Saudi America

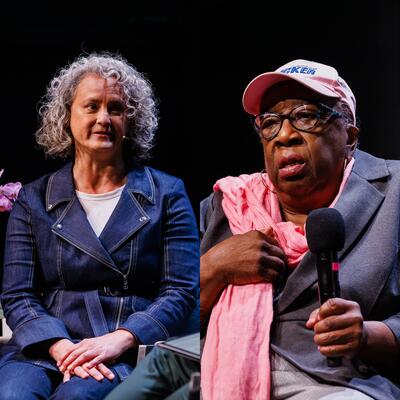

Guests

Bethany McLean

Kassie Siegel

Severin Borenstein

Summary

Production of oil and gas in the U.S. has surged to levels unthinkable a decade ago due to the revolution in hydraulic fracturing, which has helped the country surpass Saudi Arabia and Russia as the world's largest oil producer. In her latest book, "Saudi America: The Truth About Fracking and How It’s Changing the World," Bethany McLean explores the past, present and future of fracking in America. Yet new development of fossil fuels is simply not consistent with the math of the Paris climate accord, leading us all to ask: What's next for fossil fuels?

Full Transcript

Announcer: This is Climate One – changing the conversation about energy, economy, and the environment.

The United States has surged past Saudi Arabia and Russia to become the world's largest oil producer -- which doesn’t bode well for targets of the Paris climate accord.

Kassie Siegel: There is enough oil, gas and coal in already open producing fields globally to blow way, way past 1.5°.

Announcer: But is there a way to keep those fossil fuels from being burned?

Severin Borenstein: To really drive down consumption way below 80% is going to require massive innovation.

Announcer: Can the U.S. really become energy independent by sticking to brown energy?

Bethany McLean: It’s not as if we can look at Saudi Arabia and the Middle East and say, oh we’re producing our own oil we don’t need you guys anymore. Quite the contrary, it’s really highlighted all the ties that exist between America and the Middle East.

Announcer: Saudi America. Up next on Climate One.

Announcer: How did the United States become the world’s largest oil producer? This is Climate One – changing the conversation about energy, economy, and the environment. Climate One conversations – with oil companies and environmentalists, Republicans and Democrats – are recorded before a live audience, and hosted by Greg Dalton.

I’m Devon Strolovitch. Production of oil and gas in the United States has surged to levels unthinkable a decade ago due to the revolution in hydraulic fracturing.

Bethany McLean: One of the humbling things for me in working on this book was realizing that anybody who has ever attempted to predict anything about the future of energy has usually been dead wrong.

Announcer: Bethany McLean is a writer for Vanity Fair, and author of the new book, Saudi America: The Truth about Fracking and How It's Changing the World. She’s also author of The Smartest Guys in the Room, a chronicle of the Enron debacle that was made into a documentary film. In Saudi America, McLean asks what’s next for fossil fuels in America and beyond.

Kassie Siegel: The most fundamental issue here is that this is oil and gas that we can't afford to burn.

Announcer: Kassie Siegel is Senior Counsel at the Center for Biological Diversity, where she advances campaigns for the reduction of greenhouse gas pollution and the protection of plants and animals threatened by global warming. Siegel says that new development of fossil fuels is simply incompatible with the math of the Paris climate accord, which aims to limit warming to 1.5 degrees.

Severin Borenstein: Going out to the world and saying we need to immediately stop producing fossil fuels just will get us nowhere.

Announcer: Severin Borenstein is Professor at the Haas School of Business at UC Berkeley, and former director of the University of California Energy Institute. Though he agrees with Siegel on the urgent need to stop burning fossil fuels, he sees more promise in technologies that make clean energy cheaper and more accessible.

Let’s listen as Greg Dalton welcomes his three guests for a conversation about the future of the fossil fuel economy.

Greg Dalton: Bethany McLean, tell us the colorful story of Aubrey McClendon there's a quote in your book that sort of illustrative of him where he’s speaking to some oil and gas men and he says, “Last night I got back to my room at 2 AM. I went through some emails and there's no telling what I did. So if I bought you I probably overpaid. Congratulations.”

