Greg Dalton: Today, we're talking about the future of our weather, food and financial markets and how they're being affected by the burning of fossil fuels. I'm Greg Dalton and welcome to Climate One. Scientists for the United States and around the world have issued three major reports this year with one core message, 'Climate disruption is here now and evident in all 50 U.S. states. Droughts, floods and other extreme weather events are impacting American families today, present future risks for citizens and businesses.'

Over the next hour, we will look at the latest climate science and the risks and opportunities in a hot and wacky world. Joining our live audience at the Commonwealth Club in San Francisco, we're pleased to have with us six distinguished guests who will join us in two segments. In the second half of this show, we will talk about divesting from fossil fuels and investing in clean energy. We'll hear from two investment managers and a shareholder advocate. First, an update on the latest science and what it means for Americans in their lifetime.

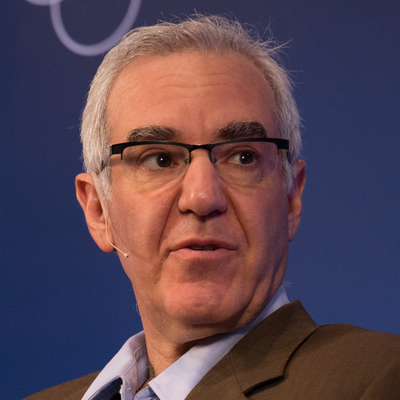

Steve Bennett is a Senior Vice President with Verisk Climate, a data firm serving insurance and other companies;

Noah Diffenbaugh is Associate Professor at the School of Earth Sciences at Stanford University and a lead IPCC

author;

Rebecca Shaw is Associate Vice President and Lead Scientist with the Environmental Defense Fund. She also is a lead IPCC author. Please welcome them to Climate One.

[Applause]

Greg Dalton: Thank you all for coming.

Noah Diffenbaugh, let's begin with you. What's – what are the headlines from the three recent major scientific reports about risks, heat, water, fire and those sorts of things in the United States. You were the lead author on a couple of those reports.

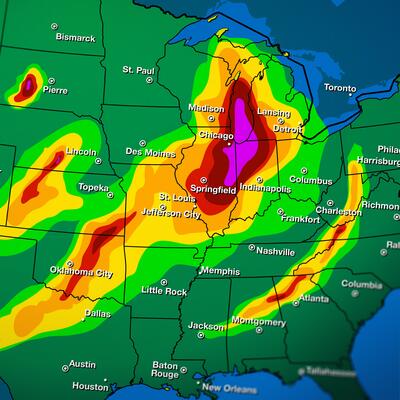

Noah Diffenbaugh: Yes. So in the North American chapter of the IPCC and also in the national climate assessment that was just released, we're collecting and evaluating the evidence. Over the last several years, it's been published in the scientific literature and it's very clear from that evidence that not only is global warming happening, but it's already increasing the risk of high impact extreme events, and we see this in the United States with severe heat. We see it with heavy precipitation. We see it with extreme storm surges, so increasing trends in all three of these. And looking out over the future, whether it's in a business-as-usual world in which emissions continue along their current trajectories, or in a world where there's policy action and technological development that curve emissions away from that business-as-usual, we see increasing likelihood of these kinds of extremes. But critically, the risk of further increases in extreme events is substantially greater in the business-as-usual world, the unconstrained world, compared with say the United Nations' two degree Celsius global warming target.

Greg Dalton: Are there some parts of the United States that are more at risk than others? Is there some place where you should tell your relatives sell your property now?

Noah Diffenbaugh: Well, I think certainly a message from the IPCC report and then say from the national assessment as well is really a question of which kinds of risks are you talking about. And I think there's evidence for climate-related risks from the coast to the mountains, oceans and continents. And in fact, we're –

Greg Dalton: Sea to shining sea, there's no place to hide, huh?

Noah Diffenbaugh: Yes. What the nature of those risks is, is really a function, not only of the physical hazard like the heat wave or the heavy rainfall, but also of the human dimension and the ecosystem dimension, so how the hazard intersects with exposure and vulnerability. And so you'll get a different mix of those three dimensions in different parts of the United States but there's no – I'm not aware of any part of the United States that has zero risk in any of those dimensions.

Greg Dalton: No place to run or hide.

Rebecca Shaw, you worked on the adaption, what communities and what sectors of economy in the United States are doing to kind of prepare and brace for this? So what's happening there in terms of getting ready for what's coming our way?

Rebecca Shaw: Yes. So I think one point I want to make that I found really exciting about being a part of this IPCC report is that the shift away from just the impacts alone, here's all the doom and gloom and what's going to happen. A shift to the focus on risk because risk has a climate component which is really important, but it also have – we do a lot of things in the way we decide to build, where we decide to grow our food, how we grow our food, that actually increase risk that don't have anything to do with climate. Climate is just an extra little push to make it even riskier and I think there's a lot of ways in this shift to the language of risk reduction means there's things you can already do today to reduce your risk that don't have anything to do with whether knowing what the climate is going to be in the future. You just need to know that things are going to get more variable and there will be greater magnitudes of droughts and floods and storms.

And in that then, you can see that there's a lot of really interesting activity happening here in the U.S. and around the globe in some of those key sectors that are most at risk, including agriculture, including coastal cities and including the health sector. They're seeing they've already – we know that there are – we're already feeling the impacts of climate change or the impacts of extreme advanced. There are folks around the planet and these different sectors actually responding those and trying to adapt to decrease the risk both for today's climate and future climate, and they're sharing these through the IPCC and other venues. They are sharing these learning and experiences. And so when we look at the world, in terms of risk reduction, there's a lot we can do to actually make the world a safer and more vibrant and more economically viable place.

Greg Dalton: A lot of the timeframes here tend to be long term to think about decades, centuries, polar bears and grandchildren, and do humans respond to that kind of risk? I mean we're not so good at saving for retirement, we're not so good at sort of long-term health impacts, we go to the bar today, then gym tomorrow. I mean is the timeframe really sinking in with risk reduction right now?

