Power Mix

Guests

Trevor Houser

Ross Macfarlane

Bruce Nilles

Summary

Cheap natural gas is changing the energy mix in America. Energy companies are increasingly making the switch from coal to cheaper, cleaner natural gas to fuel their power plants. These companies “are paying far more attention to the price of natural gas than environmental regulations,” says Trevor Houser, partner at the Rhodium Group. Shrinking domestic markets have America’s coal industry looking overseas to surging economies in China and India. Bruce Nilles of the Sierra Club Beyond Coal Campaign and Ross Macfarlane, Sr. Advisor at Climate Solutions, say developing these coal reserves would mean “game over” for global warming. Trevor Houser points out that the lower sulfur content of American coal could go a long way in reducing particulate pollution in China that drifts to the West Coast of the United States. Listen to a conversation between experts on the future of coal and natural gas.

Full Transcript

Greg Dalton: Welcome to Climate One, a conversation about energy, economy and environment. To understand any of them, you have to understand them all. I'm Greg Dalton.

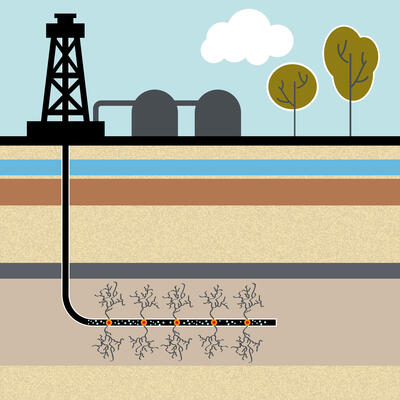

King Coal is on the rocks. A few years ago, it accounted for more than half of electricity in America. Today, it's about one-third. Cheap, abundant natural gas is undercutting coal in the marketplace and regulations on mercury and carbon pollution are catching up with the real cause of burning this dirtiest of fossil fuels. Coal plants and mines are being shut down. Many miners are retiring and new ones are not being hired. A recent article in Business Week called this "coal's darkest hour."

Overseas, it's a brighter story. China's imports of the black rock are soaring and a recent report by the world's foremost energy authority said coal will challenge oil as the world's premier source of energy in less than five years. American coal companies and railroads want to get in on that action by building new ports in Oregon and Washington to export coal from Wyoming. Advocates say that will create jobs and economic growth. Opponents say that is a foolish investment and dirty energy that will hurt human health and further disrupt the climate.

Over the next hour, we'll discuss coal and natural gas and powering America's future with our audience here at the Commonwealth Club in San Francisco. And joining us, we are pleased to have experts, three experts. Trevor Houser is with the Rhodium Group, a consulting group in New York and a visiting fellow with the Peterson Institute. Russ Macfarlane is a senior advisor with Climate Solutions, an environmental group based in Seattle.

And Bruce Nilles is senior director of the Beyond Coal Campaign at the Sierra Club. Please welcome them to Climate One.

[Applause]

Greg Dalton: Before we begin, I should mention that we invited industry voices to join us here today from the American Coalition for Clean Coal Electricity and the Northwest Coalition for Jobs and Exports. However, they did not send anyone to participate. So, Bruce Nilles, let's begin with you. You head up a campaign that is aimed at killing king coal. How is' that campaign going? What have you accomplished in the last few years?

Bruce Nilles: So, 2012 was our best year by far. The reason we care about coal is we at the Sierra Club have identified global warming and climate chaos as our number one priority -- and coal is the number one culprit. If you look at the science of Dr. Jim Hansen and others, he basically says, "We have to be off coal in less than two decades." No later than 2030, we need to have coal down to zero.

So we set out 10 years ago to do the two big things and added a third. One was to stop the construction of new coal plants -- and I'm proud to say, I'm delighted to say that after 10 years, we've stopped 90 percent of the new projects, and not a single new coal plant has broken grounds since 2008. So the pipeline of new coal is essentially over in the United States.

We then turned our attention two years ago to how do we retire and replace the existing fleet with clean energy? And so that's been the bulk of our work going forward. And this week, we're gonna be celebrating that -- almost one-sixth of the coal fleet, about 50,000 megawatts of coal in the United States is either retired or retiring in the next few years. And it's being done literally community by community, working with a broad swathe of Sierra Club activists and leaders across the country and a whole bunch of allies. We're saying Congress is not leading, so we're gonna act at a vocal level. And so literally shutting coal plant by coal plant down across the country and replacing it with our vision, which is a mix of energy efficiency, wind and solar.

Greg Dalton: Trevor Houser, coal is definitely down, but is it -- has it been Texas oil men or Texas natural gas men or has it been the Obama administration, or has it been the Sierra Club that's really been driving that?

Trevor Houser: Yeah. So with all due respect to Bruce and the great work that Sierra Club does, I think he might have to share the podium with wildcatting oil and gas developers in Texas, that --

Greg Dalton: I''m not sure-- Bruce, how do feel about that?

Bruce Nilles: It's a temporary glitch. [Laughter]

Trevor Houser: So, you know, as you said in the lead, coal accounted for about 50 percent of the Generation X and -- for most of the past three decades, I think. And starting a couple of years ago, that began to drop dramatically down to a low of 33 percent in April of this year, of the U.S. power generation. That tracks exactly with the decline in the natural gas prices over the same period of time.

So in wholesale markets where power generators compete to sell the customers, you see generators turning on or off -- coal generators turning on or off, natural gas generators turning on or off depending on what they call the dark spread, which is the price difference between coal and natural gas. And so when we talk to traders in the electricity markets, they are paying far more attention to the price of natural gas than they are to environmental regulations at this particular moment.

Over the past couple of months, coal has climbed back a little bit because natural gas prices have gone up. So in September, coal's share of U.S. power generation was back at 39 percent, from 33 percent in April, because natural gas prices have strengthened below.

Greg Dalton: But isn't there a policy dimension that -- so if you are' coal company or utility looking at the future of coal, you're gonna place big bets, don't' you have to think about the regulatory risk and the uncertainty, the kind of pressure that the Sierra Club and others are putting on. There is' a cloud over coal.

Trevor Houser: That's absolutely true for new generation. Right?

Greg Dalton: Okay.

Trevor Houser: So when people are thinking about building a new coal-fired power plant, which is going to be a 30-year asset, then you really have to think what's legislation gonna look like in the next 30 years. And there, climate is a serious concern.

It's also gonna matter on the retirement side that Bruce was talking about. So, the economics of natural gas have led to less generation from coal-fired power plants. But most of these plants haven't yet shut down. They're still available to be turned back on if those economics change. What regulation from the federal government, what environmental campaigns, the impact that they'll have on that existing generation is to force closure of plants that recently have stopped producing just for economic reasons.

Bruce Nilles: Well, it's not actually quite true because we do a lot of work in places like Kentucky where there's a giant coal plant -- 800 megawatts -- by any measure, a fairly efficient coal plant built in the 60s. Through environmental regulations that we have been very engaged to push and support at the federal level, that plant has to decide "do we put on a billion-dollar scrubber to finally clean up our act decades late, or do we retire?" And so we have been in the public service commission proceedings saying, it makes no economic sense to put a scrubber on, raise rates for ratepayers in eastern Kentucky by 30 percent. You're much better off retiring that coal plant over the next couple of years and replace them with a mix of clean energy.

