.

Greg Dalton: Mark Zoback, should be export natural gas in the last couple of weeks with what's happening in Russia, Crimea, Ukraine? If the U.S. exports natural gas could it loosen Russia’s strangle hold on Europe? Would that affect prices here?

Mark Zoback: It won't affect prices here. I heard a very interesting economic analysis that went through dozens of scenarios. And the net impact of exporting natural gas is pretty much zero. It really isn’t the issue but there's another important issue that hasn’t been raised and I think with three speakers in violent agreement on most issues. It's a global story and the climate is a global story. And what happens in the United States and Western Europe really doesn’t matter. What happens in Asia matters a lot.

And China has the potential to produce a lot of natural gas and decrease its dependence on coal. Not only is that bad for the climate, it's killing the Chinese. There is an estimate of 1.2 million deaths a year, premature deaths, from respiratory disease caused by burning coal. India has a tremendous problem. So when you look at forecast of where the world is going, we need twice as much net energy by mid century as we have today. So it's not just the established economies switching from dirty fuels to clean fuels. We have to do that while not wrecking the economy and while doubling the net energy on a global scale and, overall, achieving reductions in greenhouse gas emissions.

Now, when I present this to students, I say, “By the time you're my age,” which kind of scares them, “To begin with, you're going to have to solve this problem.” And if they're not scared by the enormity of the problem, they're not paying attention to double the system, while cleaning the system, while we’re expecting economic growth national security and social norms. It's really a challenge. Natural gas has role to play. It is not the solution. Hofmeister is exactly right. And we need a long term policy perspective that, as we move from coal to natural gas, we move from natural gas to renewables but we do so in a logical way that is sustainable.

Russell Gold: One of the lessons of the rise of natural gas, the energy boom in the United States, you cannot say what a fundamental changes it's been. We were energy paupers. We were importing tons of energy. We had peaked in terms of oil in 1972-‘73, I forget, and we've been going straight down, and all of a sudden we bring that around. So what changed that? How did we suddenly start producing more oil and natural gas? And there's a lesson here because what is was was it was a long term look at R&D. The federal governments started doing basic R&D into fracking, into shales, even into horizontal drilling back in the 1980s. And it was a price signal. The price of natural gas started to go up because we weren’t producing enough of it.

So we had this seemingly intractable problem. The United States is an energy importer, and that entangled us in all sorts of geopolitical problems around the world, et cetera, et cetera. Well, that’s been solved, not completely but we’re in a much different place than we were 5-10 years ago because government regulation, government support and the right incentives were put into place. And lo and behold, we solved this intractable problem. So when you talk to your students and you say, “You're going to have to double the amount of energy and clean it up and not like the economy,” yes, that's daunting but here we have the lesson from the energy boom that it can be done if you sort of take these two big forces, proper regulation and capital incentives, and align them over the long term.

Trevor Houser: Greg, can I comment on this question of energy on the LNG exports, and I'll take Mark’s imitation to disagree on economics. So demand impacts price. Prices went from $3 per MMBtu to $6 per MMBtu over the past six months because the weather got cold and we consumed more natural gas. Now, we can debate about how much exporting U.S. LNG will impact the U.S. natural gas prices but it will raise them. It's not going to raise them back to the levels that they were before but it will have some impact. Whether or not that matters for us depends a lot on what you think about the manufacturing narrative that Russell talked about.

If you buy the line that we’re on the precipice of a manufacturing renaissance because of cheap natural gas, then you would be insane to export any of it even if you thought the impact was going to be modest. In reality, the share of the U.S. manufacturing sector that is really benefited by low cost natural gas is tiny, that really energy intensive industries that are setting up new capacity now things like chemicals production et cetera, they account for 2% of U.S. manufacturing employment. The vast majority of the U.S. manufacturing doesn’t use a lot of energy. Making a Boeing, the cost of energy is half, a third of 1% of the cost of making a Boeing. So for most U.S. manufacturing, the impact of natural gas prices is going to be relatively modest. The geopolitical consideration – so if we make a decision today to export more LNG, are we going to be able to save the Ukraine? Are we going to be able to save Europe from Russia? A couple of important things to keep in mind; one, we have already approved, the U.S. government has approved the construction of seven LNG export terminals that when they come online if they are all built, will make us the second largest LNG exporter in the world after Qatar.