Rebecca Shaw: I think it depends on what sector you're actually looking at. If you're talking about agriculture in California, it's definitely sinking in. There's a lot that's been going on that has increased our risk within the California agriculture sector. There's growing of crops that need, are really water thirsty that makes those crops and our agricultural canning much more vulnerable when we have these big droughts, so we've increasing every year increasing our vulnerability by increasing the planting of very thirsty crops. We're feeling the brunt of this.

You'll see headline after headline now in the California newspapers about fields needing to go fallow, particularly around almonds. Almonds are really, really interesting case statement where we're continuing to grow almonds, even though the almond crop we have is at risk because they can't get water for their crops. So I think we're not responding much to the polar bear anymore. I think that it's really hard to hold that in your heart and make decisions on daily basis, but I think we are very much beginning to respond to the impacts, the very real impacts we're feeling in our different economic sectors and our lives.

Noah Diffenbaugh: Well, just to amplify what Rebecca was saying about that timeframe, in the last decade or so do you ask this experience, more than 70 billion-dollar weather and climate disasters. And regardless of any trend at all, just year after year, that level of risk and ultimately damaged from climate-related stresses suggest that we're not optimally adapted to the climate that we have now. And so that's to support what Rebecca was saying about there's a lot that we can do in terms of exposure and vulnerability to manage the stresses that we already experience.

Greg Dalton: There is still condo development going on in Miami, et cetera. So part of that is that there's more property and assets in harm's way the value of coastal property development, a lot of that is. Steve Bennett, you work in the gap between IPCC science and insurance companies who are trying to say, "Okay, bad things may happen in 2030 or 2050, but I need to make decisions today about my business, where to deploy capital," so tell us about how your filling that gap between this big picture science and people making decisions on the ground today.

Steve Bennett: Well, the insurance industry really has been out front of trying to really quantify and understand these risks for a couple of decades now. And there's been a series of models that have been developed by companies, many of which are here in the Bay Area, that basically try to take the hazards that we're talking about and present them in terms of what the risk of any given event or any given hazard might be in any given year. Just because if we have 100 years' worth of data and we've never observed a particular event in that 100 years, Category 5 hurricane in New York City. It doesn't mean it can't happen, right? The physics will allow for something like that to happen. So the insurance industry has been out front on trying to work with the scientific community to get an understanding and fill out that full risk distribution. So that's one of the things that we've been doing is trying to help individual companies understand what the baseline risk of a hazard is. So is it a 1% chance in any given year, is it a 0.5% chance, is it a 10% chance, those kind of things.

Greg Dalton: There's a specific example about roofers that you have and that sort of brings this home, so tell us about the roofers and after a big storm and maybe climate change is good if you're in the roofing business. I don't know.

Steve Bennett: So this is a good example where a few industries come together around a single need. The insurance company is very interested in severe thunderstorm activity, specifically hail falling on a roof. Hail falls on the roof and it damages the shingles, so as a homeowner, you need to get that repaired or, in some cases, you would need an entirely new roof.

So the insurance industry has been very interested historically in what's the risk of hail in Kansas City versus Dallas versus San Francisco? So what the scientific community has been able to do is take radar data over the last 20 or 30 years, develop algorithms that actually detect hail in that radar data, develop a footprint of residencies or homes or roofs, take that radar data and overlay it against the inventory of roofs to get a sense for how frequently they're hit.

So once we have a good answer for an insurance company, they get a good idea of a baseline risk. After any given storm, the insurance company wants to serve their customer, they want to server the policy holder. They'll call the policy holder or the homeowner after an event and say, "Hey, I think hail might have hit your roof. I think we probably want to get that repaired." So in an instance where we have actually real-time data, we can present that to the insurance company and help them understand who they should respond to. What houses, what policy holder should they call?

So once we have all of this built out, there's another natural industry that's very interested in the same exact hazard, and that's the people and companies that are out trying to deliver the materials to put on those roofs, and to actually restore the home. So that's a natural secondary customer group that we look at and we say, "Okay, it's the same information." The manufacturer of shingles wants to get the shingles to the market that's going to need them the most in the fastest amount of time. So the shingle goes to the distributor, the distributor then gets it to the contractor who puts it on the roof.

That whole chain is better served by having rapid response information. So the baseline data sort of helps these companies understand generally where they might need to be in any given year, and then they can respond immediately following an event based on the same underlying technology.

Greg Dalton: Rebecca Shaw, if my roof blew off, I'd probably open a bottle of wine and wine industry is one industry that's going to be affected by this, so tell us about how California wine is going to be impacted by this and whether we're going to have to pay more for wine.

Rebecca Shaw: Well, this is good because I wrote a paper on the impacts of climate on wine production, and then the indirect impacts on other land uses once wine, the wine industry, the wine grape growing industry starts to respond. And it was interesting exercise to go through because none of the stuff is just one impact and then you're done, there's cascading impacts and cascading risk. And what we found when we did this study is that everywhere around the planet, there are things you can do once there are changes in precipitation, changes in temperature and you know how important specific temperatures and specific rain amount is to the varieties, the varietals that we love and how important that is to soil, in combination with the soil.

These are very place-specific industries - the wine industry - they have their names attached to the places where they grow their wine grapes. But as climate shifts, there will be some places where wine grapes are grown today that won't be suitable for wine grapes in the future. There are a lot of things that wine grape growers will need to do on place to adapt to reduce the risk, and a lot of them are already doing that. But one of the things we thought we were being really forward-looking and looking at is they're going to actually have to start moving, moving north to where climates are different, moving up slopes to where climates – to get to follow the climate that's right for their varietal.

And when we actually published the paper, we saw that a lot of the press around it was actually wine grapes growers are already doing that. They're already moving into most of the places that we said where would become suitable, including panda habitat in China, including in the Yellowstone Park, every place where we identified that you would be able to grow grapes in the future that's already happening. So again, the impacts are here, people are already beginning to adapt around the world and it will change the kinds of produce we're able to get and where we will be sourcing it from.