So those environmental regulations -- and if you think about what was leading up to the election, we had a very vigorous discussion, and for the very first time, the coal industry took off the gloves and went after Obama hard with his war on coal, precisely because as he has been finally closing the loopholes -- the regulatory loopholes of coal, the price of coal is going up. Yes, the price of gas has been coming down; so is wind and solar. But the cost of coal is going up because we're finally internalizing the cost of coal, and that's what's different today than two to three years ago.

Greg Dalton: Let's get the export angle in here with Russ Macfarlane. You're in Seattle. There is a move to export coal -- that's a good thing if you're the coal industry. What -- what's the opposition up in the Northwest?

Russ Macfarlane: Well, Climate Solutions, you know, has always shared the kind of concerns that Bruce was talking about. Coal is the dirtiest fossil fuel by far. We were working on creating new energy solutions, energy efficiency, renewables, all those things -- and have been successful in our part of the country, in getting the only two coal-fired power plants in Oregon and Washington on the shutdown schedules.

Major accomplishments. And then we discovered about two years ago that the coal industry had identified their key strategic initiative as their markets were falling off the cliff in the United States. Their goal was to get coal that we own in the Powder River Basin onto trains, onto ships, get it to China. And we had to make a decision as Climate Solutions, we're primarily about yes, we're about accelerating new solutions, but we have to decide are we gonna focus on those if it's just gonna be a hood ornament on a giant growth of a big, gleaming MV -- or a Humvee, of building this new fossil fuel infrastructure, which is gonna significantly impact local communities and is gonna directly impact -- the climate impact, ocean acidification, impact all these other issues which are caused directly by burning the vast reservoirs of carbon.

What we've been amazed by is how prominent this issue has become, how much support we've been able to grow. We've obviously been involved in lots of campaigns along with our partner organizations like the Sierra Club. And it has been like nothing that we've ever seen with thousands of people showing up in very small communities as well as in places like Seattle. Talking about very localized concerns including the issues around shipping the coal through communities dominating the use of the rail and shipping infrastructure, but also how that ties in to our communities' desire to chart a new energy future to help areas like Asia develop a new energy future, as opposed to investing huge amounts in the technologies of the past.

Greg Dalton: Suppose you're successful in blocking some -- these ports in Washington and Oregon, you could call it "the thin blue line" of California, Oregon and Washington, those exports then may just go to Canada.

They may go to the Gulf Coast where states are willing to export fossil fuels and happy to have offshore drilling. I mean, you may not have any impact at all.

Russ Macfarlane: They're fighting it everywhere. I mean we're fighting it everywhere. And --

Greg Dalton: But it's a lot easier to fight in Seattle than it is Louisiana, right?

Russ Macfarlane: That -- I mean I would say in -- there's also significant infrastructure constraints. British Columbia for example has been exporting coal, but primarily what's called metallurgical coal, which is much higher value and is mined locally in British Columbia. Their proposals to get this thermal coal for -- that is of lower value from the United States in larger amounts there, there are significant problems, infrastructure challenges in ramping that up anywhere near as much as the coal companies want. And there's a hugely growing local opposition including the kind of first nations groups which are very powerful there and are working closely with the groups that are working in the Northwest.

Shipping it off other coasts probably just doesn't make economic sense to fuel the area that we're most concerned about, which is the growing Asian economies.

Greg Dalton: Trevor Houser, do you agree about the cost that -- did that -- won't that coal find a market somewhere?

Trevor Houser: So, I -- so there's a question about how competitive U.S. coal is in Asia. And that's not entirely clear. There's points over the past decade where had there been a rail link between Wyoming and the West Coast, that that coal would have been competitive. And there has been points where it wasn't competitive.

To me, the interesting question is, you know, over the next two decades, if we build that coal export infrastructure, from a climate standpoint, how much will that change the price of coal in Asia and how much will that increase Asian coal demand. So let's say we're exporting a hundred million tons of coal. It certainly is not true that that will increase Chinese consumption by a hundred million tons.

Greg Dalton: So by increasing the supply, we could reduce the price of coal…

Trevor Houser: That's the --

Greg Dalton: Adding more to the market price.

Trevor Houser: That's -- that's the question. So the -- if you're trying to figure out just how much we'll increase emissions for U.S. coal exports to Asia, then you have to figure out it changes the price. -- let me use an example. If I go to a soda machine, you know, everyday at lunch and I buy a Coke and the Coke costs a dollar, right? And then one day I decide to try the Pepsi. Now, Pepsi costs 90 cents. It gets introduced into the vending machine., right? I have a 10-cent cost savings. Is that 10-cent cost savings gonna make me buy two Pepsis or am I just gonna stick with the one Pepsi, right, and pocket the 10 cents and use it for something else?

At some level, I'm gonna buy two Pepsis, except I live in New York and we now have laws that are -- or if Bloomberg gets his way, what laws it will prevent me from buying multiple Pepsi --

Greg Dalton: By the little Pepsi bottles, it's just not the big ones?

Trevor Houser: Right, yeah. But that's a question from an economist's standpoint. It is how much will it actually increase demand versus just changing the price and Chinese power plants pocketing some of the money. That's important from a climate standpoint because it determines how much emissions will increase.

And climate's not the only environmental issue that we're concerned about here. One of the reasons that Chinese coal companies and power companies are interested in Powder River Basin coal, the coal that's produced in Wyoming, is because it has very little sulfur content, right? That's why it got developed in the U.S. When we passed Clean Air Act, that led to a significant increase in Wyoming coal production because it had lower sulfur than the coal that was produced in Appalachia.

In China -- so I used to work at the U.S. Embassy in Beijing, and they sent me to do all the things that nobody wanted to do like go down coal mines and around oil and gas fields. And one of my jobs was to write the air quality reporting cable that went back to Washington. It turns out that that's one of the closest watched cable so -- that leaves the embassy, because at the time when I was working there, it determined the hardship pay that U.S. Embassy staff got, which at that point, was comparable to the hardship pay you got for working in Baghdad and the green zone.

And that was the risk to life and limb that air in Beijing posed, right? And a lot of that is sulfur -- sulfur dioxide. And a lot of that sulfur blows to the West Coast to the U.S. naturally. So between 10 and 15 percent of the sulfur in California comes from China. So there are local environmental benefits if China is able to switch from high sulfur coals that it currently consumes to low sulfur Powder River Basin coals.

So as an environmentalist, the question to me is how big is the risk from a climate standpoint versus how big are the benefits from a local air pollution standpoint, because both of those issues matter if you're watching the press over the past couple of days coming out of Beijing, they have had some of the worst air quality days in recorded history there, costs the country $200 billion a year. There are 750,000 premature deaths each year from air pollution. That's not CO2. That's not climate change. That's sulfur dioxide and particulate matter.

And so you have to weigh those things. And so it's important to figure out just how much will that U.S. coal export quantity changes.

Greg Dalton: So Wyoming coal to China helps LA? Bruce Nilles, do you agree?

Bruce Nilles: Well, we're kind of missing the point here which is we have a climate crisis. 2012 was the hottest year on record. And we are debating, do we build out 20 or 30 years of infrastructure to enable the burning of more fossil fuels at the very time the scientists are saying, we need to shrink the consumption of fossil fuels. We in the U.S. have a tremendous opportunity, and I would say a responsibility. We sit on the largest coal reserves in the world. We have 25 percent of all the coal in the entire globe. Much of the carbon dioxide in the atmosphere is also from us over the last hundred years.

