Risky Business: Underinsured Against Climate Disaster

Guests

Junia Howell

Dr. Simon Young

Umair Irfan

Carolyn Kousky

Eric Letvin

Summary

Home and property insurance is complicated and typically boring – until a disaster happens to you. In recent years, hundreds of thousands of people in high-risk disaster areas across the U.S. have been dropped from their insurance policies, leaving them both physically and financially vulnerable. At the same time, premiums have sky-rocketed, putting home and business coverage out of reach for many.

Junia Howell is an urban sociologist on the faculty of the University of Illinois Chicago. Her research has found that FEMA disaster recovery payouts tend to increase inequity.

“We have a very needs-based aid system, meaning we have to establish the need in order for our government to say, ‘yes you deserve this aid.’ And because people have to establish need, they bring their inequality, the inequality that exists already in the world, into the system,” Howell says. That means that someone with a higher home property value will get a higher payout than someone with a lower-priced property.

FEMA's own analysis shows that after a disaster strikes, low-income survivors are less likely to receive money to repair damage and pay rent. In November 2020, FEMA released an internal study finding that “many FEMA programs do not consider the principle of equity.” Howell says while we may think equity should be baked into federal programs: “There's always been a preference for economic development, for basically helping those that we think are not only going to help themselves but help the community. And that has never included people who are racially marginalized migrants or others who are socioeconomically disadvantaged.”

But there are ways to deliver better disaster aid. One possible option could be as simple as cutting flat checks to everyone hit by a disaster, similar to how the government distributed COVID relief payments. That would have the added benefit of getting money to people sooner. The slow pace of payouts in our current insurance and federal relief systems slows recovery and compounds economic insecurity following disasters, says Carolyn Kousky, author of Understanding Disaster Insurance: New Tools for a More Resilient Future.

“If you have huge expenses you can't pay, you don't have the savings, you don't have a loan, you don’t have any way to handle it, then people can really start to spiral into really terrible financial situations.”

“It's not just about reimbursing damages but it's about having the financial resources that you need for whatever it is to get back on track,” Kousky says. “And maybe that's rebuilding your home, maybe that's replacing lost income, maybe that’s covering somewhere safe to stay. And maybe also in some of the sort of even more cutting-edge applications of insurance, it's providing the funds before the disaster even hits so that you can invest in protective measures to lower the damage that actually ends up occurring.”

Parametric insurance – where the payout is tied to specific parameters, like high winds speeds or temperatures – can also provide more equitable, transparent and quick financial relief, says Simon Young, senior director of the Climate and Resilience Hub at Willis Towers Watson.

“It’s fully objective. It's an independent measurement effectively of the wind, and the payment can happen very, very quickly. The value of having that money in a week or 10 days against three months to six months, let’s say if it’s coming in from FEMA, is huge,” he says, because it means the recovery process can be community driven as opposed to waiting for outside help.

As climate risk increases, these conversations will become even more important, says Vox climate and covid reporter Umair Irfan.

“There are places that are at higher risk, but there's very few places that are at zero risk. And that's the difficult thing, the needle to try to thread in terms of messaging to convey to people that the very infrequent, the very rare event is still a possibility and you have to take measures now to prevent it or to cope with it.”

Related Links:

Understanding Disaster Insurance: New Tools for a More Resilient Future

As Disaster Costs Rise, So Does Inequality

The $5 trillion insurance industry faces a reckoning. Blame climate change.

Full Transcript

Note: Transcripts are generated using a combination of automated software and human transcribers, and may contain errors. Please check the actual audio before quoting it.”

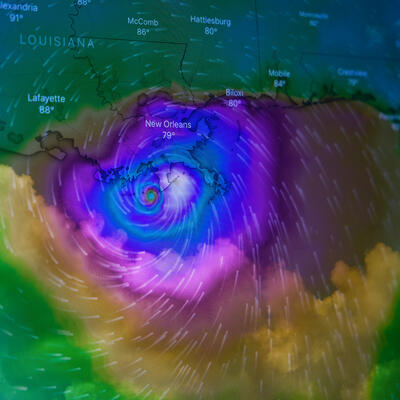

Greg Dalton: Do you have enough insurance to see you through the climate crisis? This is Climate One, I’m Greg Dalton. Home and property insurance is complicated and typically boring–until a disaster happens to you. Hurricane Fiona just flooded Puerto Rico with heavy rain and high winds, knocking out power to the entire island, before moving north to become the strongest storm in Canadian history when it hit the coast of eastern Nova Scotia. As of this taping, Tropical Storm Ian has already brought historic flooding, damage and power outages to Florida, and is expected to strengthen back into a hurricane.“As of this taping, Tropical Storm Ian has already brought historic flooding, damage and power outages to Florida, and is expected to strengthen back into a hurricane.

In recent years, hundreds of thousands of people in high-risk disaster areas across the US have been dropped from their insurance policies, leaving them both physically and financially vulnerable. At the same time, premiums have sky-rocketed, putting home and business coverage out of reach for many. And federal insurance and relief programs have come under scrutiny for payouts that contribute to inequality.

Junia Howell is an urban sociologist on the faculty of the University of Illinois-Chicago. Her current work focuses on policies and practices within housing and disaster relief. She spoke with Climate One’s Ariana Brocious.

Ariana Brocious: You’ve made the case that FEMA payouts tend to increase inequity and that FEMA's own analysis shows that after disaster strikes low-income survivors are less likely to receive money to repair damage and pay rent. How do you know that?