So that's already baked in. So the decision of whether or not export LNG has already been made. However, we’re going to debate now about should be the largest LNG exporter in the world or the second largest LNG exporter in the world. Two, those terminals that had been approved, the first one will not come online until 2015. The ones that have already been approved at the backend won't come online until 2020. Any debate we’re having now is about how much gas goes to Europe in the 2020s, not about how much gas goes to Europe and how. These are multibillion dollar investments. So we can have a hypothetical debate about will LNG exports give us more leverage in Europe vis-à-vis Russia in the next decade but the decisions we make now will do absolutely nothing about the situation in the Ukraine over the next three to four years.

Greg Dalton: Trevor Houser is author of

Fueling Up. We’re talking about fracking here at Climate One. I'm Greg Dalton. Our other guests are

Mark Zoback and

Russell Gold. Let's go to audience questions. Welcome to Climate One.

Male Participant 1: Could you talk about fracking potential in Europe given all the restrictions and restraints that have been imposed?

Russell Gold: Well, simple answer to that, there are shales in Europe, Poland, Romania, France. There is certainly the geologic potential. The problem has been – there are a couple of problems, the reason it has not moved very quickly; one, we have drilled a lot of wells in the United States. We understand the geology.

By comparison, we do not fully understand the geology in Europe. The other thing, in the United States private landowners own the mineral rights. So if a company comes to you and says, “Okay. Those 500 acres you have, we'd like to drill there,” well, you're going to get an incentive. You're going to get a big check. In response to that, you're going to get some royalties. That's not the case almost everywhere else in the world. The government owns it. And the governments haven’t really figured out how to get that incentive to get communities to buy in. And that's really been a big hold up in Poland, certainly in France where they basically said no. There's a moratorium. So the geologic potential is there but the incentives aren’t in place, and that's why things are moving so slowly in Europe as well as other places in the world.

Greg Dalton: Let's have our next audience question on fracking here at Climate One.

Male Participant 2: I come from Ohio. Last month we had several earthquakes in close proximity to fracking projects in the Youngstown area of Eastern Ohio. If fracking is found to be causing earthquakes, then doesn’t public safety require that this activity cease?

Greg Dalton: Mark Zoback, you're a world expert on this.

Mark Zoback: If fracking causes earthquake, it certainly means that we’re not doing sufficient due diligence before the permit is granted. We've been looking at the earthquake issue quite hard for the last few years. In most cases, the association between earthquakes and fracking is not the fracking act itself. It's the wastewater. When you frack a well and you use somewhere between 2 and 8 million gallons of water, when you're done fracking, you pull back the water out of the shale, and that's to get the water out of the way to let the gas flow. That water that comes back is very saline and has things like selenium and arsenic and iron and you really – you have to dispose of properly. Now, there are 150,000 EPA class 2 in wastewater injection wells operating in the United States.

What has happened is the volume that's being injected is increasing. And in some places, the pressure change at depth from those that increased injection has triggered slip on pre-existing faults. It's a real issue. And we’re working really hard to try to establish new guidelines to prevent that from happening. Now, when you're hydraulic fracturing, it's extremely rare for that to happen because you're pumping a relatively short section of a well for a very short period of time. Typically about 300 feet horizontally is isolated and you pump for about two hours. During that time, it's very rare that you actually will hit a preexisting fault and trigger slip but it does happen sometimes. We've drilled about 100,000 of these wells in North America. Each well is about a mile long. So the idea that we would have drilled 100,000 miles and not cross a couple of problematic faults is pretty silly. Of course we have.

The problem we have is that companies do not use seismic data to try to identify those faults before they're doing the fracking. So we know how to avoid this problem but, again, it's part of best practice, it's part of the regulatory system that they're simply not looking. And so these accidents are happening. My statement to industry is that we have to start doing more proactively before someone gets killed in one of these small earthquakes. The earthquakes are very small but chimney could land on someone and this could happen, and it's going to change the landscape forever. So it is an issue. We understand it geologically but because we’re generally not proactive enough, not one of those 150,000 EPA wells required any kind of geologic site characterization.

