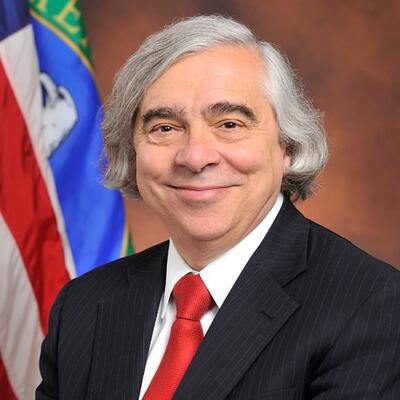

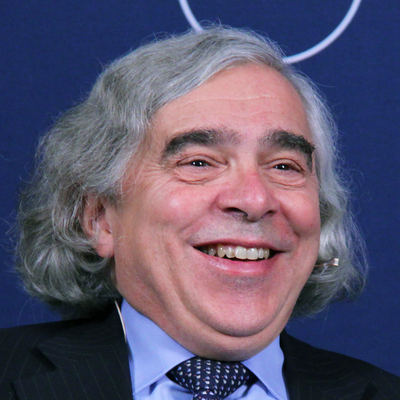

U.S. Secretary of Energy Ernest Moniz

Guests

Ernest Moniz

Summary

How can America balance its energy boom with the need to reduce carbon pollution? A discussion with U.S. Secretary of Energy Ernest Moniz.

Ernest Moniz, US Secretary of Energy

Full Transcript

Greg Dalton: Welcome to Climate One from the Commonwealth Club, changing the conversation about America's energy, economy and the environment. I'm Greg Dalton. Today we're discussing powering America's economy with U.S. Secretary of Energy Ernest Moniz. As the economic recovery gains steam, industries and companies are using more fuel. Supply is also on the rise, thanks to a boom in oil and gas drillings, spurred by hydraulic fracturing or fracking. The country's energy boom is forecast to drive domestic oil production up and imports down to levels unthinkable a decade ago. That positive trend is matched by a negative one. U.S. carbon pollution is also on the rise after declining in recent years. Over the next hour, we will look at America's energy renaissance and its efforts to combat greenhouse gases that are amplifying droughts, floods, fires, and other severe weather. Along the way, we'll take questions from our audience here at the Commonwealth Club of California.

Before taking the helm of the Department of Energy in President Obama's second term, Dr. Moniz was Professor of Physics at MIT where he was Director of the MIT Laboratory for Energy and the Environment. Dr. Moniz previously served as the Undersecretary of Energy under President Clinton. Please welcome Secretary Moniz to the Commonwealth Club.

[Applause]

Greg Dalton: Secretary Moniz, welcome. Thank you for coming. I want to start by asking you when you were young, what was your inspiration to get into science? There's so much talk about science being a controversial discipline these days, getting more people to study science. What led you into a career in science?

Ernest Moniz: I would say I've had a few periods when I've been inspired to go in science or change direction slightly. First, in high school, I was in those relatively early years post-Sputnik and it was quite literally the revolution in how physics was taught.

I must say it was an MIT-inspired course, and that was in my senior year and it just completely hooked me. And that's the entire story through my Ph.D. and much of my early career with MIT. But in terms of what I'm doing now, I must say that MIT is one of obviously the great universities in our country, obviously technology-oriented, and there it was the inspiration of some of the physicists who had been through the war period and who felt that faculty at MIT at least should really be part of the public service. And so we got going into various study groups, et cetera, that looked at energy and security issues, and then eventually that led, I guess, to my wandering off to government a few times. But now I find it difficult to distinguish life at a university and in government.

Greg Dalton: Do you think that the climate challenge is sort of a Sputnik-like motivation for younger students to get into science?

Ernest Moniz: Absolutely. First of all, it was for me as well starting in the '90s and in my first go-around at the Department of Energy and now it's a major focus, of course, starting with the president and his commitment. But if I go back to the students, I would refer to my period at MIT in the last decade in which we started something called the MIT Energy Initiative, and the enthusiasm and the commitment of the students to want to put their science and technology and management and economic talents, to bring them to bear on this challenge, the climate challenge, was really remarkable.

Similarly about 25% of the entire faculty became engaged and I think this encourages me in the sense that in contrast to the up and downs of interest that we've seen in the past with oil prices, I think that the climate challenge is one that's going to continue to hold the attention of our talented students.

Greg Dalton: So we have the climate challenge. We also have this boom in energy supply and production going on in the United States. Tell us where we are, you think, in terms of the Obama administration efforts to both manage this supply, this renaissance, while also reducing carbon pollution.