We have a tremendous opportunity to say to the rest of the world we're gonna finally do our part, lead by example, build more wind and solar as we did last year than we're building fossil fuels and leading by example. But we're also gonna keep our coal underground and out of world markets. We are not gonna enable the very behaviors that is causing hurricanes and a whole bunch of environmental problems around the globe.

That's insanity. And whether it's one Pepsi, two Pepsis, you're still adding a lot of calories to a problem that's already out of control. So my point is simply we're sort of missing the science. If the science is saying -- as Jim Hansen said in his report today, if we got to cut six percent per year, the notion of dramatically escalating coal consumption out of the U.S. off land that belongs to you and I, these are federal lands, we're selling coal for a dollar a ton to Chinese for 120 bucks a ton, there's something very wrong with this picture because we're essentially paying for our own demise.

So to me, that's the critical question. Are we gonna enable our destruction or are we actually gonna say "President Obama, we need some leadership here. The planet is calling out for help."

[Applause]

Greg Dalton: Question whether markets and respond to morals or respond to -- yeah, Russ Macfarlane?

Russ Macfarlane: Well, I wanted to just pile on to what Bruce is saying. The key issue is building now the infrastructure for massive increase in fossil fuels and for drying down these reserves that if they're tapped or gonna lead to an unavoidable climate prices, unavoidable crisis in terms of our oceans, all sorts of other vectors. And it's not just folks like Bruce saying that or folks like Bill McKibben or a prominent scientist like Jim Hansen. In the last couple months, groups like the International Energy Agency, the World Bank, have in very, very stark terms, said if we actually build the infrastructure and develop all these reserves, it's gonna be game over. So we have to be starting some places. And our feeling is we need to be starting with the reserves that we own, like the Powder River Basin and in the communities where we have the most ability to control.

Second, I do have to talk a little bit about the idea that Powder River Basin is -- coal is cleaner. It is less in sulfur dioxide, and that is as Trevor was saying, the primary reason that it was turned to mostly so that the power companies could avoid putting on controls. It has the same amount of carbon dioxide per BTU.

It's huge in mercury, huge in other pollutants which are also -- there are a number of studies showing that the largest amounts of mercury and other air toxics that come into the West Coast are actually coming from burning in China. And the kind of particulate pollution which is the primary cause of the huge increase in respiratory disease is another things that are crippling people in China, are again being contributed to directly whether it's Powder River Basin coal or rather coal that's being burned.

Greg Dalton: There's a report by an economist at Stanford, Frank Wolak, who says -- claims that exporting U.S. coal will raise the price and therefore, actually reduce U.S. emissions because it will make coal more expensive and accelerate the switching to natural gas. Bruce Nilles, do you think that's true?

Bruce Nilles: I think we already have a strategy to drive the cost of coal, and that is simply beginning coal to pay its fair share. Look, if you and I took a bunch of rubble out of our backyard and dump it into a stream, into the bay, that would be a crime. If I'm in Appalachia and I blow off the top of a mountain and put all that nasty mining waste into a stream, that's legal. Now, why is it legal? It's because the coal industry, through many years of lobbying, has carved out exception after exception to every single environmental law.

What President Obama has been doing over the last four years, with a little pushing, without a doubt, is to begin to say "you got to pay your fair share. Let's level the playing field between all the fuels and let's have coal reduce its mercury pollution, stop filling in streams in Appalachia, and beginning to do its fair share."

So that's one of the reasons you're seeing coal prices go up, because of finally internalizing the cost. At the same time, wind and solar prices are plummeting, and that's why we're seeing record growth with wind and solar, particularly here in California.

Greg Dalton: Trevor Houser, do you think that exports will accelerate the switching from coal to natural gas?

Trevor Houser: Not by a lot. I think all else equal, exporting coal will increase domestic prices, but the supply curve for coal in the U.S. is pretty flat.

Which means if you increase the amount produced in the Powder River Basin, it's not gonna change the price much for coal -- from the Powder River Basin. But the implication of that on the international side is if you have a flat supply curve. So changes in price lead to large changes in supply that the introduction of the U.S. coal into international markets will mostly come at the expense of Australian coal or Indonesian coal or Mongolian coal. So, what are -- I don't know what the upper end estimates for West Coast coal experts are, 120 million tons? Maybe their currently announce projects?

Russ Macfarlane: When -- currently announced projects should be as much as 140 million tons. There's one industry analyst who said that they expect 350 million tons would be the total amount that the industry would want to really reach its strategies.

Trevor Houser: So, let's take like 150 million tons in the announced plans just to -- as a number for the moment. So, I think it's important to quantify just how big of a deal this is for the climate because we have scarce political capital on this fight and you have to choose which battles to wage. If we're talking about 150 million tons of U.S. coal exports going to China -- even if all of that was additional, right, even if all of that was consumed above the consumption of Australian coal, Indonesian coal, Mongolian coal. So I'm buying both the Pepsi and the Coke out of the vending machine, right?

Current Chinese coal consumption is about 2.5 billion tons, on path to three billion tons, right? So that 150 million tons would be a fairly small increase in Chinese coal consumption and a relatively small increase in global coal consumption, right? So we probably would be an increase in consumption to some extent and an increase in emissions but in the scale of the problem we're talking about here, this is not the existential issue we're facing at some point.

Bruce Nilles: Let me try a different way to describe it. If we burn all that 150 million tons of coal, that's three times as much carbon dioxide the entire state of California puts out with all 40 million people. That is a lot of additional carbon dioxide.

And so that's important because there's a lot of great work going on here in California to demonstrate to the country, here's how we can cut carbon -- and for three years now we've been cutting carbon here in the U.S. -- in California, to now say, "Oh, we don't care about three times as much as what's coming out of California." I think I disagree.

Russ Macfarlane: If I could slice it a different way, done some analysis showing that, you know -- I think we all know in Western states, our biggest emissions are typically driving. And so, getting people out of their cars, electrifying vehicles, huge strategies -- if we got everyone in every state west of Minnesota, west of Texas, out of their car for a year, that would be wiped out by exporting this coal in terms of the carbon emissions. We've done some analysis indicating that this is a bigger issue than Keystone XL, which I'm sure many of you have been following in terms of the carbon emissions.

And ultimately, we have to determine where we can be stopping and we need to be stopping that with the coal we own, the coal that we're subsidizing to be burned, and the coal that we have the ability to stop the creation of the massive infrastructure to facilitate that's being burned.

Greg Dalton: Let's talk about some of the regional politics and economics of this. There's a lot of states that are off coal for the most part of California. There's a few states -- Wyoming, Appalachia -- they're very coal-dependent. It's easy for us to say, "Well, yeah, you guys should suffer some burden because it doesn't affect us." So what's gonna happen to the miners who were losing their job to people in the coal industry, you're 50, what are you gonna do? Get another job? That's real tough. Bruce Nilles?

Bruce Nilles: So, Russ mentioned the example in Oregon and Washington. We spent two years working to put those two coal plants in retirement schedule. It was very important to us. We do a lot of work with Labor to demonstrate, "Look, we want to make sure this is being done in a sustainable and a way that is good for both the community and the workers." So in both of those examples, in Oregon and Washington, those coal plants are being retired over the next six to eight years, different schedules for each of the two.