Greg Dalton: We're talking about climate science and impacts on our food in the United States. Our guests are Steve Bennett with Verisk Climate;

Rebecca Shaw with the Environmental Defense Fund; and

Noah Diffenbaugh from Stanford University.

Noah Diffenbaugh, how is this going to affect corn? A big part of the U.S. economy. Are we going to see corn grown in Canada? How is it going to affect prices and yields?

Noah Diffenbaugh: One of the advantages that we have in studying impacts on agriculture is that a lot of people have been paying really close attention to how climate affects agriculture for a long time. There's very long history of people paying close attention measuring the climate and measuring their agricultural yields and suitability in places over long time periods. We know from work that others have done taking huge amounts of data from the United States, looking at how yields vary from year-to-year in different places.

So we know that corn can be very sensitive to severe heat. We know that the likelihood of severe heat has already increased in many parts of the world. We know that it's very likely to increase further with each increment of global warming. And what we've seen in our work is that when we look out over even the two degrees global warming target that the UN has set, even with another - so that’s another degree Celsius above what we have now, we're still likely to see increasing severe heat over the Corn Belt in the United States. The result of that is likely to be increasing occurrence of supply side shock, so more and more low-yield years in the U.S. Corn Belt, if you translate that through the corn markets, as one would probably infer, we're likely to see more price volatility in U.S. corn prices.

So we now we've also identified potential for adaptation, how much increased heat tolerance would be required, where would you find the equivalent Corn Belt climate in the future and it moves as you would expect northward and as global warming occurs. If we look just at the physical hazard, if we look just how often the severe heat occur then we see the effects of that dimension. If we overlay that with what can people do in terms of exposure and vulnerability, there's a lot of opportunity to manage the risk that we are experiencing now and manage the risk that we're likely to see in the future.

Steve Bennett: One example of that is - staying in the agriculture and in corn. Technology is really coming to the aid to sort of help us get a much better understanding of this and the amount of data available is just exploding. A lot of the equipment on the farm is now has monitoring equipment, so we're taking observations from the tractor as it's moving through the field. I had an opportunity to see some results from one of these instruments. It was really interesting because if you picture in your mind sort of a satellite looking picture, right?

And in that picture, there's a line of green, horizontal line of green, horizontal line of red, horizontal line of green, horizontal line of red. This was an image of yield from a single farm. So the horizontal line of green was high yield, and the horizontal line of red was low yield. Same crop, it was all corn, same field. So what's the difference? It's a different type of seed. It was a different genetic modification of the corn seed. And what had happened, this event wasn't specific to temperature but it was a wind event, there was a high wind storm that came through, and one variant of corn, the stalks broke in half and the yield was completely lost, whereas the other variant, withstood the high winds. So with the data that we're starting to get, even at that level, I mean that really helps make some decisions about how you can adapt in real time.

Greg Dalton: And it's also the use of drones to look at water patterns and identify leaks, it’s always hard to find water leaks. Let's talk about water.

Noah Diffenbaugh, what kind of water stress can we expect the Western United States has been in a severe drought, California is in a historic drought, what can we expect with regard to too much too little water in the future?

Noah Diffenbaugh: Certainly, in the Western U.S. we’re highly reliant on snowpack as a natural reservoir and basically our water infrastructure and management system is built around some of the precipitation falling in solid form, falling as snow in the winter and being locked up there in high elevation, we don't have to store it because nature is providing that service for us. And then as the spring comes, it's gradually starts to melt and flow downhill into our reservoirs, and we're able to get through our summer dry season as a result of that natural reservoir. In California, somewhere around the third of our water is dependent on Sierra Snowpack.

And certainly this year, we're experiencing an extremely low snow year and that's mostly because of lack of precipitation in the mountains, but it provides an important example of what we've known in scientific literature for many years which is that we're likely to see increasing occurrence of extremely low snow years in response to global warming, both because of more precipitation falling as rain rather than snow with the warming atmosphere and also because the snow that does fall is likely to melt earlier, again, in a warmer atmosphere. And so, again, in terms of risk, we're seeing because of global warming, increasing risk of these extremely low snow years.

Greg Dalton: Rebecca Shaw, what does that mean for streams, fish habitats?

Rebecca Shaw: It's hard. I mean one of the things I didn't talk about in the wine grape study that we did is we really wanted to look at this because we wanted to know what the impact of the changes to adapt wine grape growing would be on habitats and on freshwater. And a lot of the adaptations that take place onsite, on current farms actually does great harm to habitat because they draw down a lot more water, and a lot of the areas in which crops will expand in the future will be wildland habitats now that will be lost if there's expansion.

So there's really a need and I think for us to really think through the kind of future we want, what we want to be able to grow where, and how much water we can afford to use on crops versus for people, the people drinking water or for the environment and really think thoughtfully about we're going to adapt our way through this so that we can meet the needs of people as well as meet the needs of nature in the future. I think if we don't think through it, we will have some catastrophic failures starting first in natural systems and streams and in rivers.

Greg Dalton: Some people talk about California exporting water in the form of alfalfa, water-intensive crops, cotton. Do you think California should not export water-intensive crops, given this water stress that

Noah Diffenbaugh has been talking about?

Rebecca Shaw: I don't really have an opinion on that. I do think that given that we really need to look at our cropping patterns. That's one of the major adaptations that will take place but that's a medium term adaptation strategy. Short term is figuring out how you use less water to grow the same crops you have now and make sure you have water irrigation that's very, very efficient, making sure that you're watering at the right times of the day. These are very simple adaptation changes that reduces the risk to both crops and to streams and wildlife.

But I think in the long term, we're really going to have to think about what we're going to grow here and some crops are going to be less viable because water will be more scarce in the future. What we want to make sure to do is we plan and adapt in a constructive and measured ways that we don't hit those disruptive things.