Ernest Moniz: Well, I’d say, the -- we are addressing our energy challenges with, first of all, I would say three major objectives in mind. One is to support economic growth, good jobs, et cetera. Secondly is to reinforce our security. And third and perhaps, in my view, of greatest interest right now is addressing the climate challenge. So the issue is how do we do all those three together. First of all, I would say by observation it is true that CO2 emissions have ticked up a little bit in the last year, but we are significantly below our levels in the 2005-2007 period and indeed roughly halfway towards the goal that President Obama put out in 2009 of a 17% reduction by 2020. So we are there. Secondly, there's no question that what's happening in energy has led to economic growth and jobs. A couple of observations there. Recently Fortune Magazine put out a list of 100 fastest-growing companies; 26 of those had their growth pegged to what's happening in energy.

We could go on about jobs. The solar industry is now up to nearly 150,000 direct jobs as deployment has really just blossomed tremendously. And also part of the economic picture is the considerable rebirth in manufacturing in the United States; 700,000 manufacturing jobs added. I would note two things in terms of the spillover effects there. One is that manufacturing in turn supports two-thirds of private sector R&D in the country. So there's kind of a nice virtuous circle there. Secondly, I would note that the abundance of relative to other major economies relatively inexpensive natural gas in turn has supported much of the growth in manufacturing. There are various estimates made between one and $200 billion as the investment in new manufacturing capacity in this country in the remainder of this decade driven by the low natural gas prices. So we are seeing the economic benefits. We are seeing CO2 reductions on the ground. That's the ground truth. Now the question is sustaining it and, in fact, accelerating the transformation to low carbon that we need to meet our climate challenges.

Greg Dalton: The notion of cheap natural gas driving manufacturing, et cetera, is often heard and yet we've interviewed some people from McKinsey and elsewhere who say, "That might be true if you're in gas, making glass or really energy-intensive industries. But if you're making other things, energy costs are 1% or 2% of your overall cost, your big cost, your capital, your employees, et cetera."

So the question is really whether the natural gas contribution is perhaps oversold in some cases as its contribution to growth and manufacturing.

Ernest Moniz: Well, I mean, clearly in what I’m counting, we're trying to take account of that. Number one, of course, if one discounts all the energy-intensive industries, well then energy prices don't matter that much. But the fact is we have large energy-intensive industries. On National Manufacturing Day, I'm sure all of you were celebrating National Manufacturing Day on October 3rd, I went to a plant in New York, a plant that was based upon innovation, a company that had really reinvented itself from a commodity company to an advanced materials company, tremendous R&D going on. But when all was said and done, their very high-tech ceramic-based product came out of a long row of kilns with natural gas heating them. So, sure, they have an advantage -- they were using the advantage, I would say, of innovation, but they were also benefitting and had a competitive edge from those low gas prices. And may I add a second thing, Greg, because we often talk about, and I do as well, we talk about gas, but we should also recognize that the natural gas revolution has also led to a natural gas liquids revolution. We're talking about ethane, the feedstock for ethylene and lots of products that we see. We're talking propane, butane, et cetera.

We have gone to have an incredible supply of this. And this is part as well of the manufacturing renaissance using those natural gas liquids.

Greg Dalton: There's a couple of ways to sort of address the carbon question, the climate question. People talk about making green energy cheaper or making brown energy more expensive. Which do you think is the right way?

Ernest Moniz: Look, ultimately we have to keep driving to less costly green energy. We must remember that climate change can only have a global solution and so the kinds of technologies that we're talking about, the green technologies, have to be deployed, of course, in the United States, in Europe, in Japan. And it is important, and the president has emphasized this, that the United States has to show leadership, frankly, in this arena. But in the end, the solution scales only when the emerging economies, the developing countries also adopt those technologies. And that means we've got to drive the cost down to succeed. The good news is we are. If you look at what's happened to solar energy, we've gone from $10 a watt to $0.80 a watt for a solar module. And we have seen the deployment as a result go up as the costs have come down. LEDs, incredible story. A factor of 100 in deployment in less than three years because the costs have come down dramatically, we're now talking about one year payback periods of only energy savings, not including some other benefits that commercial and others achieve because of the long lifetime.

We forget how much it costs to change a bulb if it's in a high ceiling, for example. Batteries for electric vehicles, a three X reduction in cost in about six years. We still need another two to three X, but the progress being made in cost reduction is critical. Now, that is not to say that we don't need economy-wide approaches to limiting carbon emissions. We do. We have them now. The President's Climate Action Plan, has put forward a number. We have, of course, vastly increased efficiency standards for our vehicles. We have a draft rule out from the EPA in terms of power plant emissions, et cetera. Eventually, we believe that we will need to bring this together into an economy-wide approach, but cost reduction is critical for a global solution.