And there is a package of economic investments and mixture of company investments and stake investments that were critical to us to make sure that both the community and the workers are left whole at the end of the process, both with training and new investments in clean energy, but also making sure the community which is getting some taxes right off from those coal plants is made whole. So, that is a very important issue to us because at the end of the day, Sierra Club -- we have members in every single state. We don't parachute in, fix the problem and leave. These are community members who care desperately about what happens in those states. And getting this right is something we spend much of everyday doing.

Greg Dalton: And are there former coal miners who have new jobs today in another industry?

Bruce Nilles: I will concede that the issue of coal mining, particularly in Appalachia, is the toughest issue we have wrestled with, and here's why. If you're in West Virginia today and you'll turn on the radio, you will hear about Obama's war on coal and it is 24/7 coal, coal, coal, coal. The late Robert Byrd, Senator Robert Byrd, had the courage and statute to stand up and say, "You know, coal has been good for West Virginia for decades, but this coal is actually going away." And the truth is, as the Energy Information Agency, the coal in Appalachia is likely gonna decrease by about 60 percent in the next four years, regardless of what the Sierra Club does, because the seams are getting too deep and too expensive to get out of the ground.

So they have to start planning for the future. And we are saying, "Let's start going. Let's start talking about investments in solar, investments in wind. Let's get West Virginia thinking about the future." And right now, there's no political leadership in that state to have that conversation. So we are struggling -- I will concede in West Virginia in particular, and it's because the coal industry has such a lock on politics that no one has a courage after late Senator Robert Byrd left and arguably, Rockefeller a little, but now he's living too, to stand up to the coal industry to state, "Stop your scare tactics and let's talk about the future of West Virginia, that's a future beyond coal," but they're not ready to have that conversation yet.

Russ Macfarlane: And I think when we're talking about jobs and coal, we need to also focus on first, coal is near the bottom of any list of where investments will produce jobs and specifically, high-paying jobs. It's highly mechanized both the mining and also the export in the other steps, so there's very few direct jobs that are created per millions of dollars of investment.

It has had a spectacular record-breaking union power and reducing the safety. It has also had a tremendous record of doing the kind of corporate manipulation that actually leaves many of these miners in places like Appalachia where the mines are played out, completely vulnerable. The miners' union is now suing the two largest American coal companies, Arch and Peabody, for creating a shell company, outsourcing many years of liabilities of pensions, worker benefits, environmental responsibilities into the shell company, and then having that company go bankrupt.

Greg Dalton: Regarding job creation, I believe it's jobs per million dollars of investment. There was a research report (0:26:47) from your website links, Russ Macfarlane, sustainable forestry was number one, crop agriculture, gas pipelines, transit and livestock. I was -- got a little surprised to see gas pipelines, natural gas pipelines in there as number three. So let's talk about natural gas. We haven't -- we can't, it's hard to talk about coal and natural gas. They go together. You know, Bruce Nilles, does the Sierra Club think that natural gas is the future? Is it cleaner? Is it bridge fuel to the future?

Bruce Nilles: We don't think it is. Let me just touch on the jobs. There's a 150,000 people in the coal industry that is working in the mines and in the power plants -- 150,000 total in the entire United States. And that's producing the largest share of our carbon dioxide emissions. We have 150,000 people a day working in the wind and solar industry. And they are just getting started, right? Even here in California, there's more people by far than in most of the rest of the western states doing clean energy versus coal.

So, just the sense of scale. Clean energy is already doing far more than the coal piece. Natural gas, we have learned a lot over the last couple of years in terms of -- natural gas has -- yes, if you burn in a power plant, about half the carbon dioxide emissions of coal.

But it has a whole bunch of other problems that we are now finally realizing, it is -- it is the last thing you want to do if you're actually trying to solve the climate crisis, and here's the problem. When you drill for gas and you transport it, you leak a lot of methane. Methane is a very potent greenhouse gas. And so, the latest science are saying it is anywhere from 20 to 30, maybe as much as 50 percent worse than we ever thought gas was because of the leakage of gas during the drilling and transportation process. In addition, there's a whole bunch of environmental issues associated with drilling and burning natural gas. A bunch of problems with communities who live in places where they are fracking the heck out of the area and you're seeing significant contamination problems. So when we think about how are we transitioning to clean energy economy, our vision is, let's go from coal to wind and solar. Let's go from coal to large investment energy efficiency and showcase how to do it and not get by -- get stuck in the process with something that has a whole host of environmental problems.

Greg Dalton: When you say you say you've learned a lot in the last couple of years, it's interesting because it was just a couple of years ago that the Beyond Coal Campaign received what, $26 million from a natural gas company. Was that a mistake? Is that part of the learning process? Was that before you do some of the impacts of natural gas?

Bruce Nilles: Totally fair. It was.

Greg Dalton: Russ Macfarlane, any thoughts on natural gas?

Russ Macfarlane: Well, I agree with Bruce that there's -- that the key issue is to focus on leakage and -- as well as of course, all the other kinds of environment issues that go with it. Natural gas is playing a pivotal role along with the pressure from communities, pressure from regulations in killing coal. And you know, it's gonna play that transition but having via long-term portion of our energy supply is certainly not a place that we're supportive of moving in any significant way. And really emphasize the area of energy efficiency as being the number one thing that we hear, need to be continuing to double down on and that is a huge opportunity in developing economies around the world where we can be decarbonizing our economies and creating greater prosperity at the same time.

Greg Dalton: Russ Macfarlane is senior adviser with Climate Solutions, an environmental group. Other guests today at Climate One are Trevor Houser, a visiting fellow with the Peterson Institute, and Bruce Nilles, senior director of the Beyond Coal Campaign at the Sierra Club. I'm Greg Dalton.

Trevor Houser, is natural gas a good bet for investors? You advise investors on partly -- on banks and financial institutions on where to put their money? Is natural gas a good bet? Low prices, stable supply? It's American, got some problems but how are they doing?

Trevor Houser: I mean, in terms of natural gas as a solution to climate change, I disagree with Bruce a bit on the -- what's called the methane leakage question, which is how much methane -- which is natural gas un-combusted, is released either when shale gas wells are fracked or when they're transported in pipelines. This is a critical question in terms of just how climate-friendly or unfriendly natural gas is. There's very little good work done yet assessing on a national level what that looks like. There's a couple of studies that are, that point to it being a bigger problem than we thought and there's studies pointing the other way. So to be honest, we just don't know what that was about yet.

Greg Dalton: Some of those studies were funded by industry --

Trevor Houser: And some were funded --

Greg Dalton: -- or by the National Oceanic and Atmospheric Administration came out recently. it's on the high side. But that can be managed with proper technology and oversight?

Trevor Houser: So that's the key to me. That it's not -- that's not an intrinsic part of the problem. So the CO2 in coal is intrinsic in the coal. There's nothing you can do about it, except carbon capturing/sequestration which is extremely expensive. Fugitive emissions from methane, that leakage, is something that you can address with proper regulation. So to me, it comes down to yes, natural gas can be an important bridge fuel, provided there's adequate regulation to ensure that methane leakage is not a problem, to ensure that fracking is done in a way that's environmentally sustainable. I think probably, the difference and my view on this versus Bruce is, is that I don't leave in California.

I live in New York and spend a lot of time in oil and gas land and while I would love to see us go right from coal to wind and solar, that is just not the political world we live in. When you're in a world where the president can't say climate change, you're not in the world where there's sufficient political appetite to replace coal-fired power plants with wind and solar. I wish we were in that world but we're not in that world. When natural --

Bruce Nilles: Let's go to real world. Texas has installed 10,000 megawatts of wind. They're not doing it because of climate change. They're doing it because it's good economics. Right? So there are states that you would put in the gas sector. They're doing incredible things on clean energy. So --

Trevor Houser: They're doing that because of a federal tax credit. Right? The PTC that gives 2.1 cents per kilowatt hour.