Bethany McLean: That’s a very Aubrey McClendon quote from what people told me he was frequently emailing people in the middle of the night from hotel rooms and doing deals. I was fascinated with him dating back to probably 2010 as a business journalist I’m always interested in these larger-than-life characters the ones who prove that old adage that truth is stranger than fiction. And I think Aubrey McClendon is one of those characters you can make a guy like this off of you if you tried. And a source of mine, oddly enough an Australian, would say to me that Aubrey McClendon was the most important man in America and he was obviously implying some degree of hyperbole. But what he meant by that was that if McClendon was right and America could produce these vast quantities of natural gas then for better or worse that would change the type of industry that we’re located here it would change geopolitics. And it was a really, really big deal for the future of the country. And if he were wrong, well then he was wrong. And this was also a guy who would have debates with his partner at the hedge fund he operated and his partner would say the oil and gas are real. And my friend John would say, yeah, but the economics don’t work. And so I was fascinated by this industry because of this observation from the beginning that the economics were very suspect, were shaky ground. But anyway, so I was fascinated by Aubrey and by just the flamboyance of his character. And he created this company called Chesapeake that grew to be the country’s second largest producer of natural gas and was just a risk taker like the world has rarely seen. And the thing I actually like and admired about McClendon is that not only did he risk a lot of other people’s money but he also risk his own, and that’s rare. So when he died he was bankrupt essentially. And the amount of capital he was able to raise was just astonishing. He was one of the world's great salesmen. And Austin, in an investment firm who was very skeptical of McClendon and pretty skeptical of the economics of the fracking revolution in entirety said to me that he never let Aubrey in the door for a meeting. Because he knew that if he did, his firm would end up buying a ton of stock and it wouldn't end well. But a lot of people did buy it’s actually pretty stunning, I calculated these numbers from 2000 to 2012 when McClendon got booted out of his company. Chesapeake raised $15 billion in equity about $16 billion in debt and over $30 billion by doing lots of other deals including some very Enron-esque deals in which they essentially sold gas forward and got the proceeds upfront as a loan of sort secured by the gas. When you think about that just huge amount of capital and for me that became emblematic of this industry because while there is some technology in fracking and there are obviously chemicals at work in fracking. The key ingredient which this whole thing wind up happened is capital, just mountains upon mountains of capital. And so while McClendon wasn't the father of that sort of the technology that enabled hydraulic fracturing, he was the pioneer of capital raising. And I was struck by what another source of mine said to me about Aubrey McClendon he said, he just did what the rest of the industry did on steroids. And so I thought as a metaphor for this industry he couldn't be a better figure. And when he dies in this somewhat mysterious car crash in the spring of 2016 this looks like the end for the U.S. fracking industry. And so it seem like the punctuation mark that was gonna underscore the end and it wasn’t, but his death still marked a moment.

Greg Dalton: And his rise and fall, tracks the rise and fall of industry, you know, natural gas was price at about $7 or $8. A lot of people thought it was going to stay there. A lot of smart people smart money on Wall Street thought it was gonna stay there. So tell us from that peak to the, you know, it crashes in around $2 in 2012 and what that did.

Bethany McLean: Yeah. So McClendon seemed to forget his own adage which is that high prices cure high prices. And so he continued to, he and others just continue to produce this mammoth glut of natural gas that eventually created the price and made it even more difficult for these companies to make any money. And then not only had Aubrey had basically borrowed against all of the stock in order to buy, yeah, more stock. And so when Chesapeake's stock plummeted, Aubrey got called with margin loans and essentially got wiped out and never really recovered from that bankruptcy in the fall of 2008. And then he ended up getting booted out of his company in 2012 went all sorts of other shenanigans that he was engaged in, came to light through a great series of pieces and writers.

Bethany McLean: Well, we’ll never know but he was speeding in his car, texting, not wearing a seatbelt, which I guess was far for the course for him. And he crashed into a concrete embankment going 80 miles an hour seemingly making no effort to avoid the collision. And he’d been indicted the day before by the Justice Department for antitrust violations. And it would have taken them down this would have been the end his investors would have fled. And he made this amazing comeback after getting kicked out of Chesapeake, he did round two and managed to raise another $15 billion people who are still willing to bet on him, that’s how good this guy was. But he probably would not have been able to have around three other then again you never know. But the indictment would have marked the end and the timing of course is incredibly suspicious so people have always speculated that it must've been a suicide. But the Oklahoma City police decided that they would not rule it a suicide and the police department captain said, we’ll never know a 100% what happened. But the funny thing about McClendon he was in some ways also in more ways admirable because he was never down and people who saw him in the months before his death that he seemed like Aubrey always did. I mean his whole empire was crumbling and falling to pieces and he was just as optimistic and carefree as he had always seem to be.

Greg Dalton: Severin Borenstein, tell us, you’ve been an energy economist for a long time. The idea of suddenly the U.S. being the number one producer what's happened here I think it happen so slowly some people who are outside of energy on a regular basis don't really appreciate how the energy world has been turned upside down by what's happened in fracking.

Severin Borenstein: Yeah, if you go back 10, 12 years we were looking at a lot of discussion of peak oil and very high gas prices and forecasts from the government for rising gas prices over time. So they are $6 or $7 per thousand cubic feet and expected to continue to rise and now they are around $3 and that is fracking. Now as Bethany mentioned, McClendon and a lot of the gas industry didn't seem to appreciate that if you suddenly have a technology that massively increases gas production because gas is much harder to trade across oceans than oil is mostly that's gonna stay in North America and it's gonna flood the market. And so the price has been cut in half and unlike oil prices which have started back up again gas prices haven’t.

Greg Dalton: Natural gas here.

Severin Borenstein: Yeah, natural gas prices are stuck very, very low. The oil side of this which came in later they first figured out how to frack natural gas but they pretty quickly figured out the same technology could be used to release oil, it's harder but it can be done. And it turns out that even there the extra 5 million barrels a day in a 100 million barrel market that the United States is now producing versus what you would've forecast 10 years ago, is enough to push prices down. We saw them pushed way down for a while and we were buying very cheap gas.

Greg Dalton: Gasoline here, probably using different kinds of gas.

Severin Borenstein: Thank you. Gasoline. But it turned out that those prices really weren't sustainable when the prices got down to $30 a barrel the producers in North Dakota and West Texas who were using this new technology couldn't stay in business. And they started folding and we saw a great decline in new exploration and now the prices start back up again. So now oil is around $70 or $80 a barrel and we're paying upper threes in California for gasoline and the rest of the country upper twos.