Greg Dalton: And in some of those instances you cite, there were subsidies that were accelerated or helped with cost reduction. Solar was subsidized in a lot of places. I think LED, correct me if I'm wrong, probably less so. So what's the role of subsidies? Should there be more subsidies for green energy or I think the president has tried to remove subsidies for brown energy so that the price differential is different.

Ernest Moniz: Well, over time, historically, you can argue, of course, subsidy is sometimes in the eye of the beholder, but there certainly have been subsidies, incentives for just about every form of energy as it is introduced for sure.

So today, we certainly have a number of ways in which we in the Department of Energy, for example, assist the introduction of technologies. Part of it, of course, is we fund directly the early stage R&D which typically is not done by industry. But given the urgency that we attach to accelerating the transformation, we also do work at the deployment end. Sometimes it's not a financial issue. For example, we have dramatically increased the pace of issuing energy efficiency standards for appliances, electric motors, you name it. And, of course, this is a way of -- it brings higher efficiency, lower emissions. In other cases, we have a very large loan program. We have issued $30 billion worth of loans and loan guarantees. We have $40 billion of authority remaining which we intend to deploy. And this is a way of jumpstarting areas. For example, this is a great example, perhaps our best, but it's one of several. If you take large-scale photovoltaic, so-called utility scale, 100 megawatts in larger plants. In 2009, there were none in the United States. There was also, by the way, hardly any debt financing available for anyone. The DOE loan program came in; it provided the help for five utility scale photovoltaic plants, all successes. Today there are 17 additional projects exclusively with private financing.

So that's the model we like, that we come in, we help get this thing pushed off, and then the private sector comes in to continue the deployment.

Greg Dalton: If you're just joining us, our guest today at the Commonwealth Club of California is U.S. Secretary of Energy Ernest Moniz. I'm Greg Dalton. We're going to try something new and different here. We're going to invite a guest from the audience to briefly tell his story of innovation. Jigar Shah co-founded - founded SunPower, one of the companies. So, Jigar, why don't you come tell us your brief one-minute story and then we'll have go on. Welcome.

Jigar Shah: Thanks. Thank you for being here, Secretary Moniz. I grew up in rural Illinois. I read a book when I was 16 about energy. Every technology was covered two pages at a time, so in my naiveté, I thought all of the technologies were equal, thought that solar was equal to coal and set about figuring it out. Got my engineering degree at the University of Illinois Urbana-Champaign, worked at a wind startup, worked at the Department of Energy and the Office of Transportation Technologies back then, and then at BP for four years.

And then I started SunEdison which has now become the largest solar development company in the world by popularizing the Power Purchase Agreement. And I think we've been able to raise lots of private sector capital for solar projects and I think we're estimating another trillion dollars comes in using that model over the next six years. And we're moving now to -- I'm moving personally to bringing that kind of capital to combine heat and power, chilled water systems, energy efficiency, wood pellet boilers. There's lots of things that could be financed with the Power Purchase Agreement, not just solar. Thank you.

Greg Dalton: Great. I’m corrected, it’s SunEdison. So there we have a person from rural Illinois, working for an oil company, starting a company that's now valued on the stock market $5 billion, somewhere in there.

He founded a $5 billion company, success story. What are you doing to have more entrepreneurs like Jigar Shah, doing those kinds of things in clean energy for America?

Ernest Moniz: Well, first of all, it's a great story and I just would like to comment that if you peel that story apart, it has a very important lesson. I talked about innovation and I think that probably I was thinking and many of you were thinking that really means innovation in technology. But we should emphasize we need innovation and technology and innovation and business models happening at the same time. This was clearly a business model innovation. And another one I’ll just mention, just yesterday it was announced with the coalition of large companies inspired apparently by the World Wildlife Fund, they are beginning to offer to their employees as an employee benefit the opportunity for rooftop solar with lower cost. So I think this business model innovation is absolutely, absolutely critical. What we are doing in terms of having more of these stories, well, first of all, for solar specifically we have a program called SunShot, obviously a takeoff on Moon Shot, and the SunShot program really works across the chain including not just the hardware but getting the so-called soft costs down.

In fact, yesterday we announced -- and it's on our website, if you all want to enter, or at this stage help to shape the rules for the contest, we announced a new contest, $10 million in prize money, for teams that shorten the time from permit to lights on from about six months typically to a week. It's a big stretch, but that's the kind of thing -- that will require innovation in a business model and in how the public sector addresses licensing. But that kind of innovation is just as important as the innovation that's driving the hardware cost down. So I really want to congratulate you on that and $5 billion isn't bad. Now again, in terms of what we do, it covers the spectrum. For example, one of our programs which was put into place in 2009 is called ARPA-E. ARPA is the, for those who don't know, Advanced Research Projects Agency. It's a semi-legendary organization of the Department of Defense which has had major technology breakthroughs. They work in a little bit more of a free-wheeling style than a typical government program.