Greg Dalton: Rebecca Shaw is Associate Vice President with the Environmental Defense Fund. We're talking about climate change at Climate One. Let's go to our audience questions. Welcome to Climate One.

Male Participant: I got a feel from all of you that you're fairly optimistic on some level about what's happening. I’d kind of like you to maybe score where you stand personally on how you feel we’re doing in terms of figuring out ways to adapt in some way with ten being we got it licked completely and we’re fine, and one being there's no chance we are not going to make it.

Greg Dalton: Professor Diffenbaugh, you grade papers, so you get that one first [laughter].

Noah Diffenbaugh: Yes. So, again, I think if we just look at the climate that we have now, we experience a lot of stress from it, we get a lot of benefit from it but we experience a lot of stress. I think just in the U.S., if we've experienced more than 70 billion-dollar disasters from weather and climate over the last decade, it’s hard to say that we are well adapted to the climate that we have now so I guess we can certainly improve in how we interact with those climate stresses.

Rebecca Shaw: So if you would ask me this question before I started working on the IPCC and had really the opportunity to spend time with some really great minds pulling together all the information from around the world about what was going on in adaptation, I would have said – which one is the depressed part? So I would have been right around one or two, because of our inability to get together and have some kind of reservation.

Greg Dalton: So you would have been more depressed? So you're happier?

Rebecca Shaw: Happier now because the only – if you're looking at risk reduction, if you're looking at making sure that people and nature are able to transition through the next era, all we had in front of us five years ago was mitigating greenhouse gas emissions, reducing green and there was really – it looked bleak five years ago on that. It looked bleak both – state wise it was looking pretty positive, national/internationally very bleak. When you look at risk reduction through adaptation opportunities through what we can do to really make our world more vibrant that we have local control over in a lot – local meaning even municipalities and the state, we really have a lot of control and there's a lot of positive things happening around the world.

We still have to – the mitigation of greenhouse gas emissions really has to go along with the reducing risk through adaptation, and they have to go hand in hand. I think you see this - the more folks around the globe are getting involved in the adaptation opportunities to reduce risks to the climate disruptions that are already feeling, they're getting more connected toward that long term, how important it is to mitigate greenhouse gas emissions. So the two linked together are powerful message for how we can change the direction and I didn't see that happening five years ago.

Greg Dalton: Welcome optimism. Steve Bennett quickly and then we'll go to our next question.

Steve Bennett: I answered this question from a slightly different angle which is, I look at it from the business community's perspective and because I guess I come out of the scientific community to get here, I think about it at two ways. First is, the more the business community gets involved in this issue, essentially the better off we are because we have more eyes focused on the issue, we have more resources focused on the issue, so I kind of look out across the industrial sector. I look at it from a perspective of what do you do? So as a business, what do you do with this information?

I think over the last ten years, there's been a solid shift of that motivation throughout the business community, so I think the insurance industry is probably one of the most attuned to it. But we have seen the agriculture community and the agribusiness community come to a point where – they've always known that weather impacts, right? I mean that's nothing new to a farmer, right?

But beginning to get engaged to the sense of trying to really understand how the weather changes year to year, month to month, that kind of thing. It's really the weather that we're interested in here because it's the weather that impacts what we do every day. Climate is how that weather is changing over time. So I think there was a study from the Chicago Mercantile Exchange mentioning about 30% of the U.S. GDP is impacted by weather. That's by extreme events and by just simple shifts off the mean. So to answer your question, I think, I would look at the insurance industry as probably being the most attuned to the issue, and then I think you sort of walk through the various industries that come down that curve.

So I think it's hard to give a number because it spreads out across so many different industries, but I would say that in my career over the last ten years, the business community, as a whole, is paying attention and they're trying to figure out what to do. They're trying to figure out how to react. So first, they want to understand what's going on and then they want to react to it from a "how does weather impact me" perspective.

Greg Dalton: Let's go to our audience question. Welcome to Climate One.

Dan Miller: Hi, Dan Miller. There's a number of scientific group say that under business-as-usual, we're going to hit and exceed four degrees Celsius or seven degrees Fahrenheit later this century. Kevin Anderson, a climate scientist at the Tyndale Centre in the UK, says of that temperature that it is not compatible with an organized global community beyond adaption, devastating to the majority of ecosystems and probably would lead to higher temperatures. Do you think there's a chance he's correct and what are your comments on that of adaption versus mitigation?

Noah Diffenbaugh: Yes. So the work that I've done on that world, that unconstrained business-as-usual world, four degree world. Almost every area of the earth is likely to see the summer be hotter than it ever was in the last 20 years or even 50 years. So basically, year after year, an extreme summer year after year, and we looked at that sort of metric in a bunch of different ways. It’s certainly becoming clear that the velocity of climate change, so basically how far in space does climate move per unit of time.

It's clear that for many parts of the world, you have to go to the other end of the world to find the equivalent climate and certainly high elevation areas, the poleward edges of continents, where the climate kind of marches to the end of South America and then hits the ocean, and now where do you find another land area that has the same climate that you started with. So the rate of change in that business-as-usual world certainly will cause big challenges.

I guess I'm optimistic about human ingenuity and creativity we certainly find a way to adapt to a large range of environments at present. A lot of it is a question of equity. Certainly, if we look at the world now with a billion and a half people that lack access to electricity, and a billion people lack access to clean water, and two and a half billion people that rely on biomass for cooking. There's a lot of vulnerability in the current climate and I think the question for this business-as-usual world, how is the world going to ensure access to the benefits of energy consumption while minimizing the impacts.

Greg Dalton: Rebecca Shaw, brief last word on that adaptation.

Rebecca Shaw: Yes. We don't want to go to four degrees and most of the climate models are saying that under business-as-usual, we get to four degrees. They sort of disagree on when we get there but we don't want to go to four degrees. I think the discussion around risk reduction to adaptation connects people more tangibly to the need for greenhouse gas mitigation that will help us avoid a four-degree world. We have a one-degree world now and look what's happening and we have these disruptions and they are severe disruptions and disruptions we’re all wrestling with, how are we going to deal with this California drought, with the hurricanes, with the heat waves and the loss of crops? We don't want to go to a four-degree world.