Greg Dalton: Kassie Siegel, your perspective on this is that the carbon budget math is simple and dire that there's already enough hydrocarbons on the books of publicly traded and state owned companies to fry the planet. So tell us how you think it needs to stay in the ground.

Kassie Siegel: Yeah, that's right. So the most fundamental issue here is that this is oil and gas that we can't afford to burn. And we now know what the carbon budget is for staying below 1.5° we know that the damages above 1.5 are catastrophic just look what we’re living through today with 1° and there is enough oil, gas and coal in already open producing fields globally to blow way, way past 1.5°. That carbon budget is overspent and what that means that there's no room for new fossil fuel development anywhere. And in fact we have to close down the majority of operating fields before they're fully depleted if we’re gonna stay below 1.5°.

Greg Dalton: Bethany McLean, let’s get your take because you don't talk a lot about climate and Saudi America. I’d like to know if these fracking companies, etc. even have climate on their radar. Do they tell themselves a story that they’re the clean guys because they’re better than coal?

Bethany McLean: The book is explicitly not an environmental book and that's partly because it's a mini book. A friend, and it was a friend even told me it was a beach read which I thought was awesome. Nobody has ever said anything I’ve written was a beach read so that was exciting. But you can only tackle so much in a mini book and I actually focused explicitly on the financial issues because I thought this shaky financial foundation of the industry wasn't as well understood as perhaps the environmental issues were. But I ended up in a weird way sort of coming around to an environmental view. And I’d say that that’s twofold, one is because I spoke to a lot of investors actually who are actively trying to figure out when the dawn of the age of renewables will be. And the prism where which investors see it is we don’t have to know when we’re gonna stop using oil and gas we just have to be able to see when that time is going to be and that’s when investment in these projects is going to dry up. And there are some big private equity firms that have already stopped putting any money into oil and gas because they think that time is sooner rather than later. So I think from a market-driven perspective it actually and there's such huge debate about when it will be, no one knows the answer. But at least there are some people who are thinking that’s in there and that was surprising to me because this aren’t people who are saying they care about the environment, they are people who are investing clearly just purely from a financial angle. Then I actually ended the book by, people had told me that Charlie Munger, do you guys know who Charlie Munger is, he is Warren Buffett’s cranky old sidekick. Still brilliant in his 90s, I can only hope for as much. But he actually has a conservationist point of view. And his argument is that chemical feedstocks are still the only way to feed a nation they would account for our great increase in yield per acre and that what are we doing pulling all the stuff out of the ground when we might need it to feed our population. And so he came at it from a slightly different perspective but one that was very compelling to me.

Greg Dalton: So better to use oil for fertilizer than to burn --

Bethany McLean: Save it until there’s a substitute because we don't now, right now there is no substitute.

Announcer: You’re listening to a Climate One conversation about the future of fossil fuels. Coming up, Greg Dalton ask whether reducing supply or demand is the key to leaving the brown economy behind.

Kassie Siegal: For decades we’ve heard let's do more R&D and let's work on demand and only working at the tailpipes and the smokestacks. That is the loophole to avoid actually getting there. We need to leave these fossil fuels in the ground.

Announcer: That’s up next, when Climate One continues.

Announcer: We continue now with Climate One. Greg Dalton is talking about fossil fuels in America and beyond with Severin Borenstein, Professor at the Haas School of Business at UC Berkeley. Bethany McLean, author of the new book, Saudi America: The Truth about Fracking and How It's Changing the World. And Kassie Siegel, Senior Counsel at the Center for Biological Diversity.

Here’s your host, Greg Dalton.

Greg Dalton: Bethany McLean, tell us how in a way Saudi Arabia tried to put Texas frackers out of business. Really squeeze them, you know, squeeze them out of the market.

Bethany McLean: So it’s a little bit of mythology and a little bit of truth. People who know Saudi Arabia in recent events have shown there’s only too painfully and horribly have cautioned me into thinking you can ever understand anything the kingdom is doing from the outside. But there was this widespread belief that as oil prices started to fall in 2014, Saudi Arabia made what came to be seen as this pivotal decision not to cut production because cutting production would have increased prices and thereby help save American frackers. And so people saw this concerted effort to put American frackers out of business and remove them as a competitive threat from the oil market. And look, it almost worked I think 150 companies went bankrupt during that period. A million barrels of production came offline and it kind of underscore the fragility of this industry. And to your point that it emerged stronger, it did, in some ways, although I think some of the reason that it survived is because Wall Street didn't go away. The capital is still there and that has more to do with dynamics in the capital markets than it does to do with anything going on in fracking per se because the Federal Reserve cut interest rates so much in the wake of the financial crisis in order to prop up the economy that's resulted in capital flows in two ways. One is that interest rates are really cheap so it's easy, or have been, so that it’s been really easy for heavily debt laden companies to raise money. And the second is that a lot of pension funds who can’t earn returns in places that they used to have been increasingly putting money into riskier areas like private equity firms and credit-based hedge funds, which in turn put money into fracking companies. And so the most important aspect I think in the comeback of the industry wasn't the industry's innovation although that was there but it was the fact that Wall Street was still there and the capital didn’t go away.