Greg Dalton: Played a role in the internet.

Ernest Moniz: Internet, stealth, hardware, lots and lots of things. And so in 2009, the Department of Energy started a program called ARPA-Energy, ARPA-E, with the same kind of idea. And so here, the Department is providing a few million dollars typically to someone with a technology that's still pre-marketplace but looks to be ready in a few years to have a well-defined product ready for market. And we also provide mentoring in terms of product to market, university professors, for example, who have not been engaged in the before. So that's one way of trying to feed that venture capital pipeline, the startup pipeline.

But we also have other mechanisms. I mentioned, for example, the loan program, where to qualify you do have to advance the ball on the technology but yet still be credible to enter the marketplace. I'll just mention one as an example of what I mean. Yesterday I was in Nevada and we have provided again loan guarantee support for building a large concentrated solar project. It's stretching the envelope as it will have 10 hours of energy storage built into it. So again, these kinds of new features is what we do and that's bringing again players into the marketplace.

Greg Dalton: We're talking about America's energy future with U.S. Secretary of Energy Ernest Moniz. I'm Greg Dalton. Let's talk about crude oil. There is so much going on being produced in the United States. There's talk of softening or limiting the ban on crude oil exports. Should the United Stated export crude oil?

Ernest Moniz: First of all, that is the responsibility of the Department of Commerce.

[Laughter]

Greg Dalton: How convenient.

Ernest Moniz: And I certainly would not want to complicate their deliberations. But a few things -- first of all, I think it is worth, given the context, which you said a little bit in your opening remarks, Greg, the increase in our oil production is quite remarkable. We are up to about 8.5 million barrels a day of crude oil. We expect to go over 10. We could go significantly over 10. Many think we will be the world's largest oil producer within a few years which is quite a change from where we were.

Greg Dalton: No one ever thought that would happen.

Ernest Moniz: Correct. Now having said that, couple of other points. First, our imports have gone down very, very substantially. However, put that in context, we still import 7.5 million barrels of crude oil per day. We are an enormous importer still because of our enormous use. So the question of exports should be kept in that context, that we are still large importers. What the oil production increase has done for sure is dramatically lower our imbalance of payments. So it's a lot more capital and a lot more resource that stays in our economy to go to other purposes.

I want to make another point. This goes back to the issue you raised initially about how do we, in some sense, put all of these together, climate, oil production, economy. We have not taken our eye off the ball of reducing oil dependence. So as we lower our imports, lower our export bill, we are aggressively pursuing more efficient vehicles, alternative fuels like next generation biofuels and electrification of vehicles like getting those costs down on batteries. So we are working very hard on reducing our oil dependence. It sounds kind of odd even as we increase our oil production and lower imports.

Greg Dalton: And this whole question, of course, is tied to geopolitics. Oil has been around $100 for a couple of years now in the '80s, some people think it might be the '70s. That has an impact on Saudi Arabia, can have an impact on Russia.

So how do you see the geopolitical dimension of oil where it is now? At some point, the Saudi Arabian regime needs a certain price to keep the place afloat.

Ernest Moniz: Well, and they and OPEC colleagues will take actions as they choose. Obviously we believe in a market structure. Oil has a global market price. The extra production in the United States, the enhanced production in the United States has come at a time actually when there has been considerable disruption in the oil markets. It's not quite recognized that we are at pretty near historic highs of what are called unanticipated outages in oil. Libya, for example, has had problems. They've come up a little bit recently and that has impacted the global prices, but they are still not back to where they were. Iraq is not back to where they were, et cetera.

Greg Dalton: Syria hasn't.

Ernest Moniz: Syria. Embargo on Iran. Unrest in Africa. So the U.S. additional production has been critical in keeping the world as a whole supplied well.

Greg Dalton: Without further price spikes, you're saying.

Ernest Moniz: Exactly. And now that's showing up in the global oil price also reflecting, of course, very importantly, what has been somewhat soft economies in Europe and in China. So the demand side has been a little bit soft. U.S. production has helped fill the gap of some disruptions and I'm certainly not going to predict where the oil price is going.

Greg Dalton: Should oil sanctions on Russia be stricter?

Ernest Moniz: Well, look, we have obviously pursued with our allies a set of actions that has been -- has affected, certainly some financing processes, including in the energy sector, and certainly has impacted the long-term development of resources in Russia. It's not really had a major impact by design in terms of immediate supply, but, of course, the hope is that the cause of the sanctions will be addressed and that we can return to normal behavior. But the issue is, in Russia's case -- and for others, too, but for Russia, if they are developing more frontier resources in the Arctic, for example, as they invest capital for large facilities like LNG export terminals, for example, those rely very, very heavily on western technology. And so really the real crimp there is in their ability to develop the future resources.