Greg Dalton: We have to end it there.

Rebecca Shaw is Associate Vice President of the Environmental Defense Fund. We've also heard from

Noah Diffenbaugh, Associate Professor at the School of Earth Sciences at Stanford University and a lead IPCC author. And Steve Bennett, Senior Vice President at Verisk Climate.

Greg Dalton: I'm Greg Dalton. Today, on Climate One, we're talking about severe weather and the risk it presents to communities, companies and investors. After talking about science in the first half of the show, we turn now to financial markets. We're joined by

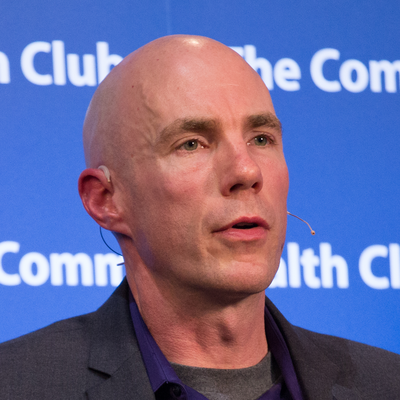

Andrew Behar, CEO of As You Sow, a shareholder advocacy group that presses energy companies to confront and disclose climate risk.

Lisa Goldberg is Director of Research at Aperio Group, an investment firm that manages $8 billion in assets. She's a former Director of Research at MSCI and an adjunct professor of statistics at the University of California at Berkeley. And

Josh Schein is CEO of Global Key Advisors, an investment firm and a former Senior Portfolio Manager at Morgan Stanley.

Please welcome them to Climate One.

[Applause]

Greg Dalton: Lisa Goldberg, let's begin with you. Can you tell us what the carbon bubble is?

Lisa Goldberg: The carbon bubble. The carbon bubble is a bunch of assets pouring into - well any bubble is assets pouring in unreasonably to a particular asset class. We had a housing bubble that I think we all remember in 2008 burst, and there's a concern that assets can be pouring into carbon-rich assets and these assets could lose their value unexpectedly and suddenly, and investors will be at a lost.

Greg Dalton: And why would they change suddenly? What is it about carbon that is risky or what's driving the potential bubble, if there is one?

Lisa Goldberg: Well, there is a huge body of science saying that we're having warming to the planet due to carbon being released into the atmosphere, and as a result of that, we could, for example, have regulation. Governments could come and say, "Well, we can no longer burn carbon-rich assets as we have," and this regulation could change the value of companies that had previously been making a big profit from carbon. For example, we would no longer be able to get the same benefit from burning oil, and then oil in the ground will not have the same value that it once did.

Greg Dalton: And is this something that this is a Greenpeace idea or is this large investment banks? Who's subscribed to this idea that there's this risk there?

Lisa Goldberg: Well, I don't think a few years back that markets were attuned at all to the financial risks associated to climate. I think we've been hearing about climate risk in terms of agriculture and so on, transportation problems for a very long time. But in terms of its impact on economic markets, I think that it's just really now coming to the consciousness of mainstream investors as well as more scientific types of more forward-looking types. And a phrase that you might have heard "stranded assets," this is assets that say oil in the ground that was once thought to have a certain value maybe it will have less of a value in the future that hence the assets become stranded. This is now becoming more and more mainstream in financial conversations and it's a concern on the mind of some investors.

Greg Dalton: So that a company could develop offshore oil wells or big energy projects and they wouldn't be able to extract the value. Basically, burn the fuel, the carbon in the ground.

Andrew Behar, let's get you on that in terms of how this is starting to percolate into the consciousness of mainstream companies, you work on that. I think one of the key points was HSBC and Citibank came out with a couple of reports, a year or two ago, and kind of put their imprimatur on that which was no longer just an environmental group it's like, "Okay, these are big Wall Street investment banks saying this is credible."

Andrew Behar: Well, I think it started with Carbon Tracker came out with a report and what they said was, if you actually look at what the proven reserves of the 200 largest oil and gas coal companies in the world, if you look at what's on their balance sheets, like what is an asset that's actually known to be have a value, you could borrow money against it. If you were to add all of those up, and you were to pull them up out of the ground and burn them that you would be raising the temperature of the earth by five degrees centigrade, and that's something that's not acceptable.

In Copenhagen, we all said two degrees is the most, so therefore, a majority of them are going to stay underground and that's the notion of stranded assets. So I think what we're seeing is that the financial markets are really starting to understand that there is a lot of risk on the fossil fuel side, and there's a great deal of opportunity on building clean energy infrastructure. So it's a transition that's happening. It's a capital flow that is happening and the World Economic Forum said that we need to move a trillion dollars a year from fossil fuels into building a clean energy future, and that's basically what we're saying.

Greg Dalton: Josh Schein, you like energy stocks for their stability oil and gas companies. Do you see the risk that you just heard about?

Josh Schein: I do see the risk. I mean, I’m not in love with it, I’m actually just part of – yes, I'm neutral if the S&P is 10% energy that's where I want to be, and then I try to find greener things to get into but the volatility is higher. I use a database where we develop it, where we look at 5,000 publicly traded companies and look at the descriptions of these companies. Ten years ago, when I first ran a screen for the word "solar," what were my options? There were three companies that came up in the database. Two of them are trading under a dollar – I couldn't touch them – and one of them, I didn't touch anyway, it was an eight dollar stock and it went bankrupt.

I ran the screen yesterday before coming into here and I found it was gratifying. I found 189 companies that had the word "solar" in their description. There's more to work with. I looked at wind power as a keyword term. I mean I looked at it ten years ago, there was nothing. Twenty-five companies came up yesterday so I do have options. There are things I can do besides fossil fuels, which is gratifying, so it definitely has my attention and I get into these stocks.