Junia Howell: Yeah, this is a great question and has actually caused a lot of uncertainty and kind of uproar when we first started doing this work. In fact, when I first started finding results that FEMA aid was actually increasing inequality people in my own team didn't believe me. And they wanted to like get behind-the-scenes and get on the data with me because they’re like there's no way that this is true. In particular, the thing that felt so shocking to myself and others is that individuals who had lived through disaster were actually making money, making wealth, ending up better than their counterparts who didn't live through a disaster, but only if they were white and educated homeowners others who were privileged in society. While their neighbors who were people of color who were renters ,who were less educated, had other forms of marginalization. They were not only losing out compared to their wealthy neighbors who live through disasters they were doing worse than their counterparts who didn’t live through a disaster. So, that the way that FEMA aid was being distributed actually was increasing this inequality after disasters.

Ariana Brocious: Right. And when lower-income people do receive some of this federal assistance, they often receive less than perhaps their wealthier counterparts and why is that?

Junia Howell: Yeah. This has been something that has been personally as like a human a little disheartening, right, to look at the numbers and to realize like oh my gosh, these numbers are starkly different. But if you start to unpack why it is, it makes sense given our system. So, first of all aid after disasters isn't just given out like a check. You know, actually very rarely has our government just given flat checks. Now the big exception of this would be recent years with COVID but pre-COVID most of the time if you needed something you have to establish why you need it. And so, with FEMA after disasters establishing that need is establishing everything from my property actually got damaged and I need a new roof and the insurance isn't covering it, so I need you to step in. Or I need a house or a hotel room for the night because I have nowhere to go or my car got flooded and I need transportation to work and I need to have some kind of down payment to buy a new car, right. We have a very needs-based aid system, meaning we have to establish the need in order for our government to say yes you deserve this aid. And because people have to establish need, they bring their inequality, the inequality that exists already in the world into the system. So, if I come in with a property that has been damaged and my property is worth half a million dollars and the roof has been swept off and half of the rooms have been completely damaged such that they need a rebuild. The dollar amount that FEMA is going to assign to my need is gonna be a lot higher than my neighbor whose house might be only worth $80,000 and who's had similar or even greater proportion of damage, but their house is seen, their property is seen as worth so much less then dollar amount becomes unequal. That's also what goes to all these other components, right, if you need a hotel room if you need rental assistance, etc., because the ways that we’re establishing that need are based on an unequal system then when individuals are asking for need they’re only getting back according to what their situation is suggesting they need.

Ariana Brocious: So, let's take this from the individual out like a community level. These FEMA payouts can take a long time that can be really challenging for low-income people who are just trying to survive day to day and maybe don't have additional resources to help them out. So, what are the long-term effects on a low-income community when they aren’t able to get relief quickly or perhaps at all?

Junia Howell: Yeah, as you kind of insinuated there first of all, the effects on individuals and their families can be really detrimental, right. If you can't get a place to stay tonight or tomorrow night or if you can't get a car and lose your job and that cascades into other issues waiting for aid needing aid can be extremely detrimental to an individual family. But if you are in a situation where your neighbor’s okay and you can rely on them and your cousin got some resources and you can rely on them. That's one thing. But if you and all your network are all waiting for aid then mutual support of each other becomes a lot more challenging. And so, this works its way up structurally, both because of those interconnections and networks, but also because of things that are geographically situated. So, if the school in your neighborhood is also struggling and the roads are flooded and no one is able to get out and everyone's waiting for a new roof and there's no housing on the street that is inhabitable and it's going months of not being inhabitable then you get other issues of the vacancy and animals or other humans coming in and using that space in ways that it wasn't intended or built for. So, just like all kind of things social when you have a concentration either in your network or geographic space of people who are struggling with the same thing. There is a lessening of how those individuals can support each other and it exacerbates the issues that they're struggling with.

Ariana Brocious: In November 2020, FEMA released an internal study finding that “Many FEMA programs do not consider the principle of equity.” Why would they not consider that?

Junia Howell: It’s easy I think sometimes to feel like equity just should be something that every program in the US should value. And sometimes it feels start and like what decade are we living in that our government agencies aren't even thinking about questions of equity. But when you think about particularly FEMA the history of FEMA goes way back to the very first Congress. So, we’re talking late 1700s, and that's not the actual agency but the precedent, the legal precedent of giving aid after disasters goes all the way back to there. And there's these like interesting legal nuggets from there to the present where it is repeatedly noted that age should be given to business leaders to upstanding citizens to individuals in the society that are basically going to build the society back up. There's always been a preference for economic development for basically helping those that we think are not only gonna help themselves but help the community. And that has never included people who are racially marginalized migrants or others who are socioeconomically disadvantaged. In fact, if you trace it disaster after disaster after disaster again pre-our current bureaucratic responses there is an enormous rich historical data about how we have repeatedly given more to those who already are privileged after disaster and less to those who are marginalized. So, in many ways it can feel stark that it took till November 2020 for them to formally say, oh, we’re not wrestling with equity, but in other ways, it is the very foundation of how we define deservedness and how we think about how we should respond to disasters and that continues today even after that report almost 2 years ago now.

Ariana Brocious: Has any other research that you've done or your colleagues have done look at what might be the impact were disaster aid to be distributed completely equitably regardless of you know level of damage or property value if it was more like the COVID payments, which were basically just a flat amount. Does that have the possibility of improving these outcomes?

Junia Howell: To my knowledge, no one has explicitly modeled or tried to estimate if you gave everyone the same what would be the implications after US disasters. That would require looking really specifically at every household’s like need and what might happen if they got a flat amount. However, myself and others have advocated for such an approach based on other studies, and other kinds of disasters and other countries that have taken that kind of approach and had really positive impacts. And again, I think the COVID aid is a great example of while not perfect, well how it addressed some of these concerns by making the aid come a lot faster and a lot more equitably across by just cutting a flat check. Now again that would still means graded, right, it was still you had to make under a certain amount which we could do with disasters as well. But I would advocate for some level of giving aid to everyone who's lived through extreme disasters in the area without having to nitpick exactly not only did they have damage but where that money is going. Another component of this that we haven't touched on is much of the money has a lot of strings. And if an individual spends some of the money, they received on an account that is not what it was intended for. So, for example they use some of the money that was supposed to be spent on rent to help get their car, even though they’re also qualified for car aid if they use the money in the wrong place they can be disqualified from any money. And there's lots of reasons that people do that: it's because the other money isn’t coming and they need it now or there is a misunderstanding where that money is coming from, etc. So, streamlining the bureaucratic process and making sure that everyone not only receives something, but that it was less tied up into particular accounts there's a lot of reason to believe that could help with a lot of the issues.