Greg Dalton: Kassie, let's ask you to talk about tactics that energy companies are doing to protect their profit streams. You’ve battle them in court they're going after children. Tell us what they're doing to protect the profit streams.

Kassie Siegel: Yeah, so thank you for asking that. The world's biggest fossil fuel producers are also some of the worst actors in many, many ways. And I don't think you can fully understand the context here without talking about the Koch brothers and the billions and billions of dollars that they have poured into politics and academia and disinformation campaigns over decades. And one of the best examples of that is the disinformation campaigns carried out by Exxon and other oil companies to lie to people about the harm that their product causes. Modeled on the disinformation campaign carried out by the tobacco industry very insidious very successful. They have been peddling those lies and they had been blocking climate progress for decades. Here in California where we actually heavily subsidize the oil industry we’re the only state other than Pennsylvania that doesn't even have an extraction tax. They have the red carpet rolled out for them and they take some of their profits and they use it to block California climate policy and they attack anybody who tries to stand up to them. From attacking the Atty. Gen. of New York who’s investigating them for fraud, to going after the local governments that have sued them for the damage they caused from sea level rise and other harms to environmental justice youth groups in Los Angeles. That together with my organization these teenagers sued the city of L.A. for illegal violations and their oil permitting for rubber-stamping not doing any environmental review required before handing out permits to the oil industry for racial discrimination because in the city of Los Angeles there's all kinds of measures to reduce harms in wealthy white neighborhoods. There are no measures in low-income communities of color. And the city of Los Angeles to their credit when we brought this lawsuit they changed their behavior somewhat we were able to settle it and the California Independent Petroleum Association which has oil companies like Chevron and Exxon as their members filed a counter suit against us and those teenagers alleging that the teenagers had violated their due process rights by filing a lawsuit and settling it in. This is called strategic litigation against public participation or a slap suit. It's an insidious problem we actually have a special statute against it in California because anybody with lots of money can come in and sue someone without a lot of money to try to harass and intimidate them and shut them up. So that's just a very brief summary of some of the bad actions by these corporations.

Greg Dalton: Severin Borenstein, the carbon math, you know, these companies are gonna defend their profits as their shareholders want them to do. What's the solution if it's not gonna be regulation is it innovation is it technology, you know, the carbon budget is being consumed every day we’re here talking kind of like business as usual while there is this ticking climate that we acknowledge. And we talk about it and then we kind of push it to the side and go back to business as usual. All of us sort of do that.

Severin Borenstein: Well, I mean we took a giant step backward in November 2016 because we lost the federal government as a partner in this. And now California is one of the largest economies in the world that possibly the largest that’s making a real effort to reduce climate change. Obviously we have to have a price on emitting greenhouse gases, California has one, it’s way too low and I think we need to make changes in that. But we, I think need to realize that pricing carbon in California isn’t gonna be sufficient. The real contribution California can make is in innovation. That's what we've been doing in revery other industry we’re a knowledge-based economy, we need to figure out how to make electric cars that are actually cost-effective. We need to figure out how to electrify a lot of things we do. We need to figure out how to integrate renewables into a grid and still have a stable grid where people can get cost effective and reliable electricity. California is doing a lot of that, you know, we’re headed towards 50% renewables in the next few years --

Greg Dalton: Electricity.

Severin Borenstein: In electricity we’ll be over 60%. The goal now is 60% by 2030, which everyone thinks we’ll make. And sure it'll clean up the environment a little bit but the real contribution is we will demonstrate that you can run a grid at 60% renewables. And five years ago a lot of people said you couldn't and California's made tremendous progress. And I think that's a much bigger contribution towards pushing the technology forward that can come in under the fossil fuels and therefore be adopted in poor countries. So when you ask India to reduce their greenhouse gases when coal-fired power is incredibly cheap in India the way I think we’re gonna get there is partially they're going to start paying more attention to the local pollution, which is a huge problem in India and cuts many years off of people's lives. But partially they're just gonna say, boy, we can do solar and wind power in a cost-effective way. And if we can do that then I think these poor countries are more likely to do it. Otherwise they're going to grow the way we grew by burning a lot of fossil fuels and emitting a lot of greenhouse gases.

Greg Dalton: In which case we’re all toast. If you’re just joining us we’re talking about Saudi America at Climate One. I'm Greg Dalton. Our guests include Bethany McLean, author of the new book Saudi America: The Truth about Fracking and How It's Changing the World. Kassie Siegel, Senior Counsel at the Center for Biological Diversity and Severin Borenstein, Professor at the University of California Business School Haas School of Business. Kassie Siegel.