For example, nobody cared about active faults. It wasn’t an issue. So we have to think about what we do before we do it. And if we are more proactive, we’ll prevent these problems from happening.

Greg Dalton: That raises a serious question about fracking in California which we haven’t really touched on but obviously California is very seismically active. The Monterey Shale potentially huge plays, as they say, in the industry. Does earthquake concerns,

Mark Zoback, mean that we should be more careful and not frack in California?

Mark Zoback: It depends on where you are. The Central Valley of California is some of the most tectonically stable crust in the world. And there have been probably 100,000 hydro fracks done to date and none have caused any problems at all. If you're in the Los Angeles Basin where there's a distribution of active faults, a very high population density, a lot of critical structures, I think we have to be far more careful and you have to raise the bar pretty high. It's then the burden on the operator, the person who wants to do it, to demonstrate that what they're planning to do is safe.

Greg Dalton: Let's go to our next question. Welcome.

Female Participant 1: Hi. So a constant theme that I heard was fracking could be great if these regulations were put into place, if we replace the freshwater with brackish water and if certain things were obtained, but right now they're not. So my question for you is should we continue fracking right now when these regulations are not in place or is it necessary that we wait for these things to be changed in government? For example, the exceptions with the Clean Air and Water Acts. Should we wait for these companies to play by the same rules and then start with this great fracking or what could be great or should we continue now while they're not under any of these circumstances?

Greg Dalton: Who would like to tackle that? There's Halliburton loophole in there. That's what a lot of communities are calling for is a pause, a ban until regulators have a handle on this.

Russell Gold. Risky business.

Russell Gold: No, it is risky business. And the way the United States operates is that you are allowed to do something until you mess up, you get caught and then you got to fix it. There are other places in Europe which say, “No. You have to prove that what you're proposing to do is safe before you get a license to do it. It's not the way the United States works. So in a sense you're asking “Well, should we just change the entire way the United States approaches industrial development?” More needs to be done, absolutely. I think on the balance, if you look at the benefits and also at what's gone wrong, it's been fairly small. There has not been – find me an aquifer that's been ruined by fracking, by water.

Greg Dalton: Well, ProPublica has done some work, I mean, I like that work but there are people out there who claim that there's been some fair amount of gas land, there's been a fair amount of groundwater contamination. And once groundwater is contaminated, it's really hard to clean it up and expensive.

Russell Gold: One of the things that absolutely needs to happen which hasn’t happened, and this is a fairly easy fix, starting to happen in certain places, is if you're going to drill somewhere, test the water, test the air, third party, independent, so that you know a year later if the water changes. All this discussion in Dimock, Pennsylvania which is where

Gasland has been located there wasn’t that much information known about what the water was like beforehand. Now, I'm not saying, “Oh, well, there wasn’t contamination.” What I'm saying is that it opened up a huge potential for arguments and lawsuits. And everyone saying, “It wasn’t my fault. It happened this…” Test beforehand. Then you'll know what the baseline is. That's a fairly easy fix. And what the results of that, I think, would be was that if you have industry that's causing problems with or without regulators, there’ll be lawsuits, they'll be forced to change. And if they're not causing the problems, then they don’t have to worry about lawsuits.

Greg Dalton: Russell Gold is a reporter with the Wall Street Journal. We’re talking about fracking in California and the around the country. Let's have our next audience question.

Female Participant 2: I would like to talk about Monterey Shale. And so scientists have said 80% of known fossil fuel reserves has to stay in the ground otherwise we will reach that tipping point on climate change. And Monterey Shale has an estimated 13.7 billion barrels of shale oil. And if we were to extract and burn all of those, it's probably something like 7.7 gigatons of greenhouse gases that will be released, totally overwhelmingly carbon dioxide and greenhouse gas reductions of AB-32 and Governor Schwarzenegger’s order. So I'm wondering what you think about that. Even if fracking was made perfectly safe, what about our climate, what about climate acceleration?

Greg Dalton: Mark Zoback, if we burn these hydrocarbons, we’ll fry the planet.