Ariana Brocious: So, referencing that 2020 finding by FEMA about there not being focused on equity. Have there been changes, policy changes within FEMA to address that since then?

Junia Howell: Yes and no, like most things. So, the new leadership at FEMA has been very concerned with addressing these issues and putting it front and center in different ways. And that has led to some smaller and some larger policy changes around bureaucratic processes. So, who qualifies for which titles or other documentations are needed to be able to access certain kinds of aid, etc. etc. I deeply appreciate and I'm grateful for those efforts. I know that they are not, these aren't things that get fixed overnight. These aren’t things that are easy to fix, and I know they're working really hard on them. As an academic and sometimes as an idealist, I still hope for more and more quickly. Many of the current approaches are kind of massaging the current system to be a little less unequal. Okay, we’ll include that kind of deed record so that you can still get aid even if you don't have the “proper deed” or we will make sure that this piece also includes a different kind of temporary housing that's more common in a certain region. All really important components, but I've seen way less and maybe it's just behind the doors that I'm not behind but I’ve seen way less of extremely creative and maybe even radical thinking. Like could we just give everyone aid after disasters. What would that look like? Could we pilot that? Could we start creating a kind of card or banking system where people have points that they’re collecting and they can redeem them if they are living in a certain area after disaster. And I’m throwing out really big ideas with no specificity right now and obviously those specificities need to be flushed out. But for an issue that is centuries old and is increasingly a problem because of climate change, if we aren’t thinking extremely creatively I fear that we are too many decades behind to actually get to the level of solution that we need to if we’re going to deal with this in our lifetime, or even our children or grandchildren's lifetime.

Ariana Brocious: FEMA has several community resilience projects underway. Are you seeing any of those funds to help better protect low-income communities?

Junia Howell: I think that it is a little too early to estimate to what extent they are actually productive. I do fear that they are not quite enough to really rethink some of the fundamental issues that are going on here. I would argue that the deeper issues when it comes to how we are responding to disasters be it via private or public. So, private insurance or public insurance public aid is the ways in which we are conceptualizing how much property is worth how we actually value different communities. These bigger theoretical questions that actually have really practical implications that matter a lot when it comes to distributing aid. And until we start wrestling with those questions I fear that our approaches of targeting particular communities that have been disadvantaged, while needed, are still not going to be enough to address the issue that we have created inequality from decade after decade after decade. And that inequality is so baked into the system that without rethinking the system all the little approaches are really just your band-aids trying to hold together a much bigger and a much more broken bureaucracy.

Ariana Brocious: Junia Howell is an urban sociologist and faculty at the University of Illinois Chicago. Junia, thank you so much for joining us on Climate one.

Junia Howell: Thank you for having me.

Greg Dalton: This is Climate One. I’m Greg Dalton, and we’re talking about insuring against climate disaster. If you missed a previous episode, or want to hear more of Climate One’s empowering conversations, subscribe to our podcast wherever you get your pods.

The Federal Emergency Management Agency is responsible for helping Americans respond to and recover from disasters. As we heard before the break, the agency has faced scrutiny in recent years for the way it distributes aid. Eric Letvin is Deputy Assistant Administrator for Mitigation with FEMA. He spoke with Climate One’s Ariana Brocious about the steps the agency is taking to change their programs to better match the growing needs.

Ariana Brocious: FEMA's national flood insurance program was established in 1968 in response to the lack of availability of private insurance. Today, if your home is located in a FEMA special flood hazard area, you have to have flood insurance, but FEMA maps rely heavily on historical data. With quickly changing and unpredictable weather patterns. How much can people rely on that data to inform how resilient they need to make their homes or whether they should even live in an area to begin?

Eric Levin: Well, we like to say at FEMA, where it rains, it can flood. So the, the flood maps are used to help mortgage lenders determine the insurance requirements and they do help communities develop strategies for reducing their risk. If you're in a mapped area or unmapped area, insurance is still the best measure of protection to make your, your home, your family more resilient. So we, we certainly with climate change and sea level rise, encourage individuals to understand what their risk is, to look at the maps, but also look at some of the supplemental information some of the sea level rise viewers that are put out by NOAA. Some non-governmental organizations and really understand what your flood risk is and take whatever appropriate actions to protect your property and your family.

Ariana Brocious: So, as an example of this increasingly unpredictable climate that we're living in, most of the land that flooded in Eastern Kentucky over the summer, wasn't in a FEMA flood zone and only about 2% of the people there had flood insurance. Those that were impacted by the flood. What happens in that case? Can FEMA step in and help them rebuild? Do they have other options to recover those losses?