Kassie Siegel: Severin, you bring up poor countries and invoke them to not do it here in California. But at the UN climate talks last year in Bonn the 47 least developed countries said to the developed world, we need you to take urgent action to stay below 1.5°, including no new fossil fuels and a managed phase out of fossil fuel production, that's what we need. So to invoke poor countries when they have spoken for themselves pleading, the most climate vulnerable countries have been pleading for decades for urgent action and we are out of time. We have heard the same arguments you're making since the 90s and before then nobody’s saying we don't need action on demand-side but we need urgent on a wartime footing action to get this done. And you have argued against doing anything on California's own dirty oil production. I couldn't disagree more vehemently with that. Three quarters of the oil produced here is more climate damaging than what comes from the tar sands of Alberta, Canada. There is no place better suited in the world than California to lead the way on what we know we need at the most fundamental level, we need to leave fossil fuels in the ground. And for decades we’ve heard let's do more R&D and let's work on demand and only working on the demand side only working at the tailpipes and the smokestacks. We’ve done for decades and yes, we need to accelerate that. But if we only work on that, that is the loophole to avoid actually getting there in order to get there we know what we need to do we have a carbon budget we need to leave these fossil fuels in the ground. It’s necessary and it's inevitable or we go above 1.5° and the choice is stark between 1.5° and 2° the IPCC the body, the scientific body that advises the world on climate change has just released this report with the stark change between 1.5° and 2° that's the difference between complete disappearance of the coral reefs and a chance of maybe saving 30% of those coral reef ecosystems and on and on. It's stark, I mean everything that we care about is at stake here and we have to do more.

Greg Dalton: Severin Borenstein.

Severin Borenstein: Well, I completely agree that everything's at stake and we have to do more. I think we see differently what's actually going to be effective. First of all, the developing world is producing more greenhouse gases from the developed world now. We are by far more responsible for the greenhouse gases in the atmosphere. But the path is that the developing world is actually growing faster. They have said they need everyone to reduce greenhouse gases but China and India are still on passive building more coal-fired power plants and they’re doing that because they're poor and they want to grow. And China, people live on per capita GDP that's less than 15% of ours and India's is half of that. So they wanna grow economically, they are not going to get off of coal unless they have a technology to replace it. I agree with you that we need to take less fossil fuels out of the ground. But I think going out to the world outside and saying we need to immediately stop producing fossil fuels just will get us nowhere. I think everybody will simply ignore us. And I think the way that we actually will get somewhere and the way that we have gotten somewhere so far to the extent we’ve made any progress is by innovating. And so I am not, I want a big price on carbon in California but I think that the real change is gonna come from innovation. I don't think we're gonna get real change by saying we need to stop producing fossil fuels in California. And then the last bit of it which you made reference to is I have spoken out against the keep it in the ground movement for a different reason, which is that if you look at how much wealth will be transferred to Saudi Arabia, Iran, Russia the major oil producers who are bad actors on the world scene by reducing California production for every ton of carbon we take out of the atmosphere it will transfer $500 from consumers to those producing countries. I don't think making those producing countries richer is the pathway to a good world. Climate change is a major threat, but it is not the only major threat. And I think the poor countries in the world and the countries that really have shaky democracies would not appreciate strengthening Saudi Arabia which we now, you, if you've been following you've known for a long time it’s not a real civil advanced country. And Russia which is now run by an autocrat who is trying to basically expand power. I think that matters too.

Greg Dalton: Bethany McLean, let’s get you in here. I mean you covered, you financially cover the markets, price is king, right. I mean that’s what really matters. Let’s get you on this on whether people will do things for any motivation other than dollars.

Bethany McLean: I think at the end of the day it's dollars that will decide this and maybe I’m a little too cynical from decades of covering the markets. But that is part of the reason that I focused on the financial underpinning of this because I thought if the capital stops going into this industry that’s what’s going to change things. If investors are unwilling to put money into that anymore that's where change is for sure going to come about not in any other way because people suddenly decide they're going to do the right thing. And I thought your point about the dollars going to Saudi Arabia when we cut production here is really interesting because we’re now seeing it play out in real time how reluctant countries around the world are to disentangle themselves from Saudi Arabia because of the huge pot of money the country has to invest. And when you think about the dollars, the Saudi Arabian dollars that are very active in supporting Silicon Valley right now there's more than one way in which problematic things happen in the world.

Greg Dalton: So you’re talking about the Khashoggi killing, apparent killing in Turkey and how that's brought the geopolitics of Saudi Arabia to the fore this idea of American independence or American dominance. You're saying that this shows it’s not there yet because the way people are still showing difference to Saudi Arabia.

Bethany McLean: So when I started the book I thought it was this interesting conundrum between this idea of American energy independence, which fracking was helping us achieve and the financial instability of the industry. And when things don't add up I’m always interested. But I came to believe over the course of working on the book that this whole idea of American energy independence was itself something of a fraud. And it’s something every president going back to the 1970s has been talking about American energy independence. But you stop to think about what it actually means in today's world and it turns out those words don't actually mean anything because the price of a barrel of oil is set by global market. So it is set by events around the world no matter how much oil we’re producing here. And because business in America depends on imports from other countries who themselves are reliant on Middle Eastern oil. It’s not as if we can look at Saudi Arabia and the Middle East and say, oh we’re producing our own oil we don’t need you guys anymore. And you can see that with the current headlines about the horrible murder of Jamal Khashoggi that nobody is saying, oh American energy independence we don't have to care about the Middle East. Quite the contrary, it’s really highlighted all the ties that exist between America and the Middle East. People talk about drilling because it's going to grant us this mythical notion of American energy independence it's kind of a fraud.