Greg Dalton: But an increasing number in recent years of investments have gone toward passive investment the idea that stock picking is kind of a fool's game and that indexing. If you buy into an index, most commonly the S&P 500, you're getting a pretty healthy basket of some of the biggest companies by market capitalization in the country are fossil fuel stocks - Exxon, Shell, et cetera. So if you're investing and indexing, smart thing to do. Aside from carbon risk, you're owning fossil fuel stocks, isn't that right,

Josh Schein?

Josh Schein: That's correct. But then you can also get sector indices so that you can avoid fossil fuel stocks. You can just put together a grouping of companies and there are even companies out there like Motif that will let you put together your own ETF basically. You can have a theme that you - you can have them create an ETF for you, so you can have them create your own little investment universe of a particular set of stock. It could be a theme. I like Seattle or I want companies there or it can be something like I don't want fossil fuel and I want to short it.

Greg Dalton: In your experience do people short stocks that they think are bad? Is that a tool?

Josh Schein: No. I have never, in my career, seen or heard of anyone doing it, and it's always fascinated me because I think if you want to own stocks that you think are good, well what about shorting the villains, what about shorting stocks that you think are not good and –

Greg Dalton: And we should explain shorting is basically betting that the price is going to go down.

Lisa Goldberg, is that a tool at all, shorting of fossil fuel stocks? If you really want to be serious about this and if you buy the carbon bubble theory, then you would short these stocks and say they're going to go down.

Greg Dalton: Risky. You got to put some skin in the game.

Lisa Goldberg?

Lisa Goldberg: Well, there are some examples that I can think of where carbon stocks have been shorted, most notably in a swab by the World Wildlife Foundation, so it's exactly an example of what you're talking about. But at Aperio, we've done a slightly different exercise which I'd like to tell you about having to do with staying with the market without carbon. Now, if I were to have an investor who wanted to stay exactly with the market and didn't want to have carbon stocks, well by excluding, simply excluding carbon stocks, it would not be possible. I would be different from the market. My attorney –

Greg Dalton: You pay a penalty probably and have less return or make less money?

Lisa Goldberg: No, I wouldn't say that. I would say you would have different returns. It could be greater or it could be less, depending on whether energy did better than market or did worse than the market. But there are quantitative tools that you can use to take stocks after carbon stocks have been excluded and re-weight the remaining ones to have match the characteristics of which have been excluded. This is an exercise that we've actually done and found that you can stay very close, say to the S&P 500, a broad market index without carbon by simply re-weighting, cleverly, re-weighting the stocks that remain, and this is done with factor models and optimizations, standard tools of finance that may not be familiar to the audience, but they're actually quite mainstream.

Greg Dalton: So does that mean sell Exxon, buy more Apple?

Lisa Goldberg: It means sell Exxon and buy more something, and in this case, a lot of the money went into utilities. Buy what you need to buy in order to stay close to the index, that’s the simplest thing to do and that’s the nature of the study we’ve carried out.

Greg Dalton: And how many people or institutions are doing that now, percentage of your clients at Aperio?

Lisa Goldberg: At Aperio, a relatively small percentage but I would say definitely a growing percentage interested in just staying with the index without carbon and yet another group that are doing what you suggested namely targeting where the money that’s come out of carbon stocks ought to go, through an index, an environmental innovator index that we have been using which looks at companies that put a large percentage – get a large percentage of their revenue and their income from climate science innovation, from waste – green waste, from renewable energy, from those types of activities.

Andrew Behar: And let me just add to that because BlackRock recently came out with a fund that they’re working with the Footsie [FTSE] and that –

Greg Dalton: Financial times, NRDC environmental group and BlackRock, a big investment house.

Andrew Behar: Right. And so what this shows to me is that because BlackRock is such – well, it’s the largest investor in the world, that they’re seeing that there’s a market for this kind of products, for a carbon-free product. And they’re set up so that large institutions could move, you know, $50 million, $100 million in a chunk over into this and have – and have reduced their or eliminated their carbon exposure.

And there’s many mutual funds that are coming up that are carbon-free. There’s the Aperio carbon-free index, and – so products are coming and more and more people want to be away from that risk of fossil fuels.

Greg Dalton: Stanford took a move away from fossil fuels recently and divested from publicly traded coal companies, small portion of their overall portfolio, but

Lisa Goldberg, does that hurt the coal companies when Stanford says, “We don’t like you, we’re not going to invest in you?” It’s symbolic, but does it really have an impact?

Lisa Goldberg: Well, it’s very hard to answer that question like all questions in economics I’m afraid there’s not a consensus. But there is certainly a very big psychological impact with a leading – science leading institution like Stanford. People pay attention, people think, well maybe this is important. And so I would say the feedback from doing the sort of divestment is certainly very important at getting others who have confidence in Stanford and in Stanford’s ability to generate income to feel it’s okay to divest.

Greg Dalton: But

Josh Schein, if stocks for coal companies go down that’s just cheaper for people who likes coal company.

Josh Schein: That’s the thing, creating opportunities for other people to take the money you’ve left on the table. I struggle with this too and then I also looked at the academic work on this, and you’re right, there’s no consensus on it, you’re not sure if you’re just creating opportunities for others to come and buy them cheaper or if you’re really having an impact on the stock and making people, not just people who want to own it but maybe the executives who come in and they get paid in stock options maybe they don’t want to work for these companies because their stock sure isn’t going to go up as much as 20% of the investment public. Not willing to buy them.

Andrew Behar: In case of coal, I mean the coal companies were hurting all these big endowments because coal dropped 58% in the last four years.

So, the fact that there is risk, that is I think the bottom line is that, you know, we talked about the carbon bubble, well, coal is the carbon bubble letting out its first – it’s the first bursting of the carbon bubble is coal which is collapsing. Five bankruptcies, 58% decline, and oil is going to be next. Here you see Chevron missed its numbers by 27% in the first quarter. So it’s a shift, it’s a big shift.