Eric Levin: Yeah. So what happens there and that, and that's very common. If you live in the 1% annual exceedance area or more commonly referred to as the a hundred year flood plain, that is the area where the mandatory purchase requirement happens. And we, we saw in Kentucky and we've seen Hurricane Harvey in Houston, almost half of the flood insurance claims come in areas that are not mapped. So if you have a catastrophic event, events that are certainly gonna occur more frequently from climate change, it can certainly flood well outside of the map area. So that's why we say take a look at the maps, but also look at other information,to understand your flood risk. If you're right on the edge of a flood map, that doesn't mean that the flood waters are gonna stop at the edge of that map. The challenge is when you have areas that have what we call a low penetration rate of flood insurance, like in Kentucky, what happens typically there is, yes, there's assistance that's available to them. They would typically go into our individual assistance program that average payout is somewhere around $7,000 or $8,000, you know, roughly from disaster to disaster. So there is funding available. We saw after Harvey though, that the homeowners that did have flood insurance, the average flood insurance claim was over a hundred thousand dollars. So when we talk about community resilience, a community that does have more flood insurance policies, wildfire insurance, if they're better insured, they're gonna be more resilient and able to recover,

Ariana Brocious: It's good to hear that there is some insurance money available for those who maybe aren't carrying flood insurance. Although as you point out, seven or 8,000 in the face of a big flooding event in your home is probably not gonna go very far. It sounds as though your recommendation is to have people get insurance and be insured, but we've seen with the national flood insurance program recently adjusting its rates, accounting for these climate change risks, that instead of seeing more people buy insurance, we're seeing hundreds of thousand people, hundreds of thousands of people let their policies lapse, meaning that they are now unprotected. Between 2014 and 2018, FEMA assessed its own data and found that after disasters, low income homeowners received about half as much to rebuild their homes as higher income homeowners. Other studies have shown that those in minority neighborhoods are less likely to receive FEMA grants for repairs. And after Hurricane Harvey, bankruptcy rates in one part of Houston, went up by almost 40% in non-white neighborhoods. Why did that happen?

Eric Levin: So we're, we're taking a look at that. The way our programs are run, both pre-disaster and post-disaster, meet different statutory requirements. So for example, our hazard mitigation grant program that by law, the governor of that state, he or she sets the priorities in terms of where those dollars go, which communities would receive those assistance. So there's been some excellent academic studies recently, some media on this particular area, and we are taking a look at our programs and saying, ‘are we delivering our programs to communities that most need them?’ Do they have to, you know, they shouldn't have to hire a consultant to write a grant. And so are our programs being distributed equitably. There's an executive order 14, 0 0 8 called Justice 40 and two of our grant programs fall under that, which directs 40% of our grant funds go into those disadvantaged communities. So we are very much supporting those initiatives and taking steps to ensure that our programs are delivering all the citizens that need them.

Ariana Brocious: You mentioned the Biden administration's Justice 40 program addressing environmental equity. What challenges has FEMA faced in trying to actually implement some of those changes, addressing inequality? I imagine it's not easy to rewrite your policies overnight.

Eric Levin: Yeah, the challenge there is providing the right assistance. So, um, we call it direct technical assistance. We started with 10 communities, the first year of our grant program, uh, building resilient infrastructure and communities. We went to 20 the following year and we want to keep really doubling that every single year, in the near future so that we can provide more. So we know the need is there, it's a matter of finding those resources, working with nonprofits, working with universities and building our capability to deliver the kind of assistance those communities need to help them better access our programs.

Ariana Brocious: How can FEMA, the way it's currently structured, handle disasters at the scale that we're seeing now, and we anticipate seeing in the future.

Eric Levin: Well, that's always a challenge.We know with climate change, emergency and disaster declarations have definitely increased. So the challenge is going to be not just with FEMA, cause really I think, it is a whole of community, whole of government approach. FEMA can't solve these problems on our own, I mean, FEMA doesn't issue building permits. Those are done at the local level. Um, hazard mitigation planning is done at the local level. So it's really a partnership between local governments, federal, or state governments, federal governments, the private sector, NGOs, various organizations to really help identify the hazards, and take the appropriate action. Whether it be catastrophic bonds or insurance or projects, what actions can be taken to reduce that risk in the community?

Ariana Brocious: Eric Letvin is deputy assistant administrator for mitigation with the Federal Emergency Management Agency.

Greg Dalton: The standard model in the insurance industry simply wasn’t set up to account for climate change, which is increasing the frequency, scale and severity of disaster claims. And as we’ve heard, the need-based requirements for proving loss before payouts arrive can really hurt recovery and relief. From flooding in Appalachia to fires in the Pacific Northwest, we’ve seen frequent and fierce weather take lives and devastate communities all across the country, and many more extreme weather events are coming our way. So who will pay to protect and rebuild communities? And what policies can help the insurance industry stay afloat? I invited three guests to discuss how insurance could better respond to a disrupted climate.

Carolyn Kousky is Associate Vice President for Economics and Policy at Environmental Defense Fund, and author of Understanding Disaster Insurance: New Tools for a More Resilient Future. Umair Irfan covers climate change, energy, and Covid for Vox. Dr. Simon Young is a Senior Director in the Climate and Resilience Hub at Willis Towers Watson, an insurance consulting company. I asked Carolyn Kousky when people end up living in disaster prone areas, who should pay when their home floods or burns?

Carolyn Kousky: Typically, homeowners might turn to their homeowner’s insurance to help cover losses that they sustain from a big disaster event. But what we’re seeing repeatedly is homeowners learning in the aftermath of one of these weather-related extremes that they might not actually be covered for that disaster or they might not have as much coverage as they thought they did and they end up getting less. And when they don't have the insurance then things can be very financially challenging for households. Many people don't have enough savings to cover these damages on their own. They might not have access to loans or credit and we know that federal disaster it can sometimes just be insufficient and too delayed. And then people must turn to different types of coping mechanisms that can be really costly for the household.

Greg Dalton: And Umair, we’ve seen COVID present all sorts of interesting opportunities to understand and relate with risk. You cover both COVID and climate. How has that work informed how you think about people approach risk?