Greg Dalton: Production tax credit which is extended for one year.

Trevor Houser: Right. The production tax credit. Right. So there's taxpayer subsidy to wind that enables it to deploy. Right? Everything's subsidized. Okay. So, in this case, that's what allows wind to deploy.

Bruce Nilles: So, let's be fair. Oil and gas is subsidized.

Trevor Houser: Sure. In Texas, I think the opportunity that natural gas provides is you have a state that produces a lot of natural gas, is reliant on Powder River Basin coal imports and a friend of mine who works at UT Austin got a call from the governor's office a couple of years ago and they understand the logic of that. "How come we switch from this coal that we import from the Powder River Basin, to natural gas that we produce within our state? We're out of compliance with our, with EPA regs. We just need to find a good way to do that." Now, unfortunately, the governor had -- Rick Perry had already crossed off the list most of the policy options that you would point to as being not politically acceptable.

But for a large swathe of the country right now, some of the very same states that are coal producers are also emergent natural gas producers. And so it changes the political map of climate change policy in a useful way. So in Pennsylvania, right, which is a very large coal producer, natural gas now employs more people in Pennsylvania than coal mining did.

And so that stranglehold of the coal industry that you've had a hard time breaking in West Virginia, that's being broken in places like Pennsylvania because of natural gas.

Greg Dalton: And some people would argue that that low natural gas prices are making American industry competitive again, that it's helping the economy. And Trevor Houser, you were a negotiator for the United States State Department at the Copenhagen Climate Summit in 2009, and if you have anticipated the trajectory of U.S. greenhouse gas emissions to 2013, what would have -- what did you think would happen and what actually happened?

Trevor Houser: So, today, U.S. emissions are about 13 percent below where they were in 2005. Our pledge in Copenhagen was a 17 percent reduction by 2020. So, the U.S. was within reach of its climate commitment.

Greg Dalton: Without any cap and trade, any policy?

Trevor Houser: Without any cap and trade.

Greg Dalton: Okay. So, we're stumbling and we got lucky.

Trevor Houser: Right.

Greg Dalton: But why?

Trevor Houser: So, it's been a mix of things. The largest single reason has been the recession. So, that's not something as politician I would want to be showcasing.

Greg Dalton: It depends on what politician you are but --

Trevor Houser: But a large share has been renewables and natural gas, right? So, renewables in the transport sector, renewables in states like California with good state level incentives for renewable deployment, and the large switch from natural coal to natural gas that we've seen over the last year or two.

Greg Dalton: And on natural gas, Russ Macfarlane, some people want to export natural gas. Would people in the northwest, Oregon and Washington, would you be opposed to exposing natural gas to Asia? A lot of people want to do that through British Columbia elsewhere?

Russ Macfarlane: There are very active opposition campaigns. Ironically, two years ago, there was a major push to build these large liquefied natural gas import facilities along the Columbia River and Coos Bay and other coastal communities. All of those sites, all of those developers have now shift their focus to -- now, we're gonna build an export. So…

Greg Dalton: Turn the pipes around.

Russ Macfarlane: Just to I think, try to show how volatile these markets are and a lot of experts are raising questions about how long-term and durable this, you know, price disparity is and the likelihood of doing that.

You know, we at Climate Solutions haven't camped out firmly in terms of this other than strongly agreeing with Bruce that this isn't a long term strategy for either our country, our region or the globe. And also, agreeing with Trevor, that we need to have strong controls, which we don't have currently. There's no way of being able to verify what the leakage rates are other than individual studies, because the industry managed to get things deregulated. And -- but that there are huge, there is huge opposition. There will be huge opposition to any effort to build liquefied natural gas because of many groups who are concerned about, you know, direct community impacts.

Greg Dalton: So, do you think that natural gas ought to be regulated at the state level as it is now? Texas -- some states have pretty good laws. Other states, it's wild and loosey goosey. Do you think it ought to be federal regulated or at the state level?

Russ Macfarlane: I'd say all of the above. I mean it was under -- it was under vice-president Cheney and his energy commission that was set up, some of us remember back in 2001, 2002, that really ramped through the massive deregulation that natural gas wanted at the time and created the circumstances for the boom that we're seeing now. Now, the major sophisticated companies are saying, "Well, we can do this safely. We can't do this with minimal leakage." But there aren't any circumstances or regulations or even transparency in place for any of us to know that they are in fact doing that or that the wildcat developers won't continue to do it in a very destructive way.

Greg Dalton: Bruce Nilles? Local versus state regulation?

Bruce Nilles: If we look at our history, the only thing that actually works to really level the playing field is when we have strong federal regulations. The notion that West Virginia is gonna put in place state regulations and everything's gonna be hunky-dory and that the people of West Virginia are gonna have clean drinking water, we tried that once. It didn't work, right? So, let's be honest about the experience we've had of 30 years of environmental regulations.

We need strong federal laws that say everyone has a basic right to clean air and clean water and states can go stronger, and we've always said states like California can lead and show us what's next. But we have to have minimum safeguards that say, regardless of what industrial activity you have, wherever you do it, some basic things that we as Americans are all entitled to and the notion that we're gonna say to the gas industry, "Oh, you can do what you want and whatever deal you work out in West Virginia," it's a recipe for disaster.

Greg Dalton: But that's a tough political proposition in an area where the Environmental Protection Agency is on defense and basically has a moat around it just trying to maintain the gains they've had, protect the Clean Water Act, protect the Clean Air Act, your new major regulations. That's a heavy lift for an EPA that's back in its heels.

Bruce Nilles: I think of you ask Lisa Jackson, whether she's been -- she's been on offense for four years and she passed through the strongest mercury regulations in our nation's history before she left office a couple of weeks ago. She passed through a strong increase in particulate matter standards. It pushed through two different standards on fuel efficiency standards. That's pretty aggressive and focused and achieving significant reductions.

And when you mentioned how we've been getting these climate reductions, I actually -- the way we think about at Sierra Club is there's two ways things are happening. It's not in Congress. The notion of a grand bargain on climate change we realized back in 2009, we ran into the brick wall of coal industry. They were simply too powerful. I'll concede here on stage that in 2009, we could not roll the coal industry. They have a lock on Congress and the Congress will do whatever the coal industry says.

But there are two other very important places where you can make change. One is the executive branch, working with the President to get EPA to do its job. And the others, the state and local level, and that's where all the progress has been happening. So we have EPA and the White House passing regulations reducing carbon emissions from power plants and from cars, and a whole bunch of stuff going at the state level which is really changing and driving, I would argue, the carbon reductions that we are seeing, not enough. And certainly, 17 percent reduction of carbon by 2020 is nowhere near enough to what the science requires.

But we're beginning to put together a framework that shows us, "Here's how we do it and let's accelerate our progress."

Greg Dalton: Trevor Houser?

Russ Macfarlane: You know --

Greg Dalton: Sorry. Russ Macfarlane?