Greg Dalton: We’re talking about Saudi America at Climate One. I'm Greg Dalton. Our guests are Bethany McLean writer for Vanity Fair and author of the new book Saudi America: The Truth about Fracking and How It's Changing the World. Kassie Siegel, Senior Counsel at the Center for Biological Diversity and Severin Borenstein Professor of Business at the University of California, Berkeley. I have some true and false, and association questions for our guests. Beginning first with Bethany McLean. True or false, Aubrey McClendon retired on April Fools' Day?

Bethany McLean: True.

Greg Dalton: Kassie Siegel. True or false, yes or no. You wish Saudi Arabia was successful in its efforts to kill the businesses of American frackers?

Kassie Siegel: It would've been good for the climate if only we had been so lucky. But the markets are not gonna do it. We need the government to do it.

Greg Dalton: Severin Borenstein. True or false. Oil companies donate research funds to universities to win friends and influence people?

Severin Borenstein: True.

Greg Dalton: Bethany McLean. True or false. Fracking has proven more resilient than anyone dreamed?

Bethany McLean: True.

Greg Dalton: Association. I’m gonna mention a person, place or thing and you mention to me the first thing that comes to your mind completely recklessly unfiltered. Bethany McLean. George Mitchell.

Bethany McLean: I think the father of fracking.

Greg Dalton: One of the first billionaires from fracking. Kassie Siegel. The Environmental Defense Fund's collaboration with energy companies to measure the extent of methane leakage.

Kassie Siegel: If methane leakage is as high as about 3% actually little less, burning gas is worse than coal.

Greg Dalton: Severin Borenstein. President Obama's legacy on energy.

Severin Borenstein: Mixed.

Greg Dalton: Bethany McLean. Energy dominance.

Bethany McLean: A myth.

Greg Dalton: Kassie Siegel. India's new taxis powered by natural gas.

Kassie Siegel: Kyoto. The Clinton administration went to Kyoto and pushed a bunch of market mechanisms for addressing climate change on the rest of the world and they didn't want them. And they said take this because it's the only way we can do it and we're supposed to fund green development in China and India. And we renege, the United States reneged on that in 1997. That's why that kind of stuff is happening.

Greg Dalton: Severin Borenstein, last one. What comes to mind when you hear U.S. Secretary of Energy Rick Perry?

[Laughter]

Severin Borenstein: That was the answer.

[Laughter]

Greg Dalton: Alright, let’s give them a round of applause for getting through a gauntlet of --

[Applause]

Announcer: You're listening to a conversation about the new fossil fuel economy. This is Climate One. Coming up, Greg Dalton asks more about making the transition from brown to green energy.

Severin Borenstein: If we actually managed to reduce world oil demand by 20% and we’re gonna have to reduce it a lot more than that, the price of oil is gonna crash. And oil is gonna be $20 or $30 a barrel, which means gasoline is gonna be a dollar a gallon. That’s this thing that keeps me up at night.

Announcer: That’s up next, when Climate One continues.

Announcer: You’re listening to Climate One. Greg Dalton is talking about the future of fossil fuels with Severin Borenstein, Professor at the Haas School of Business at UC Berkeley. Bethany McLean, author of the new book, Saudi America: The Truth about Fracking and How It's Changing the World. And Kassie Siegel, Senior Counsel at the Center for Biological Diversity.

Here’s Greg.

Greg Dalton: Kassie Siegel, I’ve interviewed people involved in energy supply who will say things like they’re starting to be recycled water in fracking they’re starting to be better measurement betterment tracking. Do you believe that and they will say fracking is getting incrementally better more environmentally responsible, not across the board but in some cases fracking can be done cleaner and so it protects the health of people around, is that true?

Kassie Siegel: Well, I doubt it. But I mean fundamentally from a climate perspective, we can't do it. If it's bad for lots of other reasons I mean you do not want the hydro frackers moving in next to you. I mean fracking is inherently dangerous, and it totally supercharges the harms to our air and our water and our environment when you frack. And you know people suffer terribly when they’re living next to an oil and gas well not just from the fracking, but from all phases of production and the air pollution it makes people really sick. I mean in California we have largest urban oilfield we have tremendous amounts of neighborhood drilling and, you know, kids have nosebleeds they're nauseous there’s long-term health effects. So, you know, we need to do what we can during the transition but fundamentally we just have to stop digging this stuff up and burning it.

Greg Dalton: Bethany McLean, I wanna ask you about a character in your book, Ali Al-Naimi who started working at 12 years old at Saudi Aramco. Tell us about him and how that relates to the bigger picture.

Bethany McLean: So he was the oil minister during this pivotal time in Saudi Arabia where in the run up to whereas oil prices started to fall in 2014. He made the call, is largely regarded as making the call to not cut Saudi Arabian production and to let the price continue to plummet. And it eventually plummeted all the way down to $26 a share. And the question is then why the Saudis reversed course cut production. And one person I talked to speculated that lower oil prices can wreak havoc on the environment, obviously because they encourage us to use more but they also wreak havoc on vulnerable places around the world that depend on oil exports in order to keep their economies running. And that Saudi Arabia basically didn't want to be responsible for breaking the world as this person put it to me. And it is a question if we transition away from oil what happens to all of these economies because there's this interesting concept known as the fiscal breakeven. So the question isn't as simple as what does it cost for us to get oil out of the ground but a lot of societies, Saudi Arabia most permanently have built up enormous public spending works that are based on a high price of oil. I think the estimate for Saudi Arabia is they need an oil price of $85-$90 a barrel to support their society as it runs currently. So with low oil prices or the end of the oil era it also unleashes an enormous amount of geopolitical uncertainty.

