Greg Dalton: Welcome everyone. It's great to see you here. I hope you enjoyed that video I think it’s neat that a former member of the president’s cabinet was plugging in my electric car, I think that was pretty cool. I'm Greg Dalton, and today on Climate One we're talking about powering innovation. California is leading the trend toward clean energy and away from fossil fuels that are destabilizing the weather and the economy. Prices for wind and solar electricity are dropping and entrepreneurs are conjuring up new companies and technologies that capitalize on this power shift. They’re chasing what could be the biggest business opportunity of this century. Over the next hour we will discuss disruptive technologies, the role of government, cool startups and new ways of powering our connected and mobile lives.

Joining our live audience at the Commonwealth Club in San Francisco, we’re pleased to have with us four guests.

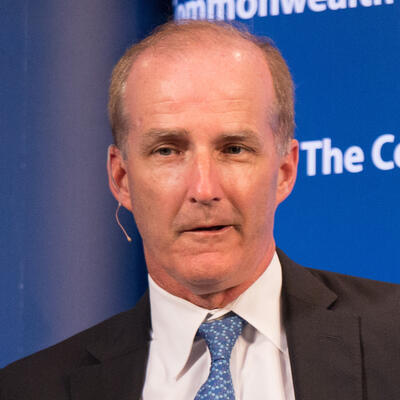

David Crane, CEO of NRG Energy a $10 billion company that operates power plants around the country.

Katie Fehrenbacher is reporter with GigaOm.

Adam Lowry is Co-Founder and Chief Greenskeeper with Method Products, maker of soaps and other cleaning supplies. And

Arun Majumdar, is Professor of Mechanical Engineering at Stanford, former Vice President for Energy at Google, and former head of the advance energy research program at the US Department of Energy. Please welcome them to Climate One.

[Applause]

Greg Dalton: Welcome. Thanks for coming.

David Crane, let’s begin with you. A lot of companies seek to be loved by their customers. Apple and Google have this deep, very emotional connection with their customers. Why don’t people have the same relationship with energy companies that empower those lives and all those cool applications and technologies? Where is that disconnect?

David Crane: Well, I think the answer to that question is on two levels. One is sort of a positive answer and a negative answer. On the positive, it’s hard to be loved when you’re providing energy for people. We have to recognize that energy enables other human behavior that people are interested in. But no one wakes up in the morning and says I can’t wait to turn that light on so that I can use electricity. So on the positive side, it’s hard to create an emotional connection with what’s an enabling function but on the sort of more negative side for a variety of reasons which I could bore you to death with.

The nature of the energy system in the United States is a command and control system where for the longest time people have had no choice of where their energy comes from. If it’s on the electricity side, historically it’s a state granted monopoly and the fact about monopoly is if your customers have been given to you and no one has a right to compete, you don’t really, you know, prioritize giving them what they want. But the last thing I would say and this is one of the things that makes the world we’re in so important today is that if you -- I mean I’m 55 years old. The defining events of my sort of formative years were the two oil crises of the 1970s. I know out in California there are CEOs of major corporations that are in their 20s and all that but in the energy industry almost every CEOs in their 50s or 60s.

And so, everyone’s like me and we grew up through our whole professional careers in the energy industry in an era of fundamental energy scarcity. And it’s been an article of faith in the American energy industry that whatever we can produce, the American public will consume. So we don’t have to stimulate demand, we don’t have to care, we just have to produce it. And for variety of reasons, the gas boom which is itself a little controversial, you know, the unconventional fracking, the dramatic reduction in the cost of renewable energy, we now actually live in the world of energy abundance. And when you have abundant supply, people should be able to make decisions about where they want their energy to come from. And so that’s why the energy industry has not spent a lot of time on becoming beloved with the American consumer.

Greg Dalton: Katie Fehrenbacher, what are some of the cool energy startups that are out there that might be more exciting and might change the way the people think about energy, make energy a little more cool and sexy?

Katie Fehrenbacher: Cool energy startups. Well, one in particular a very known this isn’t necessarily startup anymore is Tesla, obviously an electric car company, probably the sexiest company in energy, no offense to NRG.

[Laughter]

David Crane: No, it’s okay. As long as you didn’t say sexiest CEO, you know, that’s just [Laughter].

[Laughter]

[Laughter]

Katie Fehrenbacher: I’ve been writing about energy startups for about seven years now and Tesla is by far the biggest draw. And then there’s these other companies, internet companies that are moving into the energy space, kind of on the fringes. So Google buying Nest last year for -- or was it really this year for $3.2 billion, you know now Google has these energy assets and, you know, Apple building solar energy in North Carolina. Largest privately owned solar farm in the US I think it is. So some of these kind of bigger, cooler brands are paying a lot more attention to it.