Russ Macfarlane: So, I was just gonna add in, despite some of the spinning that's going on, pulling and specific campaigns where this has been issue, shows that breathing, drinking, having health communities are actually surprisingly popular from most people, and that people do draw those connections in a way. So, you know, when you get away from some of the rhetoric around war on coal or particular, you know, volatilized issues and just ask people about whether or not they think that we should have stronger or weaker environmental protections, very uniformly -- not just in places like California or Washington, people support having stronger protections.

Greg Dalton: We're gonna invite your participation and put a microphone up here and encourage you -- if you're on this side of the audience, please go through that door and the line forms with our producer, Jane Anne right there. We welcome your participations, what this is all about, and invite you to come up with one, one part question or comment. [Laughter] If you'd like to read us on it, I'll jump in.

Bruce Nilles: No filibusters.

Greg Dalton: No filibusters, yeah. We've had filibuster before here. So, until that gets going, we're talking about coal and clean energy at Climate One at the Commonwealth Club. Our guests are Trevor Houser with the Rhodium Group, Russ Macfarlane with Climate Solutions, and Bruce Nilles with the Sierra Club, I'm Greg Dalton.

Trevor Houser, let's get you in that policy perspective. You are a former diplomat with the State Department. Do you think the action's gonna be at the states, is it gonna be in Congress, executive branch, where is it gonna be -- policy-wise in the next few years?

Trevor Houser: I think it's gonna be a combination of regulations coming out from the EPA are gonna be important. State-level actions are gonna be very important and there's always the prospect of -- I don't think that the prospect of economy-wide policy is completely dead.

And I think that the -- that the event that might catalyze that policy is the budget situation that we face. You know, reasonable adults would agree that we're not gonna address the debt just through tax cuts or through tax increases. We're not gonna address to that just through spending cuts. If there's gonna be some combination of increase in revenue and some combination of reduction and spending that's required.

If you talk about something like a carbon tax in isolation and you put it to the American people and say "Would you support a carbon tax?" very few people are gonna support it, right? Because who likes to taxes? If you start talking about a carbon tax relative to other sources of revenue like raising the Medicare and social security retirement age to 68 or imposing a one-percent tax on millionaires. Those types of things give you the same amount of revenue that a carbon tax would. Suddenly, a carbon tax starts to look a little bit more attractive. And if the European experience over the past few years has taught us anything, it's that when you hit a fiscal crisis, what seemed politically impossible yesterday, seems political inevitable today. And so I think given our fairly precarious fiscal position going forward that it's dangerous to rule out some fairly aggressive national policy.

Greg Dalton: And it has a lot of support among some very conservative circles who like the idea of taxing bad things, coal, fossil fuels, and not taxing good things, jobs, et cetera. So, it may have some length. Let's have our audience question. Welcome, sir.

Gavin Purchas: Thanks. I'm Gavin Purchas from the Climateworks Foundation. Question's really to Bruce, but to all of you. We've got a sixth of the coal fleet already, the current regulations that are in place, make maybe a third vulnerable that we can get offline by 2020. How do you get the rest?

Bruce Nilles: So, to me, the economics of coal changing in the last couple of years has been one of the most exciting things in the decade I've been doing this work. We are seeing wind development in a state like South Dakota which I want to appropriately think of as a very red state and is not -- a lot of discussion at the state legislation about solving climate crisis.

Today, there are about 30 percent of wind power, just quietly going about building wind turbines, adding in a ton of clean energy. And to me, when I think about why does that happen? Yes, there's subsidies for wind but there's also subsidies for everything else. But it's also because the economics of the alternatives are worse. And as we know here in California being on the cutting-edge of clean energy technology, all those prices of wind and solar are coming down. LED light bulb is coming down. All the good stuff is coming down. Price of coal is going up, and variable is the price of natural gas. I think anyone will bet at some point, it's gonna go up.

And so, the question is, how do we position ourselves in the next couple of years, getting the first third of the coal fleet offline which is what we are trying to do by 2015, and then really set it up so the rest of those coal plants, which are now fully internalizing all the cost of environmental compliance, are simply being outcompeted in the markets space because clean energy is coming in much cheaper and essentially disrupting the old way of doing business because it is too expensive.

Greg Dalton: Michael Bloomberg gave the Sierra Club $50 million to fight coal. Why did he do that?

Bruce Nilles: That was a nice grant.

[Laughter]

Bruce Nilles: It was --

Greg Dalton: Better than that natural gas one, yes.

Bruce Nilles: So, Mayor Bloomberg, as you know, has been fighting a bunch of things including large sodas but really because about public health and has been -- like us, has been very frustrated at Congress not addressing what are -- what in his views, as a moderate Republican or as an independent, he says, "These are things we as Americans can all agree on." So he's been working on guns, on tobacco. He's been willing to pick fights with some very powerful industries.

He came to us -- well, we actually went to him a couple of years back and said, "Look, we have a very measurable human health crisis associated with coal mining, burning and ash disposal. We can tell you that there's 13,000 people a year dying. There's about a million people ending up in the emergency rooms from asthma attacks." There's all these measureable health consequences about current reliance on coal -- about a hundred million Americans from cities where it's unsafe to breathe, a lot of it coming from coal. We have a campaign that we believe we can get a third of the coal fleet retired.

The rest of it could clean up its act in the interim and then ultimately get it all retired, and he put us through a very rigorous process with some of his staff to demonstrate how we could do this, literally working state by state and he made a big bet on us two years ago to say, "I'll give you a four-year grant to go forth and see if you can in fact do it." And I'm delighted to say we're almost halfway there two years in.

Greg Dalton: Let's have our next audience question. Welcome.

Gary Latshaw: Thank you very much for an interesting evening. Gary Latshaw from the Loma Prieta Chapter of the Sierra Club. Carbon soot has been described in a more -- actually today, it was announced in an article, as a major cause of climate change. I wonder if you could comment on what fraction of that might be coming from coal.

Greg Dalton: Is that black carbon? Yeah. Trevor Houser?

Trevor Houser: I don't know the exact numbers for black carbon.

Russ Macfarlane: I don't know the exact numbers either but -- soots, black carbon is at, you know, significant outcome of coal plants especially the kind of relatively uncontrolled --

Greg Dalton: Explain what it is and why it matters.

Russ Macfarlane: Well it's, you know -- it's essentially a particulate matter that is formed from incomplete combustion of coal and other things. There's also a large amount coming from diesel. So, you know, the transporting of this coal, huge distances, will be contributing to that. And --

Greg Dalton: And it can land on ice fields attracts heat to accelerate the melting.

Russ Macfarlane: Exactly. And so, these are all just, you know, cumulative kinds of impacts on top of the basic carbon dioxide impacts which are overwhelming in themselves.

Greg Dalton: Let's have our next question. Welcome.

Amanda Joy Ravenhill: Hi. I'm Amanda Joy Ravenhill. I teach at the Presidio Graduate School here in San Francisco and I'm curious about what you find to be the most promising technologies to draw down carbon from the atmosphere.

Greg Dalton: Trevor Houser?

Trevor Houser: Trees.

Russ Macfarlane: Yeah.

[Laughter]

Trevor Houser: And not cutting them down.

Greg Dalton: Planting more of them?

Trevor Houser: Yeah. Planting more of them. Absolutely.

Greg Dalton: Bruce Nilles?

Bruce Nilles: Harvesting coal plants?

Greg Dalton: Harvesting coal plants?

Bruce Nilles: I was being facetious. But I mean, there's a ton of very exciting war going on. Forest being won, restoring prairie soils -- I mean there's a bunch of things to help from a landscape level, really pull carbon out of the atmosphere.