Greg Dalton: You also write that U.S. supply, U.S. being a petroleum exporter which is a very new thing it used to be illegal just a few years ago, is a supply stick in geopolitics. Tell us how that.

Bethany McLean: I think oil is lesser than natural gas in some ways. So the big speculation or belief or hope is that if we export natural gas we can change some of the geopolitical issues in Europe because Europe is for a long time been very dependent on Russia for its natural gas. And so the idea is if America can export o and g to Europe then Europe can free itself from its reliance on Russian natural gas and that can have some very good impacts. Again apart from the environment but some good impacts on Putin’s ability to wield power in the world. But I’ve encountered some real skepticism about how viable that is, it was funny I was in Houston a couple of weeks ago, and couple people came up to me and said the infrastructure in Europe is a long way away from making this a reality. So it’s much more of a theoretical concept now than it is an actual reality. And as we saw with oil, the ability to export -- foreign export of oil that cuts both ways, right and we threaten China with tariffs, they can threaten us with tariffs.

Greg Dalton: Right, U.S., you’re right, $10 billion of petroleum to China something again unthinkable a few years ago. We’re talking about Saudi America with Severin Borenstein, Bethany McLean and Kassie Siegel, let’s go to our audience questions. Welcome.

Female Participant: Thank you. My name is Lila Holzman, I work in shareholder engagement at As You Sow. Many of the oil and gas companies we work with acknowledge to varying degrees that a shift to a low carbon energy sector is underway. Many are investing heavily in petrochemical buildup, noting that one of the byproducts of fracking is ethane and things like that that are then used in the petrochemical plastic industry. And that plastics will sort of take the place of energy demand going down as we shift to renewables. Any comments on that and if that's as financially sound the decision as these companies are making it out to be and maybe a next book idea. Thank you.

Greg Dalton: So using oil for plastics rather than smoke in our cars. Who'd like to.

Kassie Siegel: Yeah, so that is such an excellent point. This is the oil and gas industry’s plan. There are literally hundreds of petrochemical plants somewhere in the approval process were already drowning in plastic. And their plan is to push a vast, vast amount of more plastic products on the world to continue to be able to produce this stuff even as the world transitions to renewable energy.

Greg Dalton: So bad for the traditional environment, good for the climate because it’s not getting burned but it's bad for ocean pollution, etc.

Kassie Siegel: It’s completely horrifying on every level when separate and apart from whether it’s financially viable we just shouldn’t allow it that’s why we have government. It just shouldn’t happen we don’t need any more plastic.

Severin Borenstein: I would just say, I also think it’s a head fake. I think, yeah it's a small hedge and they are going to get move more into petrochemicals. But if you get inside an oil company or even look at their public plans. They are not planning to substantially reduce production of transportation fuels and electricity generation any time in many decades and we’re gonna be far past 2° by then. So we’re not gonna get this solution from the oil companies we’re gonna have to get it somewhere else.

Greg Dalton: Next question. Welcome to Climate One.

Male Participant: Hi, there's been a lot of speculation debate around when the world economy will reach peak demand for crude oil. I was wondering if the panelists would like to choose a year or come out with some sort of prediction about what year that might be.

Greg Dalton: Peak demand we heard a lot about peak supply 10 years ago. Bethany McLean.

Bethany McLean: So one of the humbling things for me in working on this book was realizing that anybody who has ever attempted to predict anything about the future of energy has usually been dead wrong. So I’m gonna heed my own warning and be careful about that. What I will say is that there are a lot of people who are actively trying to figure that out and I think it's not algebra I think it's really multivariable calculus depending on so many things. And so no one has the answer, but it's something that people are actively trying to figure out. And I think the smartest thing in light of this history has to say I don’t know but it’s the right question.

Severin Borenstein: Actually, I’m gonna argue it's not quite the right question. Peak demand may occur fairly soon, in the sense of 5, 10 or 15 years from now. The problem is that well the last little bit of oil right now is coming from $50 or $60 barrel sources. There is this vast pool of $5, $10 and $20 barrel sources. If we actually managed to reduce world oil demand by 20% and we’re gonna have to reduce it a lot more than that, the price of oil is gonna crash. And oil is gonna be $20 or $30 a barrel, which means gasoline is gonna be a dollar a gallon. That’s this thing that keeps me up at night. I think we’re gonna actually manage to electrify the or to move to hundred percent renewables and electric system. But transportation right now, particularly with how cheap, how much really cheap oil there is, it may be possible to get past the peak but to get far to really drive down consumption way below 80% is going to require massive innovation.

Greg Dalton: Next question. Welcome.

Male Participant: Hi, my name is Yan Goyure and my question is mostly to Kassie, it’s another take on the Keep It In The Ground movement. And I read somewhere recently that in Australia even though the Great Barrier Reef is being pretty much decimated by bleaching and so on it hasn't affected the tourist trade there not really at all. And so I worry that if we set up a target of okay we’ve only got so many gigatons left that they will be this basically oh well we better use it or lose it, in the same way the tourists are flocking to the Great Barrier Reef before they and other people manage to destroy it in the same way that I went to see some aging walkers down in the desert a few years ago before they croaked. So is there a possibility that keeping it in the ground would in fact accelerate basically the taking it out of the ground as countries compete take it out before they have to stop.