Umair Irfan: Well, one thing that’s become clear is that people as individuals don't gauge risk well. Most people have a very binary understanding of being at risk or not at risk. If you tell somebody that there are less at risk of contracting COVID many of them parse that as saying they're not at risk, particularly younger people. But we’ve clearly seen that's not the case that you know even though they maybe have lower rates of getting ill that, you know, many of them can instill suffer and die. And similarly, with climate -related risks we’re seeing across the country, you know, there are parts of the country that are far more vulnerable to flooding, sea level rise, wildfires and other risks that are exacerbated by rising average temperatures. But there's no part of the country that's out of danger. You know, the US National Climate Assessment said that every part of the country is going to be affected by the impacts of climate change. And so, we’ve seen flooding that’s very far in land across the Mississippi River and parts of the Midwest. This year we’ve seen, you know, other kinds of like wildfires as well break out in parts of the country that typically don't see such big fires as well. So, there are places that are at higher risk, but there's very few places that are at zero risk And that's the difficult thing the needle to try to thread in terms of messaging to convey to people that the very infrequent, the very rare event is still a possibility and you have to take measures now to prevent it or to cope with it.

Greg Dalton: And COVID risk is very direct and personal, right? Whereas climate is more indirect, right?

Umair Irfan: Well, I mean I would say that there's elements of both of the individual and the collective risk. I've personally never contracted COVID, but I've been affected by it because my workplace closed. Many of my packages have a hard time getting here. I have family members who can’t send their kids to school. Similarly, with climate change in a way we’ve seen like disasters occurring in parts of the world that's disrupted shipping that's disrupted supply chains that’s disrupted things like you know, grain yields, that’s gonna be a big issue this year, you know, with the Russian invasion of Ukraine affecting global grain supplies. And so, while we may as individuals have this risk at different levels when we work in a global economy and like in an interface society, we’re all affected by these risks.

Greg Dalton: Simon, I know most of your work is around the world, not necessarily in the US, but we definitely see that in the US 40% of the population lives in coastal areas another 10% in floodplains. We’ve seen wildfire areas spreading. But a lot of those people aren’t generally covered by basic home insurance. So, what does this mean for homeowners?

Simon Young: Some of the work that I've been doing in the Global South, Greg, has revealed that insurance has a probably a bigger role to play as these risks materialize more across a broader swath of the population and in different ways or new ways. And some of the tools that we've been developing I think are going to have use in the Global North in the US and Western Europe. And those tools simplify I think the insurance process that they make a much more direct link between what's happened to you in terms of you know the amount of rain that’s happened or the flooding that you’ve experienced and getting some money. It might not be all the money that you need but you can get that money very quickly.you know, a few days rather than waiting months for traditional insurance payouts.

Greg Dalton: So, later down we’ll get to, you know, what can the North learn from the South, and the parametric piece. So, Umair, as a commercial enterprise, insurance pays out to people who can pay premiums. What about the people who can't? What about the renters, the underinsured and the uninsured who simply can't afford any insurance?

Umair Irfan: That’s a difficult question to resolve. And we've tried to come at this in different ways in different policy regimes across the US and across the world. And all of them have their drawbacks. So, in the United States, for instance, we have the National Flood Insurance Program, which is a program to cover flood risk because most private insurers won't cover it. But because it's federally subsidized it helps reduce the cost of it, but it ends up creating something of a moral hazard where we have people in very high-risk properties continuing to stay there. So, in the NFIP this program about 1% of properties account for 25% of payouts. So, you have these very high-risk properties continually being flooded over and over again. And at the same time, they have to continually update the maps and the risks as sea levels rise, as average temperatures rise and there's a lot of resistance to doing that. So, now the NFIP recently did evaluate and reevaluate their risk maps and they raised the rates accordingly. And what happened in response? A number of people just let their policies lapse because they couldn't afford it anymore. So, now we’re in a situation where rather than having the subsidized protection that’s leading to a moral hazard, you’re in a situation where people are at high risk and not protected at all. And so, there's these two extremes, both happening with this similar program. And similarly, with wildfires for instance, that’s almost entirely a private-sector enterprise. There are some state-level regulations on that but we've seen in recent years, particularly in California many homeowners have been kicked off of their policies. They’ve been paying premiums diligently and even though they want to continue paying, the insurance company saying this risk is too high, we think the payout risk is too high and we just cannot afford to insure you anymore. So, it's not just the people being able to afford it. It's also the insurance companies’ willingness to bear that risk that's playing out right now.

Greg Dalton: Right. And this is where we get into the what's the role of the private sector, what’s the role of government. Carolyn, California's Insurance Commissioner imposed a series of moratoriums barring insurers from dropping policies in wildfire prone areas. Though those are critical for those affected, but are they sustainable because they are forcing companies to stay in markets at prices that aren’t economic for them.

Carolyn Kousky: Yeah, those moratoriums are a legislative mandate and they've been used in other states post disaster and they can help stabilize the market in the aftermath of a big disaster. But what we’re seeing in California is not just a reaction to one big fire, but the reaction to the reality of ever-growing risk. And that's a very different type of environment and so small fixes aren't gonna cut it, right? And I think to come back to some of these questions about the private sector it’s important to realize that as these risks are escalating, it becomes harder to offer insurance by the private sector or the public sector at a price that's still profitable and that people are able and willing to pay.

Greg Dalton: Right. And Simon, what I see is risk being pushed onto public balance sheets. In California, earthquakes, private insurers said, oh, that’s too big, so the state came in. We’re almost at that point for wildfire where will the state come in and do things because companies don't want to recant at an affordable price. Are we seeing this huge transfer of risk to public treasuries and what does that mean for ultimately taxpayers?

Simon Young: I think we are, absolutely. And I think the potential upside of that is that it will make it real to the public sector to the public purse and that should promote better planning, better regulation to building floodplains to building coastal areas or retreat away from those areas where possible. So, I think there is a potential for some of these issues to become more real and therefore for policy to start to be made actually addresses some of the underlying root causes.