Greg Dalton: And does lower gas prices have an impact on renewable energy that if gas prices – the difference between renewables is different. Sometimes renewables are more expensive if gas prices come down, it makes it harder to beat those. Is there less of incentive with lower gas prices?

Ernest Moniz: Natural gas prices.

Greg Dalton: Gasoline prices, sorry.

Ernest Moniz: Oh, gasoline prices.

Greg Dalton: Yes. Because crude oil is down from where it has been, gasoline prices are soft, does that make it tougher for biofuels or things trying to compete against that oil?

Ernest Moniz: Okay. So first of all, in terms of obviously the electricity sector is not, in the United States, impacted by oil in a direct sense.

In terms of biofuels, clearly ultimately we have a market for all of these different fuels. But, of course, today -- it's a little bit complicated right now, but today we do have by law, of course, requirements for alternative fuel use, ethanol use, both ethanol and cellulosic ethanol. There's a little bit of strain in the system right now getting worked out in terms of so-called blend walls because we did hit 10% essentially of our gasoline being displaced by ethanol. And now the question is if gasoline demand is flat or declining, then how do we adjust in terms of the biofuels and gasoline. But certainly the standard in terms of ethanol is still there, frankly, even if gasoline prices drop a little bit.

Greg Dalton: And how about that trend of some Americans are driving fewer miles, millennials don't lust after a set of wheels like you and I did when we were teenagers, the total number of gasoline demand is down and softening and I think the gasoline industry knows that. So how is that going to affect America's economy when sort of declining driving and gasoline?

Ernest Moniz: It's a very important issue. As I said earlier, we are, in fact, focused on reducing oil dependence. But you know, Greg, I think the issue you raised there is a very important one in the context of accelerating the low-carbon transformation. And it touches again on this issue of the need for business model innovation.

What I mean is the following. If we look historically, the energy system is slow to change, characteristically a half a century for major changes in the fuel mix. We want to pick up the pace because of the climate, 25 years maybe. So cut it in half, let's say. However, there's a difference. In the past, those changes of market share, if you like, of different fuels, wood, coal, oil, gas, et cetera, those all came at a time of significantly increasing demand. Your business model isn't changed so much if what you are doing is moving in to meet new demand. But today, in gasoline, in electricity, we are not seeing that kind of demand increase. Indeed we believe, and I think most of us would believe, that part of meeting the climate challenge, a major part has to be on the demand side. So working hard on efficiency, for example, that makes a certain complication in transforming the system more rapidly when you don't have that increasing demand. So that's an issue where again I think we have to keep the technology innovation and the business model innovation kind of going hand in hand.

Greg Dalton: Let's talk about nuclear power. It’s often seen as it is a zero carbon source of energy. U.S. has, what, 103 nuclear power plants. The Obama administration has provided some new financing, some new plants for the first time, yet you're talking about the reduction of cost of lots of forms of energy.

Nuclear keeps going up. All the other forms of energy keep going down. So is nuclear wise given the cost inflation that it's seen, industries failed to deliver on lower cost?

Ernest Moniz: Again, costs are a huge part of the issue and the new generation of nuclear plants. Look, these are not going to be inexpensive obviously. But they do have the advantage, very similar to renewables in principle, by the way. They are basically capital-intensive and very low cost relatively to operate. So that's the equation. And the same is true for wind and solar. The difference is that up to now the economy of scale arguments has made the chunks you need to buy for nuclear 1,000 megawatts up to 1,600 megawatts for one plant.

Greg Dalton: $10 billion.

Ernest Moniz: Exactly. Versus the more modular opportunities you have with renewables. So the financing equation is different even though it's the same basic equation of high capital and low cost. So two points. One is, as you alluded to, we have four so-called Generation 3-plus nuclear plants being built in the United States, two in Georgia and two in South Carolina. These are the first new plants in decades. Their cost and schedule performance will be critical. Certainly if they have the kinds of cost escalations, which they don't seem to have -- they have some cost escalation but nothing like we've seen in some recent plants in Europe, for example.

If they come in on reasonably close to cost at schedule, I think we probably will see some additional plants built particularly in parts of the country where the regulatory structure allows cost recovery plus in the southeast.

Greg Dalton: Which means consumers pay.

Ernest Moniz: In the southeast. Yes, but the issue is that the levelized cost may be quite competitive. It's that upfront cost. But the second thing I will say is we also have a program where again I can't tell you how it will turn out. We have a program for what are called small modular reactors. So the idea here is they look very attractive in terms of safety features, et cetera, we are supporting two of them towards licensing in the range of 50 to 200 megawatts, so much smaller.