Kassie Siegel: Yeah, you know, I think that's a fair question. But I think that we’re already seeing aspects of this. I mean can remember having a conversation in 2007 with a friend about the death throes of the coal industry. And we thought it was coming a lot sooner than it came but, you know, the fossil fuel producers see this and they're fighting as hard as they can against it. The Koch brothers are fighting as hard as they can against it. I mean it, you know, we're not having a policy debate in this country about what's the economically optimal way to do this, we’re having a war with the Koch brothers and the oil companies, you know, about fossil fuels and also about the survival of our democratic institutions. So, you know, I think you’re making a fair point, but the bottom line is, you know, the physical reality of our climate system is that we have to leave these fossil fuels in the ground at 1° global warming fueled super storms are wiping out entire cities at 1°. So the physical reality is if we want to have a planet that we recognize we have to figure out a way to keep these fossil fuels in the ground.

Greg Dalton: And I saw a chilling statistic recently about 1.5° it’s possibly being only 12 years away. Think about that. Next question. Welcome to Climate One.

Female Participant: Hi, I’m Lola Flegg and I’m currently a senior in high school at Sonoma Academy. Obviously there are a lot of externalities on a international relations level climate level economic level due to changes in the oil market. What do you think as an economist is the most realistic step forward in terms of the global financials fear to mitigate those externalities?

Greg Dalton: Before you answer that I just want to say, wait a minute, you know what externalities are and you're in high school. I mean, let’s just give it right there. Okay, I’m impressed. The next time you’re up here but okay. Severin Borenstein.

Severin Borenstein: And now I'm gonna duck your question because you asked an economist about basically a geopolitical solution. And I think ultimately it's very hard to get a geopolitical agreement, particularly because the very largest oil producers in the world outside the United States are ones that really have very poor world global citizenship records. So getting them to stop producing or to actually participate usefully I think is even less likely than getting U.S. oil companies to participate usefully. So I wish I were more optimistic about the sort of getting that sort of participation. I have worked in this area for decades longer than you've been alive and that has really brought me around to the view that we need to be pushing on the technology side because we’re not gonna get, I shouldn't say, I’m not optimistic we’re gonna get a global agreement. But technology can just push these things through when they really are more cost-effective. And, you know, the world has thrived on a market economy and yes, it's a regulated market economy. But the tighter that regulation squeezes somebody particularly if it's a rich somebody, the more they fight back. The Koch brothers are saying things that are just not true they’re smart guys I'm sure they know it's not true. They're saying it because they make a lot of money at it. And so I think the way we’re gonna have to break through that is with the technology that figures out how to run a grid on hundred percent renewables figures out how to store electricity, figures out how to have automobiles that don't need to run on gasoline.

Greg Dalton: Let's go to our next question.

Male Participant: Thank you. My name is Reagan Belichick, I’m visiting here from Alberta, Canada today and I’m a researcher that studies the oil and gas industry. And my question is for all the panelists and it grows out of some work from Dr. Borenstein’s Institute around the fact that bankruptcy protection insulates firms from the worst outcomes and in hazardous industries like the oil and gas industry it leads for oil and gas firms to take excessive environmental and public health risks. And so my question is about the environmental and fiscal impacts for the public if fracking doesn't live up to its promises, and instead collapses into bankruptcy.

Bethany McLean: Well, I should say I’m not sure the industry is going to collapse into bankruptcy. And again it was another humbling thing out of this book was saying that nobody's called this, right, nobody has predicted this. And so it’s possible this doesn't end badly. Yet at some point in the future it does because we all better have the advent of renewables, right. And there's a lot of work being done, somebody on Alberta is actually doing really interesting work about stranded oil and gas assets and the huge cleanup that will be necessary after those assets are no longer productive. And his point is it’s already we already can’t fund it. And I think it’s another aspect of this that we need to understand better and plan for.

Announcer: Greg Dalton has been talking about the future of fossil fuels with Bethany McLean, a writer for Vanity Fair and author of the new book, Saudi America: The Truth about Fracking and How It's Changing the World. Severin Borenstein, Professor at the Haas School of Business at UC Berkeley, and former director of the University of California Energy Institute. And Kassie Siegel, Senior Counsel at the Center for Biological Diversity.

To hear all our Climate One conversations, subscribe to our podcast at our website: climateone.org, where you’ll also find photos, video clips and more. If you like the program, please let us know by writing a review on iTunes, or wherever you get your podcasts. And join us next time for another conversation about energy, economy, and the environment.

Greg Dalton: Climate One is a special project of The Commonwealth Club of California. Kelli Pennington and Sara-Katherine Coxon direct our audience engagement. Tyler Reed is our producer. The audio engineers are Mark Kirschner and Justin Norton. Anny Celsi and Devon Strolovitch edit the show. I’m Greg Dalton, the executive producer and host. The Commonwealth Club CEO is Dr. Gloria Duffy.

Climate One is presented in association with KQED Public Radio.