Greg Dalton: This is Climate One. I’m Greg Dalton. Let’s get back to my conversation with Simon Young of insurance consultant Willis Towers Watson, Carolyn Kousky with the Environmental Defense Fund and Vox climate and covid reporter Umair Irfan. The National Flood Insurance Program has run up tens of billions of dollars in debts, and efforts to overhaul it haven’t gotten very far. I asked Umair Irfan about the political prospects of a real policy solution to such a vital risk management instrument.

Umair Irfan: Yeah, it's been sort of a botched job here just sort of ad hoc extensions of the program and as you note, yeah, the program’s been in debt like they aren’t balancing their sheets they’re charging their customers less than the risk that they actually bear and ultimately that's distributed across every taxpayer. And there's this sort of like inconsistency about what we want to do with price as a signal. Now, that's one instrument, but if we raise prices the idea is that perhaps people respond accordingly by, you know, buying homes in less risky areas. But you know as we've seen again with the insurance premiums going up with the National Flood Insurance Program people just let them lapse because it's difficult to move your home. And there's other reasons why people want to stay in one place rather than move. And so, that becomes a very thorny political question like how do you go to a community and tell them we need to pull up stakes and move to a place that we think is safer versus saying that okay, maybe we need to issue a bond or raise taxes to build a seawall or defensible perimeter around you. There's no easy solution and there's no cheap solution.

Greg Dalton: Right. And there's a lot of people who have a second house in the woods that may be what's at risk for them, and others who might be, you know, low income people who can't afford to move. Carolyn, there are some who would say that buying insurance is like betting against the house. Insurance companies are in the business making money they have actuarial that know the math better than we ever will. So, what do you think of that argument that the insurance companies always know the math better than consumers

Carolyn Kousky: Yeah, it’s important to understand the role of insurance in someone's life. And the idea is that you make small regular payments that’s your annual premium, when things are going well and you can afford that. So, that when things don't go well and you face a very huge expense you get access to the funds needed to pay for that. And in that arrangement, you're actually paying more than the actual cost if you were to smooth those all over time for that service. You have to pay for the administration and the transactions and the profit loading. So, it's not like trying to make money on something you're not going to come out ahead. But most people want that financial protection and they're willing to pay for that financial protection because being stuck with hundreds of thousands of dollars in damage that you can't pay for is not a position anyone wants to be in. The challenge is that the prices that you're paying have to be as we've all been talking about related to that underlying risk and that's really challenging for some people. And so, some of the policy solutions that have been talked about, to come back to say the flood insurance program, is for explicit means testing in our assistance. So, we don't need to suppress prices across the board. We could provide targeted assistance at people who can't afford a policy to cover some of those costs for them in the way we do with other goods and services for lower-income households for example. And that would be an important policy change because those are also the houses that need this protection the most because they are also the ones who don't have savings who can't access credit. And so, for them the insurance is even more important than for say, more affluent families. But I’ll also say that the way the US has approached disaster coverage is not the only way to do this. And there are other countries around the world that have taken more comprehensive and inclusive approaches. So, several countries, for example, mandate that insurance companies include all natural hazards in your standard homeowners’ policy. Now the challenge is that when that big one hits like we're just talking about the claims in California from the wildfires, it could bankrupt insurance company. So, they don't want to just offer that, right? And so, in those countries, the public sector steps in and says for those really extreme events where you might go bankrupt it’s so big that's where we come in. That’s where the taxpayer, that's where the government comes in and will pick up those losses.

Greg Dalton: Umair, you reported that in 2012, North Carolina's Coastal Resources Commission found that over the next century water levels along the coast could rise by as much as 39 inches. And coastal property developers didn't like the sound of that and they pressured the state government to outlaw policies that incorporate that agency's findings and Stephen Colbert made fun of his home state outlawing sea level rise. How are the battle lines drawn between property owners, government and other stakeholders here that might know this information and be threatened by it?

Umair Irfan: Yeah, you know, this is again getting to the political problem of this. Like it's not simply a matter of how much we expect sea levels to rise, but like to what benchmark do we prepare for. Do you want to have properties insured to the level of 2050 or 2100? How much turnover are we respecting in our housing stock? How much more do we expect the population to grow in this area and how many more resources are we willing to devote to keep people here. Those are all questions that we also have to answer at a holistic level and you really can't answer them piecemeal. And yeah, and again, like the North Carolina example illustrates that you know there are some pretty powerful lobbying groups that are pushing back against these more accurate risk assessments. You know, I talked to a climate scientist a while back who said, you know, if you don’t want to believe the climate scientists believe the insurance companies because they have a financial stake in this, and they're the ones that are looking at the risk. And they 100% believe that climate change is real and it’s caused by humans, and it's going to get worse over time.

Greg Dalton: Carolyn, we’re talking about this and I can't help but mention some of the horrifying images we’ve seen from Pakistan. It's hard to imagine anyone there has insurance. So, how did you respond when you saw what happened in Pakistan? It didn't get a lot of coverage, perhaps the coverage it deserved in the United States.

Carolyn Kousky: No. I agree with that and it's the really sad thing right is that this is just one in a series of these types of global catastrophes and they’re becoming so frequent now that they’re not getting the attention they deserve anymore. I think because we’re seeing floods and fires and all sorts of things play out around the world and these disasters cause enormous costs for households that aren't just the property damage that we tend to focus on when we think about the United States, but they completely disrupt people's well-being and way of life. And the question I think there gets to what role can and should insurance play in that broader conversation of recovery that isn't just about rebuilding a structure, but getting people's lives back together. So, that it's not just about reimbursing damages but it's about having the financial resources that you need for whatever it is to get back on track. And maybe that's rebuilding your home, maybe that's replacing lost income, maybe that’s covering somewhere safe to stay. Maybe that's relocating and maybe also in some of the sort of even more cutting-edge applications of insurance it's providing the funds before the disaster even hits so that you can invest in protective measures to lower the damage that actually ends up occurring.