Greg Dalton: How far in the future?

Ernest Moniz: So we hope the first one will be operating in about 2022. Okay? But here's the proposition. The scale argument says, "If you go smaller, it's going to cost more per unit." By the way, the scale argument also says, "If you are really big and you have a problem, it costs a lot more, too."

Greg Dalton: You got a really big problem.

Ernest Moniz: You got a big problem then. So the idea here is these much smaller reactors would be built entirely, all the guts would be built on a factory production line, bringing along all of the quality control and the quality assurance and trained and established workforce. The question is, will the economics of manufacturing overcome the economics of scale? We don't know. There's a lot of interest in these because you don't need the $10 billion at a pop.

There's a lot of interest in foreign countries for serving smaller loads, but we don't know. And our argument is we won't know until we try some of this, so we are putting in fairly modest amounts of support to have these go towards licensing. But I do want to emphasize, and not everyone agrees with this, but I want to emphasize, the president's position is clear and so is mine. We pursue an all-of-the-above approach. We put resources in to every fuel, fossil, nuclear, renewables, efficiency that will lower emissions. And so we are going across the board because we believe that when the words low carbon solution are stated, it's in some sense misleading. There will be multiple low carbon solutions. They will look different in different countries. They will look different in different parts of our country. The important thing is to get to a low carbon solution. And in that sense we think across the board there's going to be a role for just about everything if it reduces carbon emissions. So we are making these investments in nuclear as well as our very strong investments in renewables and efficiency.

Greg Dalton: On the small nuclear reactors, I want to know what Homer Simpson has to say about those. I bet he has some kind of thought on those. There's got to be a Simpsons episode on that coming soon, if there isn't already. On consumer choice, you talk about all of the above. One of the tenets of capitalism is consumers have choice. Yet in choosing power, most of consumers don't have a choice. There's a monopoly power provider in each area. There's been some efforts in California and elsewhere to provide competition in consumer choice.

The incumbent utilities have tried to stab that and stomp it. What's your position on consumers having choice in utility markets? I know that's more of a state issue, but should there be more competition in consumer choice for electricity in the United States?

Ernest Moniz: Well, first of all, I do want to reinforce what you said, that it's a state issue in our overall regulatory structure. I also want to emphasize that, of course, the person or the entity that is actually delivering the electrons to your house, certainly in many parts of the country, does not actually own generation, is the distribution company that -- because that's been separated. Now, having said that, there are many, again, business models that are enabled by public policy, like renewable portfolio standards, for example, allowing consumers to buy green energy. That's great. I absolutely believe that we should provide those choices, but those will be provided in the context of business models that are perhaps framed by local state and regional policies.

Look, in this country, it's clear, as has been the case many times before -- California, of course, has always been on the frontlines in terms of advancing environmental regulations and laws. But right now, we do see, of course, in many states -- roughly half of our states have some form of renewable portfolio standard. In the northeast where I come from, Regional Greenhouse Gas Initiative, we have a whole bunch of states together in terms of climate action.

And by the way, the EPA rule on power plants, one of the things that's very important there is it emphasizes flexibility in state responses to the carbon target and the ability for states to group together into regional groupings that can further aid them in meeting the targets. I think that eventually, as has happened before, all of the various experiments going on in our states and regions will hopefully come together and inspire an appropriate national approach.

Greg Dalton: If you're just joining us, our guest today at the Commonwealth Club is U.S. Secretary of Energy Ernest Moniz. I'm Greg Dalton. You talked about getting the cleanest, lowest carbon fuels. One of the main arguments for natural gas is that it's cleaner than coal and yet there's quite a debate about whether natural gas, when you consider the methane released during extraction, natural gas burns cleaner than coal, but when you consider the whole picture, there's really quite a debate about whether coal really is dirtier than natural gas. What's your view?

Ernest Moniz: Well, I definitely see natural gas as a bridge to a low carbon future. First of all, again, the facts on the ground are that the increase on natural gas use in the United States has accounted for roughly half of our CO2 reductions in the last years. Now, methane -- of course, we should also -- I think it's important to -- I'll come back to methane explicitly, but to remember that carbon dioxide is different from the other greenhouse gases that we are concerned about in terms of its very long residence time in the atmosphere. A CO2 molecule today, roughly speaking, we bought it for a long time.