Greg Dalton: But globally, coal’s market share of electricity is growing. The coal is often talked about dying in the United States partly because of fracking and natural gas is making it more competitive to generate electricity with natural gas. But China and India, they bring it on. In fact the coal that used to be consumed internally in United States is now thought to be, you know, exported, Appalachian coal to Europe and other places.

Andrew Behar: Actually the coal is not being exported. Most of those ports that were – they’re trying to export it, there’s a lot of fights going on in a lot of ports and coal is not moving offshore. I doubt that it will. But Chin a is actually talking about closing coal plants within the next 10 years because they’re going to be building solar and wind at 15 times the rate that we are building it because it’s just cheaper to get a kilowatt of electricity from solar than it is from coal. It’s just less expensive and that’s the whole point is that it’s just economics. It’s just cheaper and that’s what China is doing. China is going to be leading the way on this as far as I can see and they will be closing coal plants.

Greg Dalton: Josh Schein, there’s more opportunities to invest in clean, solar, et cetera, but those companies could be pretty risky too. A lot of people got burned on solar stocks, what do you see there in that sector?

Josh Schein: Right. I don’t necessarily want to put 10% of the portfolio into solar.

It’s just – it’s too risky. And I feel like I want to do it but then I feel like –

Greg Dalton: You might get fired.

Josh Schein: Right.I mean, you know, I’m being paid to represent clients on Wall Street not Washington. And that part of me says that and part of me wants to do a better job, so I’ll try to fit the solar into it but it’s a struggle. And I think we all, we all struggle with this.

Greg Dalton: And on this carbon risk, do you think that if there’s stranded assets and boy, there’s going to be a big crash coming if some of this unburnable carbon is – these coal and oil on the ground at some point government, as

Lisa Goldberg said are gonna say, “You can’t burn this, we will destroy civilization, fry the planet” do you think you will see that coming in time to switch your clients out of oil and gas stuff?

Josh Schein: Not at all. Not at all. But I also look that the energy’s 10% of the portfolio, if it went down 30%, you lose 3%. So these things happen and I think that’s just the prevailing view of Wall Street.

Greg Dalton: Let’s get back to growing global demand. While it’s true that because of auto efficiency in the United States and partly the recession, partly regulation, peak car, people owning fewer cars that sort of thing, vehicle miles, that sort of thing is going down but globally Andy Behar, there are hundreds of millions of people who, a billion people without electricity, energy poverty, people who live on a dollar a day, those people want to get up into the middle class as 300 million people have done in China and they are hungry for a connected, electron-powered lifestyle that we have. And that will increase global demand which means the Exxons and the Chevrons and the coal companies will say “Hey, we’re just satisfying demand. There’s a market for what we do and we’re going to suck it out of the ground and make money as long as people want it.”

Andrew Behar: The key thing that you just said is an electron-based demand. So how you make those electrons is really what the issue is, is it less expensive to build a giant coal plant in India, run transmission lines or is it more efficient to put solar and wind out in the villages, out in the people who have – have nothing.

The thing about renewables is once you install them, the only cost is going to be servicing your debt. With commodities, you’re constantly having to buy coal, having to buy gas, having to buy, you know, something to burn if it’s biomass and those fluctuate up and down all the time. So the thing that we’re seeing and we filed shareholder resolutions at big utilities at First Energy and Southern. And what we said to them is look, “Your biggest or our biggest shareholders, box stores, our biggest customers are these box stores and they’re all putting up solar. Why? Because they want to lock in a 20-year rate. They want to be able to know absolutely what their electricity bill is going to be for 20 years. You can’t do that as a utility, so you’re losing your biggest customers and yet we have to maintain all these transmission lines.” So we’ve graphed this out and we think we’re losing revenue, we’re increasing our cost and it doesn’t look very good for us. Here’s a better business model, why don’t we own this. Why don’t we get behind distributed power, why don’t we push the state regulators to increase the number of all the distributed power? It’s also a much more resilient grid, you know, the United States Army does not believe the U.S. grid is resilient enough. They’re totally off the grid and, you know, and they’re working, they’re making JP-8 out of, you know, out of algae.

Greg Dalton: Jet fuel.

Andrew Behar: Jet fuel, sorry. So anyway, we proposed this to First Energy and they came back and said –

Greg Dalton: That’s an electric utility?

Andrew Behar: That’s a huge electric utility in Ohio and they came back and said, “This is very interesting. We’re going to work with you to write a report and to analyze this. So the utilities are really looking at their business plans. And that’s I think a critical turning point.

Greg Dalton: We’re talking about climate and invest and divest in fossil fuels at Climate One, I’m Greg Dalton. Our guests are we just heard from

Andrew Behar, CEO of As You Sow, a shareholder advocacy group. Also

Lisa Goldberg, Director of Research with Aperio Group and

Josh Schein, CEO of Global Key Advisers.

We haven’t talked yet about water, there’s also some water risk, some people think that climate impacts will be most direct water, either too much of it or too little of it. Andy Behar, are you engaging companies on water risk?

Andrew Behar: It’s one of the things that we talked with utilities about particularly there’s a lot of water that’s used in coal fire generation. And so we’re seeing that as just shareholders were seeing as a major risk point. And so we’re asking them for reports on their water, what they’re going to do about it, how they’re operating particularly in drought areas. Last summer, there were some examples where they had to shut down power plants because water was too hot and there wasn’t enough water. So they’re having to mix this into their analysis of how they’re going to make their business model work. So water is a big issue with utilities.

Lisa Goldberg: Absolutely. It’s one of the categories for the environmental innovators, there are five of them and this water is all by itself in that group. So I think it’s definitely important.

Greg Dalton: And what are the big risks, sort of big opportunities for innovation in water, is it –

Lisa Goldberg: Well, reusing water, just imagine in your own home. If you didn’t just push all water down the same pipe, you would be able to reuse some water say on your plants more efficiently. And so there’s a huge innovation opportunities for refitting homes and refitting businesses to use even the water, just as we’re doing it now more intelligently.