Greg Dalton: So, Simon, let's talk about innovative approaches. What could help people in Pakistan or future incidents like we’ve seen in Pakistan?

Simon Young: So, Carolyn mentioned some work that’s going on anticipated reaction and what we call full cost space financing. And that’s using a, I would say, a quantitative approach to be able to trigger funding to flow in advance of let’s say a flood, a large flood like on the Indus in Pakistan which, you know, works its way down from the Himalayas in the Hindu Kush town through Pakistan north to south. And that takes weeks to a couple of months actually, rather than you know it isn’t something that’s happening immediately. And so, there is a window there if you can get money into those communities to help them prepare. In this case, it's really difficult to imagine how you can do anything much more than rely on individuals and families and households and community’s resilience to get through this in the short term. So, and certainly preparedness can help but most of my work has been on trying to get resources to those households as soon as we can after that immediate impact has passed and hopefully you know they’ve survived, but they haven’t got any assets. If they had built assets then they’ve usually gone or certainly been damaged significantly. But even more fundamentally it maybe, you know, not fixed assets it was crops in the ground for example, or livestock in drought-prone areas like the Horn of Africa or the Sahel. And it’s actually the weeks and months right after that disaster they’ve put everything into surviving, but then they’re faced with no means of income no means of getting back on their feet in any meaningful way. And that's really I think where the potential impacts of what we've been trying to do in terms of developing kind of innovative insurance tools to try and get that funding into those, all the way down to the individuals if possible in the households at the time that they really need it, which is as soon as they start to get back on their feet after the immediate impact.

Greg Dalton: Umair, I've heard of things where actually they are even trying to, we’re talking about the release of funds and the timing of funds like we know something bad is coming. Can people get help before it hits for example, if there is a weather forecast of extreme heat for a number of days that cooling centers that money starts to flow before people go into the ER from heatstroke. Is that discussion starting to happen and is that broadly being discussed?

Umair Irfan: It’s starting to come up more I mean, and from a public policy standpoint we tend to be generally reactive in every aspect of how we respond to disasters both the public and the private sector. And mustering the resources ahead of time before the disaster happens in anticipation of things that may or may not even occur at all. Like I mean that’s one tough political sell and it’s also a tough sell to customers. Like how do you tell somebody that you know a flood that you've never seen before could still happen here to your home and your property. And so, one, there needs to be sort of a sales job as far as like convincing people that these risks are worth planning for and it's worth making the upfront investment so that you don't have to pay with interest down the line. And it's starting to happen now I think certainly as all these disasters are concurrently happening around the world. I think it's help make this a little bit more tangible for a lot of folks who didn't realize where these risks are and how severe they could be. But it's something that we will need to lead with going forward. I mean if we constantly stay in a reactive mode, you know, then we’re always going to be responding to disaster rather than trying to mitigate the losses ahead of time which in general is probably gonna be the better strategy as far as reducing the overall harm to individuals and to society writ large.

Greg Dalton: Yeah. We’re not so good at that as humans and as a society. Carolyn, historically marginalized communities have received the least amount of relief and the most amount of harm from climate impacts. So, how can policy open up insurance to those currently not being served?

Carolyn Kousky: Yeah, I think that's an excellent question. As we were talking about some of these communities are just not getting access to the resources they need after a disaster. And to Simon’s point not nearly fast enough. Some of the sources of financing that might come into a community or like government assistance or access to loans. And we see that on average those can take months to get to people. And for particularly low-income households months matter. And if you have huge expenses you can't pay, you don't have the savings, you don't have a loan, you have any way to handle it then people can really start to spiral into really terrible financial situations. And so, there's a number of these models that are starting to be developed and as Simon said, bringing some of the knowledge from the Global South to the Global North to help these populations. So, some of these are and what are thought of as micro-policies like super small policies so they cost less, but you also get less payout but they can be paid really quickly and help get people sort of out of that downward financial spiral.We’re seeing other models where intermediaries might sometimes play a role. Sometimes there are NGOs or even local governments or other types of organizations that are thinking that way. And they might be the ones to harness insurance and then be the ones to help distribute the funds to those in need. And so, we want to have trustworthy insurance systems in place that people get the money they need quickly. And some of this comes back to an underlying structure of insurance companies which is that you pay in your premiums hoping to get a payout and at that moment when the insurance company is supposed to give you a dollar back every dollar back, they give you is less profit for them. So, there's this inherent, you know, tension in the insurance model that is really problematic for people and I think develops distrust among consumers. And so, there's also interesting ways around that these policies that Simon and I have been mentioning around parametric get away from that because they’re just set payouts based on the disaster itself so, there's no arguing over how much you are owed.

Greg Dalton: Speaking of parametric, Simon, traditional insurance pays out when there is loss or damage. Explain what parametric insurance is and how it could be a benefit in what we’re talking about.

Simon Young: So, fundamentally it's the same, but we don't need to wait in parametric insurance, we don't need to wait until the full knowledge of what the loss is and it's been what we call adjusted. So, you know, you’ve had someone visit and assess what the loss is from the insurance company and they’ll pay you and then they’ll try and reduce that as Carolyn was just saying. With parametric insurance the payout that you get is effectively pre-agreed and is relative to the parameter of the hazard. So, let's say the wind speed during a hurricane is a good proxy for how much damage is going to be done to a particular home or community or whatever it is. And so the insurer promises to pay if that windspeed happens not on the basis of what's happened to the properties that were in the way of that wind. And so, in that way we can get a much cleaner, more transparent process. It's fully objective, it's an independent measurement effectively of the wind and the payment can happen very, very quickly. the value of having that money in a week or 10 days against three months to six months, let’s say if it’s coming in from FEMA is huge. It’s huge for the household, it's also huge for the community as well because it means that the recovery process could actually be embedded within the community rather than coming from the outside, and that helps to the overall economic benefit of the community.