Whereas others like methane, hydro fluorocarbons, these are more on a decadal time scale. And that's important because it means if we control those greenhouse gases, then the problem kind of goes away in a few decades as opposed to centuries with carbon dioxide. So that's an important distinction. So with methane, we know what to do. I mean, we have to do it. And there has been a considerable reduction in methane emissions from production as far as we can see. But we are concerned about methane, the Department of Energy, in a broader context, it's end to end. So, for example, we have in the transmission pipes, the compressors, so we have announced that we look forward to standards on compressors. And, of course, an area that we do not have the authority but you've seen in a lot of cities, including my hometown, Boston, we have a lot of very, very old pipe, cast iron pipe, and of course that's a safety issue. So what we need to do for greenhouse gas purposes, for safety issues, we need to renew the infrastructure in this country and this is part of what we need to do. And a lot of states and cities have come forward with innovative ways for their distribution companies to accelerate the replacement of this old infrastructure. It's also great for jobs, by the way, not surprisingly. Labor is very, very favorable towards these kinds of infrastructure things. So we need to look at the solutions in a broader context.

I certainly believe with methane, the goal -- organizations like the Environmental Defense Fund, for example, we held five roundtables with all the stakeholders on these issues of end-to-end methane emissions and a goal, which I think is a realistic goal, is to be able to get end-to-end emissions below 1%. And in that context, I think natural gas is definitely a bridge.

I do want to emphasize, no one, at least I -- and I think no one who studied in any depth has ever said that just by producing more natural gas, we solve the climate problem. It is a bridge to where we have the kinds of economy-wide policies that we can have very, very low carbon emissions.

Greg Dalton: This is Climate One. I'm Greg Dalton. And my guest today is U.S. Secretary of Energy Ernest Moniz. Mr. Secretary, I have one question before we go to the audience portion. You recently were on the NPR show, Wait Wait…Don't Tell Me! You called in and you talked about -- I'd like you to confirm for us -- that you actually do have the best hairstyle in the president's cabinet.

[Laughter]

Ernest Moniz: The statement made on the internet was since 1794. I won't comment about today.

[Laughter]

Greg Dalton: And you also, since we are here in California, where are the origins of that hairstyle?

Ernest Moniz: Oh, you obviously heard the program. I made the point that this is what happens when you move from Boston to California. It's just kind of natural.

Greg Dalton: Still live in the '70s. Okay. Let's go to audience questions. Welcome to Climate One.

Female Participant: Yes, thank you. You mentioned earlier the importance of bringing the issue of climate change to a global stage in terms of spreading the responsibility and one mechanism for doing that is to involve corporations and governments in purchasing carbon offsets to support projects around the globe that are reducing carbon emissions. And I wanted to ask you, how do you view the role of carbon offsets in today's carbon economy and how do you see that role evolving over the next, say, decade in terms of energy policy in the U.S.?

Greg Dalton: If I could just briefly will say, carbon offset is paying a company to save some trees in the Amazon or do something good somewhere, and they get a benefit for that. Your answer, Mr. Secretary.

Ernest Moniz: Yes. And as you know, there has been a clean development mechanism, for example, which, in fact, is a way of allowing perhaps cheaper per ton CO2 emissions reductions in other countries, in developing countries, for example. I personally believe -- this is just a personal statement. Clearly what happens in Paris will, I think, be very important for this. I should say Paris, but I mean the negotiation in climate that will take place in November-December of 2015 in Paris.

It's clear that the opportunities are there for again having less costly reductions in CO2 in some developing country context. There remain challenges for knowing how to score it, so-called additionality challenges. I personally would hope that we would see that as part of a global climate solution partly because I would like to see it integrated with economic development in developing countries. I must say that in early June, I co-chaired in Africa, in Ethiopia, it was held in Addis, a U.S.-Africa Energy Ministerial. We had over 40 African countries engaged, including over 20 at the ministerial level. We also had 60 American energy companies there and what was stunning to me was the desire on the part of so many of these African countries specifically to have American companies engage there in clean energy development. And so somehow we're going to make all these things come together in a way that helps our global climate challenges, helps our companies, helps the economic development of these countries. In Africa, I must say I sensed a real dynamic situation in which the next decade could be really, really critical.

We all know and they know that there are some governance challenges to be met in various countries, but the opportunity for all this to come together is fantastic. Just one example -- and then I'll stop. In Ethiopia, for example, and this flowed from the president's Power Africa initiative, a big geothermal project going on. It turns out East Africa, a huge piece of East Africa, has got tremendous geothermal potential. And just yesterday, I was looking at all of this in Nevada in terms of geothermal. So I think it's a great opportunity to have all this come together and accomplish multiple goals.

Greg Dalton: I'm Greg Dalton. I'm talking about U.S. energy with U.S. Secretary of Energy Ernest Moniz at the Commonwealth Club. Let's have our next audience question.

Female Participant: Hi. On a related note, so not just in terms of Africa, but you'd mentioned beforehand that while the demand in the U.S. is decreasing, but as we all know, demand is increasing in places like China, India. So what has been the role of the U.S. DOE so far to help address the climate challenge in those emerging economies and how do you see the role of the DOE progressing in the future on the international sense?