Greg Dalton: Arun Majumdar, what do you think are some of the areas that the big innovations, what are some areas you think where innovation coming out of university or government could be really exciting and really change the way US powers its economy?

Arun Majumdar: How much time do you have? I think there’s a lot of stuff coming along. I was very fortunate to be at RPE and starting off RPE with my team out there and some of the members are here.

Greg Dalton: So that’s the US Department of Energy’s advance research program?

Arun Majumdar: That’s right, that’s right. And we got to see, you know, people throwing ideas at us. And the best new story is that there’s a tremendous capacity for the United States to innovate in technology and this is what we are focusing on. So things like storage, storage I think is a game changer. Especially if you are transitioning to renewable sources which are intermittent and if you could get storage out there at low cost, the cost is very important, I think that would be a game changer. And I think we saw some of these technologies that we invest in early stages, the private sector then picked it up.

And they are now -- many of these are now, you know, piloting some of these technologies overseas frankly because the need for storage overseas, many times is higher than out here because it’s unreliable electricity. But they will eventually be use out here, so I think that’s one of the big areas not just for electricity but for transportation. We are talking about Tesla, if the battery cost come down by a factor of two or three which could happen in the next, you know, 10 years or so. This is going to be a game changer, then you’ll have -- you won’t have a range anxiety because you can afford to put more batteries in there.

So storage I think is a big game changer and one thing that is often lost is heat storage. It’s much cheaper than electricity storage. So we are trying to combine heat and power massive opportunities of that as well. I think the other part is that and I think David has alluded to in the past as well our electricity system is in transition and how that system evolves from what it is today, to something which is much more automated, where you don’t have people making phone calls, but it happens. And that’s going to be and I think there’s a tremendous need for technology and there’s room for innovation out there. So I think those are the areas that we’re going to see.

Greg Dalton: So if you are remaking The Graduate in the 60s rather than plastics, you would say storage to Dustin Hoffman --

Greg Dalton: -- while he’s floating in the pool?

Arun Majumdar: Well, as far as plastics I think my dear friend is going to talk with some --

[Crosstalk]

Greg Dalton: I think soap is the answer.

Greg Dalton: Adam Lowry, you kind of -- you’d use energy, you’re trying to rethink and redesign the way corporations use plastic. You’ve made soap sexy which I’m not -- it’s quite a feat to do that.

Greg Dalton: Let’s have your take on this sort of as an innovative disruptor and industry trying to change it and move it in new directions.

Adam Lowry: Yeah, I think it’s probably worth noting to begin with I’m the only person on the panel that isn’t explicitly in the energy world.

But I do operate in probably -- there’s probably only one industry that move slower than the soap business and that’s the energy business.

[Laughter]

So at least maybe that we have in common but the role that -- my business is really dominated by very large international, you know, $90 billion companies and things like that. Really huge companies that don’t move particularly quickly and as an upstart within this business that’s now big enough to at least we’re established. Really the role we play is we’re an innovator and a challenger brand. And what that allows us to do is actually catalyze our competitors to actually follow our lead on a lot of things.

And so we do that with the way that we use plastics and materials and take toxic stuff out of cleaning products. But we’re now actually starting to get into the energy business as a -- we’re building a factory in the city of Chicago that’s going to generate its own power. And so we’re building utility-scale wind, lots of solar. And so it’s been an interesting experience from that side of the business to go through what it takes to actually try to generate your own power which is has been very interesting experience.

Greg Dalton: Illinois is coal country, any coal --

Greg Dalton: -- going into that factory?

Adam Lowry: Well, it’s grid-connected or will be grid-connected. It’s being built right now and it’ll be open in late December. But it’ll be grid-connected but we’ve got nearly a megawatt of capacity mostly in one utility-scale windmill and bunch of solar that will for a long time produce all the power we need.

Greg Dalton: David Crane, let’s talk about coal. Coal has been the primary source of electricity in the United States. It’s still is in China and many places, it’s the number one climate killer. What’s the future of coal?

David Crane: Well, I’m glad you asked that question. The -- and let me start by saying, I would have a gentle disagreement with Arun has said what’s the key -- my Dustin Hoffman in the pool moment would be capture carbon. Because whether we like it or not, we’re in a period where we have to go negative carbon. We have to take carbon out of the atmosphere at this point given where we are. And so, if you can solve for that problem, which is an engineering problem, you’ll be a billionaire. Which and I know there are a lot of billionaires out here, so that doesn’t impress people in the Bay Area but [Laughter] and there -- let me tell you, and the rest of the country say you could be a billionaire when you talk to an engineering student in Rochester, New York you say billionaire and, you know, it works.