Greg Dalton: Andy Behar, you talked briefly earlier about shareholder advocacy and then we’re going to go to audience questions. But tell us about Anadarko and what happened there as well some other companies in terms of getting shareholder pressure to get fossil fuel companies to recognize some of the fossil balance sheet risk we’ve been talking about.

Andrew Behar: So we filed the same resolution that we filed with Exxon about carbon asset risk with Chevron, Hess, Consol and Anadarko. In the case of Anadarko, we got a very large vote, 30% vote. And just so you understand how shareholder votes work, they’re non-binding votes but it’s an indication to the board and to the management that shareholders are very concerned about risks. The SEC requires that you get 3% and we got 30%. So just – what’s – how you judge it. The reason we got such a good vote is I believe, we spent a lot of time talking to pension funds, to CalPERS, CalSTRS, New York City, New York State to some of the big unions. They’re all very concerned because it’s not so much – well it is the company itself, and they all own everything. So they own these companies, but the impact of climate across the whole portfolio like when you have a Hurricane Sandy, when you have a drought, when you have what happens in the Philippines, when you have all of the stuff combined, what they’re seeing is that it’s when you have $70 billion worth of damage to United States year after year after year and who’s going to pay for that. And it’s just – they see it as impact across their whole portfolio. So that was the signal they wanted to send to Anadarko is you guys really have to look at your business model.

There is deeper risk here than anybody is talking about. And it goes across the whole economy as well as within the oil and gas industry.

Greg Dalton: And what did Exxon Mobil say, that received a lot of headlines because of their previous role in funding, research, communications denying climate science. And for Exxon Mobil to say, yes, we’re going to acknowledge climate risk, that was a –

Andrew Behar: I’ll quote them. They said, “We are confident that none of our hydrocarbon reserves are now or will be ever become stranded.” What’s interesting is that that statement came out the same day as the IPCC 5 report came out. They came out, like basically within hour of each other. And the reason that Exxon said that they don’t see any risks is because they said, “We must uplift the poor and the impoverished and the vulnerable of the world through burning our fossil fuels.” And the IPCC 5 report which was reviewed by 830 scientists of every nation of the world looking at 10,000 peer reviewed studies said exactly the opposite. It said, those very people that Exxon says we’re going to uplift will become climate refugees, that they will – and I will quote the IPCC 5 that “there’s going to be death, injury, ill-health, disrupted livelihood, severe ill-health for large urban populations, breakdown of infrastructure, electricity, water supply and health.” And then they add that particularly for the least developed countries and vulnerable communities. So you have two very different visions of the world. You have Exxon’s that everything is all okay and we’re going to save the world with, you know, burning our oil and then you’ve got the rest of the world and all the scientists saying this is not going to happen that these very people are the ones going to be, who are going to be most affected and that we need to do something about it rapidly because business as usual is going to create havoc.

Greg Dalton: Let’s go to our audience questions. We’re talking at Climate One about climate and investment risk. Welcome to Climate One.

Male Participant: California has been using the Cap-and-Trade system for the last I believe year or two and and British Columbia province in Canada has taxed carbon for the last five years. And I’m wondering to the financial community what sort of approach from the government side is the most easy for markets to work with?

Greg Dalton: Policy and market going together.

Andrew Behar.

Andrew Behar: Well, I guess one of the things about the EPA’s announcement - while it was great to get an announcement –

Greg Dalton: This is about regulating coal fire emissions for the first time.

Andrew Behar: Right. And is that – well, first of all they based it on a standard, they said 30% but what they really mean is 15%. And so they just kind of dressed it up because they are actually not looking at today’s numbers. They’re looking at I believe it’s –

Greg Dalton: 2005 or 2007?

Andrew Behar: Yeah, 2005. So they kind of, you know, got a little bit better press than it deserved. And then they also, there’s a real I think problematic thing with that states can decide on how the Cap-and-Trade is going to be implemented. And so it would allow companies that are burning coal to continue to burn coal, they would be able to buy credits from, you know, some other entity and then probably be able to charge their rate payers to pay for those credits. So, you know, the people who are going to get hurt I believe are the people, the rate payers and that is not going to actually decrease the amount of carbon emissions. There’s a lot of loopholes but I’m very happy to see that there was something at least put out there because it’s been few and far between and –

Greg Dalton: A step forward. Welcome to Climate One.

Female Participant: Thank you. I worked with 350 Bay Area and a coalition of people from around the state that are advocating for divestment of California’s public institutions from the 200 largest fossil fuel companies, namely CalPERS, CalSTRS, and UC, and some of the people that we talked to say that it’s a better strategy to do shareholder engagement because then you can get the companies to change their business practices. I’m wondering if you can just comment on how you see divestment versus shareholder action for fossil fuel investments at this point.

Greg Dalton: Andrew Behar, you got to support both inside, outside?

Andrew Behar: Well, what’s interesting is that Bill McKibben’s response to the Exxon report is “Exxon has just stated exactly what I’ve always said. Exxon has now come out publicly and said that they are, you know, outside of the laws of physics,” I believe he said. And Wall Street looks at that really carefully when Exxon is over here and IPCC 5 is over here. And Exxon says, “No risk.” I think that with this does is it really helps Wall Street to look at Exxon and say, “Lots of risk. We need to really assess this.”

And so I think the shareholder advocacy and the engagement in getting that report is critical. And that’s why I think it received so much press, you know, there are like 300 press reports about this because Exxon had never even spoken about climate change at all. They were climate deniers and here they were now saying, “Okay, there is this risk and here is what we’re going to do about it.” So just having that conversation publicly I think is a huge step and I think it’s a real milestone.

Greg Dalton: We have to end it there. We’ve been talking about carbon and climate risk at Climate One. Our guests have been

Josh Schein, Senior Portfolio Manager formerly at Morgan Stanley,

Lisa Goldberg, Director of Research at Aperio Group and

Andrew Behar, CEO of As You Sow, an advocacy group. I’m Greg Dalton, thank you all for coming and listening to Climate One today.

[Applause]

[END]