Greg Dalton: There's a big article recently about synthetic, artificial photosynthesis technology doing that sort of thing? Russ Macfarlane?

Russ Macfarlane: We at Climate Solutions are working on an exciting initiative called the Northwest Biocarbon Initiative which is basically how we can move beyond what we need to be doing in terms of stopping carbon emissions, declining carbon emissions but then, figuring out how we can create healthy ecosystems, that degree with trees, farming versus sustainable practices are still the key ways to be able to do that and we've got to be able to harness all of those kinds of techniques in both urban and rural environment.

Bruce Nilles: And let me add why it's important.

Greg Dalton: Bruce Nilles?

Bruce Nilles: According to the best science, we essentially need to be done with fossil fuels sometime in the next 20 to 25 years and then being negative -- negative carbon. And the question is how to get there and there's a lot of very exciting ideas as Russ has described, about how you better manage the landscape so it's absorbing carbon out of the atmosphere. But essentially, we need to stop making the problem worse in the next couple of decades and then actually begin to pull more carbon out in the atmosphere, which is a very exciting work.

Greg Dalton: And you're confident that's gonna happen? Optimistic?

Bruce Nilles: We have to make it happen.

Trevor Houser: Yeah.

Russ Macfarlane: Yeah.

Greg Dalton: Yes, sir. Welcome.

Nate Aden: Hi. Thanks for a very interesting discussion. My name is Nate Aden. I'm with the World Resources Institute in Washington. As everyone here knows, the EU has been pretty far ahead of the U.S. in climate policy and energy policy overall. However, for the past couple of years, coal has been skyrocketing there. This year, it's been increasing at an annualized rate of about 50 percent in some countries. Also, the largest, you know, everyone likes to talk about U.S. exports to China, but actually, the largest export destination for U.S. coal is the Netherlands for 2012 and 2011.

I'm wondering if the panelists could comment on what went wrong in the E.U. and what's going on there because the EU-ETS, the idea was that when this happens, the price of carbon would go up but it's been very low for the past year regardless of rising coal use. So…

Greg Dalton: ETS being a carbon market in Europe. What's wrong with Europe coal and this is a very good point. Thank you. Coal is really surging internationally, maybe on its knees in the United States, but internationally it's a different story. Bruce Nilles?

Bruce Nilles: I wanted to dig below that story because it's actually a couple of fascinating things going on. So, I actually grew up in England and the story was England's increasing its coal use, which is in part was true because gas prices were up. But it was also because they have a rule in Europe, which is to phase out their coal plants, and they have a certain amount of hours in which to operate before they have to retire. And they're essentially, over the last two years, has been running them full out to use those hours up and now, they're shutting down.

So, I think I think what's important in all this is what's the trend? And the trend is not, at least long-term, that coal use is gonna go up in Europe, it's actually going down. Now, Eastern Europe is a different story. But at least in the Western Europe part, indications are that it's a short term phenomenon because the way they set up the program that they're running these coal plants before they ultimately shut them down.

Greg Dalton: But wasn't there also some things in Germany went from nuclear and they went to coal after they shut down nuclear pretty fast after Fukushima and coal replaced it. Trevor Houser?

Trevor Houser: Yes. Primarily, you can blame the Greeks. I mean, it's -- you have a cap and trade system which means you set a cap for overall emissions and then, you know, if emissions are below the cap, then you can burn whatever you want. From an economist standpoint, that's fine. You should be setting your cap at where you want emissions to be and then you want the market to determine what's profitable to burn. So, if the bottom falls out of the economy and there's just less demand for energy, then you meet the cap pretty easy and that's what's happening in the EU-ETS right now, that it's just that emissions don't cost a lot in the market because of weak demand for energy.

Greg Dalton: Russ Macfarlane?

Russ Macfarlane: I'll only add, I spent a lot of time reading coal industry publications and even the very -- folks are very bullish on coal, see that EU growth has been a short-term phenomenon for the reasons that both Trevor and Bruce were describing.

Greg Dalton: Let's have our next question. Yes, welcome.

Shawna Rappaport: Great. Thank you. Hi. Thank you for a wonderful discussion. My name is Shawna Rappaport. I'm curious just about your perspectives in terms of cap and trade versus the increasingly discussed fee and dividend, especially in relation to the policy element of this evening's discussion. I'm curious about your perspective on both.

Greg Dalton: We'd like to tackle that and define with fee and dividend is. Jim Hansen was recently -- and he said -- I guess, he's a main advocate of fee and dividend and I guess David Letterman asked him, who's a meteorologist who really gets climate change. "What do American people need to understand?" And he said, "They need to understand the difference between cap and trade and fee and dividend," and Letterman just that down. So, please define what --

Russ Macfarlane: You know, I'm not gonna define any of this. Our primary goal on this is "git'r done." We need to start putting a significant and escalating price on carbon. We need to be putting the cap on carbon. We -- you know, we personally had been more in favor of cap over the years. We put less focus on the trade but, you know, that can be an economically efficient model to get things done. But we want to be focusing on what politically feasible to both address this overwhelming climate crisis, but also to provide revenues for some of the key physical issues that we're all facing, which is absolutely need to be doing that. And we can all set up circular firing squads or dance around the head of the pin and say, "No, it should be this way or that way." I think we need to all be getting common cause to get this done.

Greg Dalton: But there's a big difference between -- Trevor Houser, you talked about carbon tax being part of a fiscal solution, which means more money coming in to the government.

Trevor Houser: Right.

Greg Dalton: Fee and dividend is, the money comes into the government, it's revenue-neutral and it goes back to the people.

It doesn't feed big government which includes, which may engender some political support. So, I'd like to hear your take on fee and dividend versus other revenue mechanisms that bring money into the government.

Trevor Houser: Yeah. I mean, the basic question is, are you taking the revenue that's being generated from a program? You can generate revenue from a cap and trade program. You can generate revenue from a fee and dividend program. You can generate it from carbon tax.

Greg Dalton: And California is doing that.

Trevor Houser: Right. You've got three options with that revenue. You can either give it to the companies that are impacted to offset the cost to them. That's why what would happen with most of the revenue under the Waxman-Markey Bill, that it would have been given back to power-generating companies in the hopes that they use that revenue to keep electricity prices from rising. It can take the revenue and use it to pay down the debt or you can take the revenue and use it to offset other taxes or to give it directly back to the people and that's basically the same thing.

So whether you use that specific revenue from a carbon tax to reduce the corporate income tax or you give it back to people directly, the distributional impact to that is a little bit different but the concept is the same. At a national level, I think there is almost no prospect for cap and trade in the foreseeable future. It is -- you cannot overstate how politically toxic that particular mechanism has become. I think that there is much more prospect for a carbon tax or fee and dividend-like scheme where the revenue is used for other priorities -- other fiscal priorities.

Greg Dalton: That's happened in British Columbia where they put in a tax and it offsets some other taxes and people are getting money back. Bruce Nilles?

Bruce Nilles: Well, it's interesting you mentioned British Columbia because one of the great models to us is the sister state of Ontario which just yesterday, announced it was shutting two of its last five coal plants. It wasn't through any fancy cap and trade or fee and dividend or carbon tax.