Mark Zoback: I think the question is absolutely germane. We’re talking about – I know it seems ironic that when fossil fuels are the problem, we’re talking about fossil fuels as part of the solution, but in fact that's the case. While renewables are increasingly rapidly, we’re starting from such a low point. And we need oil for transportation and aviation. We have no alternatives. We need to not burn all the oil that's in the ground, not all the coal that's in the ground and not – we have 200 years of natural gas. That's current estimates around the world. We don’t want to burn all that natural gas. We want to dramatically change the energy system over the next half century and we need to do it. And natural gas can play an important role. The oil can play an important role for a temporary period but we don’t have a lot of alternatives to liquid fuels for transportation. And we need technology to point us in new directions. So we don’t want to burn these hydro carbons and we shouldn't do it.

Greg Dalton: Russell Gold, you work at the Wall Street Journal. Is climate change real? Are humans contributing to that?

[Laughter]

Russell Gold: Yes, I do work at the Wall Street Journal [laughter]. No. Climate change is real. Humans are contributing to it. I don’t think that the science – I mean, I don’t work for the editorial page. They might have a different view. I'm a reporter. But I will tell you that the companies that I cover, the oil and gas companies that I cover, they believe that now. There is not a lot – within the industry when you talk to them on the record for interviews, there's not a lot of climate denial.

Greg Dalton: And ExxonMobil recently announced they're going to disclose their carbon footprint. Let's go to our next question as we get close to our end here.

Male Participant 4: Hi. I wanted to ask again about the high level narrative here. Fracturing is always talked about in terms of a technological revolution and the people who make money from it, and that's the sort of fun part to talk about. But can't we also understand this simply as a reaction to the rise in oil prices, the end of the conventional cheap oil era?

We’re doing this today because we can, and that’s the fun part. But we’re also doing this today because we have to. Can you talk about that? Isn’t the element of the story that gets lost in all this and the environmental stuff is that looking forward we’re going to have to make do with less energy whether we like it or not? This fracturing gives us kind of a few years to sort of get our act together. Between the money and the excitement and the personalities that piece of that story gets lost. Isn’t that ultimately the most important piece of the story of why this is all happening?

Greg Dalton: We’re going to greater and greater extent to support our habit.

Mark Zoback?

Mark Zoback: Yes and no. Currently one-third of global oil production comes from the Middle East. Two-thirds of recoverable supplies of oil reside in the Middle East. We could have a policy just to import all of our oil from the Middle East. It would not be a good climate policy. It would not be good energy security policy. It's probably not a good economic policy either. The real issue is there are a lot of hydrocarbons around and we’re going to produce whatever is accessible to meet the demand of the marketplace. And there's no shortage. We could burn coal for hundreds of years if we chose to. As Sheikh Yamani pointed out, the stone age did not end because we ran out of stone. And the age of hydrocarbons will have to end before we run out of hydrocarbon.

Greg Dalton: And we are running out of time so I have to wrap up here. I just want to ask you briefly at the end, we ask all the guests who come here, what are you doing to manage and reduce your own personal carbon footprint?

Russell Gold, you're from Texas. We get to hit on your first.

[Laughter]

Russell Gold: Starting to use – I live in Austin. They've got great new bus lanes which makes moving through the city a lot easier. So using more public transportation and teaching my kids about public transportation also.

Mark Zoback: Well, we provide all our own electricity. We've been driving a hybrid car for 10 years and I plan to buy an electric car.

Greg Dalton: Pure electric. Running on the sun.

Trevor Houser: Most recently we’re going to get rid of the nine person Jacuzzi in the backyard of the house in Oakland we just bought, and replace it with a tree house so we don’t have to heat 500 gallons of water 24 hours a day.

[Laughter]

Greg Dalton: So you're going to export that to Marin.

Greg Dalton: Okay. We have to end it there. Our thanks to

Russell Gold, reporter with the Wall Street Journal and author of new book

The Boom: How Fracking Ignited the American Energy Revolution and Changed the World,

Trevor Houser, a partner with the Rhodium Group and co-author of

Fueling Up: The Economic Implications of America's Oil & Gas Boom, and

Mark Zoback, a professor of geophysics at Stanford. I'm Greg Dalton. Thanks for coming to Climate One today.

[Applause]