Greg Dalton: Carolyn, I can see how that benefits sellers of insurance, but as a homeowner I don't know what a 90 or a 95-mile wind, is that gonna tear off my roof like who can make those decisions about what a certain number translates to their real life, their home?

Carolyn Kousky: Yeah, this gets to the really important challenge of how we’re communicating and talking to households about risk and that’s your insurance company but it's also your realtor and your local government and we could get into these other things. But for the insurance products we’re seeing some interesting examples. For example, where talking about these parametric products in particular, you might be shown past disasters and storms and see what payout you would've gotten under different choices so that you have sort of a more intuitive understanding of like this type of disaster results in this much payout. That’s one example of the ways to do it. But we do see that with standard homeowner’s insurance policies for example, what everyone has to buy if you have a mortgage. There's so much fine print that consumers never understand. Unfortunately people don't even realize those are in their policy until they go to rebuild and it's like oh, oops, you're not gonna get enough for that. So, we have a lot of fundamental challenges with communicating in our standard insurance models as well. And I think to circle back on this topic of communicating risk to some of our earlier conversations about how risk is increasing from climate change and that it’s gonna have to increase insurance prices and that that could be some sort of financial incentive for communities for households to think about building and locating differently. In order for that incentive to work people have to know about it. And right now, it's hard to get an estimate of your current insurance premium before you move in somewhere let alone the trajectory of that over time. And we don't have good ways to tell people hey, this is your rate today this is where your rate is going in five or 10, 20, 30 years. No company wants to communicate that. The government doesn’t want to communicate that. And so, we have a real mismatch in the information people are getting and what they need to be making these longer-term decisions.

Greg Dalton: Right. And if we had that we might not have people moving into high risk areas. So, we’ve been talking a lot about processing risks, how people perceive risk personal risk the systemic risk as climate impacts accelerate. To sum up in just a sentence or two. What needs to happen to make insurance policies affordable and available for everyone. Umair, what would you like to see?

Umair Irfan: I think I’d like to see a larger expansion of the risk pool and make sure that more people are chipping into this. Because as we’ve learned you know very few parts of the world are going to be immune from climate change. So, it behooves everyone to contribute to some sort of risk management system such that they will be covered should like a catastrophic risk occur. And I'd like to see more policies that help make that easier that facilitate that but also a greater recognition and education effort so that people can get the resources to cope with disasters after they occur and also prevent them or mitigate those risks before they occur.

Greg Dalton: Simon, a couple sentences: what would you like to see in a better balance climate risk?

Simon Young: You know, I view insurance as a, you know, in some part a societal construct where you're just kind of formalizing what would normally be you know family risk sharing neighborhood risk sharing. But it becomes particularly relevant where the risk could happen to all of your neighbors, all of your family all at the same time. And many climate risks are like as we’re seeing in Pakistan with the floods. Whole communities, almost the whole country, is being affected by single event. And so, that traditional kind of sharing of risk, you know, if you're having a hard time this week then we can help you and you’ll help us next week when we’re having a hard time. That does not apply for climate risk. So, we have to think about insurance as actually formalizing some of this informal structure so that they are fit for purpose for this for the climate risk that are emerging.

Greg Dalton: Carolyn, what would you like to see to balance this economic reality with the growing need for insurance and climate disaster.

Carolyn Kousky: Yeah, I think we need some deeper partnerships between the public and private sector and deeper engagement across those sectors. I think that the public sector needs to define its roles and disaster insurance and for me, one of the biggest ones is supporting the challenge with affordability and actually providing assistance to people with the cost of disaster insurance to make sure that people are covered. The private sector needs to in my opinion, sort of deep in their commitment to supporting risk reduction and climate adaptation and climate policy with sort of very serious models that move the needle on actually lowering the risk in partnership with the public sector. And then continuing to think about an expansion beyond our traditional view of insurance as indemnity policies for property and you know structured firms in a certain way to thinking about some of the innovative products we’ve talked about, but also new structures for companies the role of nonprofits of captives of local and state government and playing in the space. So, sort of a dose of creativity.

Greg Dalton: Umair Irfan is climate and COVID reporter at Vox. Carolyn Kousky is Associate Vice President for Economics and Policy at the Environmental Defense Fund and author of Understanding Disaster Insurance: New Tools for a More Resilient Future. And Simon Young, a Senior Director of the Climate and Resilience Hub at Willis Towers Watson and Insurance Firm. Thank you three for joining us and sharing insights into this really important and interesting and complicated question.

Umair Irfan: Thank you for having me.

Simon Young: Thanks, Greg.

Carolyn Kousky: Thanks, Greg.

Greg Dalton: On this Climate One... We’ve been talking about insuring against climate disaster. Climate One’s empowering conversations connect all aspects of the climate emergency. To hear more, subscribe to our podcast on Apple or wherever you get your pods.Talking about climate can be hard-- but it’s critical to address the transitions we need to make in all parts of society. Please help us get people talking more about climate by giving us a rating or review if you are listening on Apple. You can do it right now on your device. You can also help by sending a link to this episode to a friend. By sharing you can help people have their own deeper climate conversations.

Brad Marshland is our senior producer; Our managing director is Jenny Park. Our producers and audio editors are Ariana Brocious and Austin Colón. Production Manager Megan Biscieglia co-produced this episode. Our team also includes consulting producer Sara-Katherine Coxon. Our theme music was composed by George Young (and arranged by Matt Willcox). Gloria Duffy is CEO of The Commonwealth Club of California, the nonprofit and nonpartisan forum where our program originates. I’m Greg Dalton.