It was good old fashioned regulation that said, "we, the State of Ontario, we both do healthcare," they have state-subsidized health care, "plus we provide energy for our people, electricity. We did the math. It makes no sense to burn coal and then have to pay to get people well from getting sick. Let's do that math and we're gonna shut down all the five coal plants over the next five years," and that's what they did. And it was very orderly and they're building out clean energy in a sort of rational decision-making process that says "we're gonna shut them down through regulation," and that is a very clean and efficient way to do it.

Greg Dalton: And the United States federal government has parts of the government that are charged with getting money from leasing public land for fossil fuel extraction and other parts of the government that are charged with addressing the consequences of doing that. So, let's talk about the leasing aspect and how you think that subsidized very cheaply that U.S. taxpayers are not getting a good deal.

Bruce Nilles: Well, so this is one of the things that's really bubbled up over the last twelve months which is, most of the coal in the U.S. comes off the federal land, land that you and I own in Wyoming in Montana. It's leased by the Bureau of Land Management out of the federal government, and it's been run with this most bizarre, corrupt process where there's essentially there's no bidding. It has all the coal things -- has anything been touched by the coal industry, you've essentially gutted any requirements for any open bidding and they're essentially getting coal for rock bottom prices of around a dollar a ton. And that's land that belongs to you and I.

And so, the question we have, whether it's coal or the oil and gas drilling that we are calling on the President to ask is, "Is this division that we in America have?" which is, "we're selling off our public lands for the coal industry to make a quick buck to then ship to China to accelerate climate change?" That's not the vision that we had when we elected you and we need him to pay attention and start to demand. Let's reform this insane process that's having us give away coal and then ending up frying the planet.

Greg Dalton: Well, how good of a job do you think President Obama has done in the first term on climate change?

He came in saying he was gonna heal the planet, et cetera. Has he delivered?

Bruce Nilles: I think we've given close to outstanding marks when you look at what he did on investments in -- during the stimulus, in terms of investments in energy efficiency and clean energy, and he appropriately says during his four years, we doubled the amount of clean energy installed in the United States, which is true. So we have the largest investment in wind and solar ever over the last four years. Under the leadership of Lisa Jackson, at the behest of the President, we also did two rounds of fuel efficiency standards to cars and began to put in place a regulatory system to regulate carbon from coal-fired power plants and natural gas power plants, the first ever in the country.

So, from a carbon perspective, doing what the President can within his executive powers, we think he did a pretty good job in terms of really beginning to lay the groundwork for how do we get there? Now, Congress needs to do their share and that is a whole separate problem. But in terms of what the President did in his four years, it's a good foundation. Yesterday or a couple of days ago, we laid out a bold vision for the second term, a whole sweep of things the President can do to really build on what he did in the first term to really accelerate and build on the games of what we've accomplished in the last four years.

Greg Dalton: Trevor Houser, do you agree? Close to outstanding marks?

Trevor Houser: I will recuse -- having to work for the administration, I will excuse myself from evaluating he performance.

Greg Dalton: We'll let you. Okay. Russ Macfarlane?

Russ Macfarlane: I would agree. The -- but there's far more that the President needs to be doing moving forward, and that's what we're gonna be looking to hold them accountable for -- I mean I think any leader says, "Look," you know, "I wanna be doing these things, now make me do it." And we all need to be doing that certainly around the building out of infrastructure for whether it's fossil fuel exports, things like the Keystone XL which we're gonna tap into these usual reserves. Reforming these leasing or royalty practices so that we as the taxpayers aren't getting fleeced by these companies who are trying to profit from these schemes.

Making the kinds of strong appointments that are going to follow up with the leadership of Lisa Jackson as head of EPA and ensure we got equally strong leaders in places like the Interior, which are gonna be critical for this, are all things that we're gonna be looking to do. But you know, we need to be having that kind of leadership moving forward if we're gonna turn this climate crisis around.

Greg Dalton: Let's wrap up and I want to ask you individually about what you've done personally to reduce your own carbon footprint. [Laughter] And what you might do in 2013. We'll go this way. Russ Macfarlane?

Russ Macfarlane: Well, let me say a good thing and bad thing. I do have a -- I just installed solar panels and they're powering a plug-in Prius in my driveway which I'm very excited about, and actually, the economics on both of those things are phenomenal. The bad thing is I'm actually on a different project flying around the globe, a huge amount trying to work with aviation leaders who are looking to create low carbon fuels. I figure that part of my carbon footprint is an investment in a low carbon future but it's still risky bet.

Greg Dalton: And what are you gonna do in the future? Other than stopping flying? What's your next -- what's your next thing?

Russ Macfarlane: Walk more, bicycle more.

Greg Dalton: Yeah. And thanks for flying here today by the way. [Laughter] Trevor Houser?

Trevor Houser: I think unfortunately, I'm moving in the wrong direction because I'm moving from New York City to California this summer. So I'm going from no car, 900 square feet of coal generation apartment building to, I don't know how many cars you have here in California. It just seemed like seven or eight.

Greg Dalton: It's a law that we have five each, yeah.

[Laughter]

Trevor Houser: Yeah. So I'm not -- I'm not going in the right direction.

Greg Dalton: But moving to California is a good thing. Bruce Nilles?

Bruce Nilles: So, I had moved to California three months ago and after four years of car-free living, I bought my first car, my first new car ever and did a lot of shopping around about the electric choices, and I ended up on a plug-in Prius. And to me, it still obviously has a fair amount of gasoline.

But to me, it was, the notion of driving around the East Bay with no -- nothing but electricity and then thinking about how California is on the track to have at some point, if we push hard enough, 100 percent clean energy. That to me is enormously exciting. So even though I spend my days working to shut down coal plants, the transportation sector and the excitement of having an electric car, to me is -- there's a lot of promise there.

Greg Dalton: I'm not sure I can let this but a plug-in Prius, it's not quite an electric car. So why don't you guys go all the way to electric?

Bruce Nilles: The thought was, because if you have a full electric, because we only have one car, you have a full electric, then you may want to go to Tahoe and go skiing. And you can't get there and head back.

Greg Dalton: And how many -- and how many times a year does that happen?

Bruce Nilles: I've been once.

[Laughter]

Greg Dalton: Okay. Russ Macfarlane?

Russ Macfarlane: You know, it's actually primarily my wife's car. I -- mine --

[Laughter]

Greg Dalton: Oh, the old wife does. The old wife does.

[Laughter]

Russ Macfarlane: No, no. [crosstalk] And her -- she goes to Olympia once a week, which is outside the range of a pure electric.

Greg Dalton: Once a week. That's a different story. It's interesting. Some of the electric car companies are talking about bundling car rentals with that so they try to address that kind of, you know, you buy for the 90, 95 percent of the usage and you sort of rent for that five percent usage that dreamy, fictional trip to Tahoe once or twice a year with -- I really like to think that they do with their SUV and so they're thinking about making that really easy. Some of EV owners also swap with their neighbors and say, "Well, okay, can I have your SUV for the weekend and you can have my Leaf." And they do that. We have people who do that which sometimes, it's really interesting. We're doing an event here coming up pretty soon about this sharing economy that will address some of that.

So, I'd like to thank Trevor Houser, partner with the Rhodium Group and a visiting fellow at the Peterson Institute. We've also been hearing from Russ Macfarlane, senior advisor at Climate Solutions. And Bruce Nilles, senior director of the Beyond Coal Campaign at the Sierra Club. We're talking about clean energy and coal here today at Climate One. I'm Greg Dalton. Thank you all for coming.

[Applause]

[END]