Ernest Moniz: Well, we have very strong engagements working with other countries, developing, emerging, established, in terms of clean energy. With China, we've had a very energetic collaboration. Four-plus years ago, for example, with China, we established something called the Clean Energy Research Center, U.S.-China Clean Energy Research Center.

And it's a program where both governments and industry in both countries comes together to do R&D, to do demonstrations, do analysis around clean energy. And actually, to give you an idea just of how important we think this kind of dialogue is, in July, for what's called the strategic and economic dialogue, the United States -- this happens every year, alternates places; we had five cabinet members in Beijing for the discussion. And clean energy and climate was a track that was involved the whole of our delegation and of their delegation. So it's taken quite seriously. And there, we agreed that we would both renew for a second five years and expand the nature of this collaboration. That's just one example. But we are working quite closely.

And frankly, I would say that the Chinese leadership expressed very clearly their understanding about the importance of addressing climate change. The question is always how, how fast, when, et cetera. But we have similar dialogues with India, with Brazil, with South Africa, with some Middle Eastern countries, Saudi Arabia, UAE, for example. We also have something actually called the Clean Energy Ministerial which involves approximately 20 countries, started in 2009. We had our last meeting in Korea and this is having some material benefits.

For example, from the Clean Energy Ministerial, India became the first country of the world working off some developments that are taking place in the United States actually, but they were the first in the world to really establish a set of standards for LED lighting that will be very, very important in terms of obviously high-efficiency et cetera. So we are -- this is critical.

Greg Dalton: Let's have our last audience question for Secretary Moniz.

Male Participant: At the recent United Nations meetings, over 60 countries signed on to the principle of carbon pricing. You mentioned this is a global issue and there needs to be national solutions, and the Climate Action Plan is moving that way. There are two approaches: carbon tax, preferably revenue neutral, and the more complex cap and trade. How will the U.S. pursue this issue as it gets into the Paris discussions coming up?

Ernest Moniz: Well, needless to say, either of those solutions requires legislative action. And as I've said, we -- the president has said, we are eager to work with the Congress in terms of legislative approaches, but frankly right now, we don't see that happening. It hasn't happened in the last couple of years. It's probably not going to happen next year. So we're going to have to work around the sectoral approach that the president has brought together using existing authorities. So that's the reality of where we stand.

Greg Dalton: Or everybody could just move to California, like you did, in the '70s from Boston.

[Laughter]

As we close here, I'd like to ask you one last thing about unburnable carbon. There's this idea out there that a significant amount of carbon assets on the balance sheets of fossil fuel companies, oil, coal, gas, cannot be burned.

Recently a central banker in the United Kingdom mentioned this. I'd like to hear your view that some of this carbon can't be burned if the world is serious about maintaining civilization as we know it.

Ernest Moniz: Well, there's the famous quote of the Saudi oil minister in the 1970s that the Stone Age didn't end for lack of stones and the oil age won't end for lack of oil. It goes back again to the story of we need to keep working, driving down the costs such that the low carbon alternatives are going to be the best choice. They're good for security. You don't have to worry about importing the sun or the wind or the earth's heat. And I think in the end, the technology and associated business model innovations are going to have to carry the day. There are some, of course, technologies that can alleviate that to a certain extent. For example, the Department of Energy is -- I said we're all of the above. So we have huge investments in what's called carbon capture and sequestration or carbon capture, utilization and sequestration. So for those not familiar with it, you have, say, a coal plant, and rather than having the carbon dioxide go to the atmosphere, you capture it, compress it, pipe it, put it underground. Today in the United States, it may not be widely recognized, we actually produce 300,000 barrels of oil per day using 60 megatons of CO2 per year that is injected into older oil wells.

The CO2 stays down there is the idea and the oil comes out, so you have the economic benefit. So for a while that may work. The estimate is that that could be increased by about a factor of 10. Well, okay, if we could have 600 megatons a year of CO2 disposed of in this way with an economic benefit, maybe that will take us there. It won't replace 9 billion tons of coal use globally, but again the solutions are going to come across the board with, I would say, a little bit of this, a lot of renewables, a lot of efficiency, and then hopefully we'll just drive the system down to very low carbon and, of course, very low pollution generally which is something that China is highly motivated by, of course.

Greg Dalton: We have to end it there. I'm Greg Dalton. I've been talking about the future of U.S. energy with U.S. Secretary of Energy Ernest Moniz. You can listen to this and other podcasts of Climate One in the iTunes store. I'd like to thank our audience here at the Commonwealth Club and those listening on radio. Thank you for coming.

[Applause]

[END]