So the future of coal and I would say, I expect there’d be a significant amount of disagreement with me on this. I think that if you think of about the United States’ two parallel energy delivery systems, one that sort of starts with which is all oil and goes through refineries and basically into the gasoline of your vehicle and then the other where it’s turning into electricity and goes into the stationary environment. The fundamental advantage we have is that we’re not mono fuel. We’re not dependent on oil and coal, natural gas, nuclear, wind, solar. We are a stronger country if we use all those fuels. So I fundamentally believe that coal should be part of the equation going forward in this country. Having said that, my goal and I, you know, for a full disclosure for people that don’t know our company, we own many coal plants.

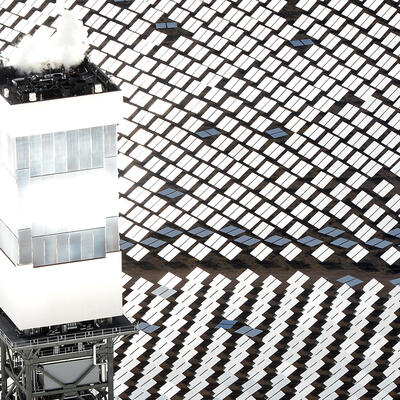

I don’t want to put carbon in the atmosphere. I want to use coal to make electricity, I just don’t want to put carbon in the atmosphere. So last week, we actually broke ground on what would be the largest post combustion carbon capture project in the world. A billion dollar project in Texas which will capture 1.6 million tons of carbon from the exhaust gas from the coal plant.

So we need post combustion carbon capture. You cannot solve the problem of climate change without affordable, post combustion carbon capture, because of this natural gas which you could actually envision a United States three years now that has no operating coal plants but you cannot envision a China or an India that does not have operating coal plants. And the average age of a coal plant in United States right now is 40 years old and whatever the EPA does, you know, plants live for about 60 years so they’re on the way out. The average age of a coal plant in China is 6 years old. And so the best thing, if you give me one wish, I would say that the United States deploy post combustion carbon capture technology at a price that the Chinese would adapt to make part of their system.

Greg Dalton: This is basically sort of a cigarette filter put under the smoke stock of coal plants to suck out the carbon. It’s very expensive billions of dollars have been thrown at it. Some people think it’s pie in the sky and will never happen.

David Crane: Yeah, I absolutely fundamentally don’t agree with that. I’ll go out on a limb and I’ll say the technology that’s going to prove that to be wrong is being develop right here in the Bay Area as we speak.

Arun Majumdar: Well, let me just add to that. Let me explain the severity of the problem. It’s actually worse than that.

David Crane: I thought it was pretty much a downer though.

[Laughter]

Greg Dalton: Good. Take us down --

Arun Majumdar: This goes back, this goes back to the industrial revolution. So if you look at the lifetime of a CO2 molecule in the atmosphere, it’s a few hundred years. Which means that the CO2 molecule that were emitted during the times of Watt steam engine are still there. And so the rate of emissions is going up linearly, the way we are going, India, China, United States or Brazil.

So if you all combine the global it’s going up linearly and we’re just emitting the CO2 and it’s like a big capacitor. So the rate is going up like this, the amount of CO2 atmosphere is going up non-linearly. So even if you do all the renewables today and flattened the emission rate, that means if you flattened it but that means next year we’re going to emit the same as this year, which is not true today. We’re emitting more and more as we go along. Even if we flattened it, the amount of CO2 still goes up linearly and that is a huge, huge problem.

So in addition to, so this is necessary CO2 capture, absolutely necessary. But it’s not sufficient to really address climate change because at some point, you got to scrub the atmosphere. And we really don’t have the science and the engineering to do it in a cost effective way. And we really need to invest in this R&D to really get that done.

Greg Dalton: So how far are we away -- many companies have pilot projects, Shell has a program up in the Tar Sands of Canada.

Arun Majumdar, how close are we today to having carbon capture, these filters on coal plants that are economical today that can be deployed to start bending those carbon curves?

Arun Majumdar: Well, I mean there’s a business side to it and David can explain that way better than I can. But if the cost of carbon capture is lower than the price of carbon CO2, then you have a business. And a few years ago, this used to be $80, $90 a ton for a coal-fired power plant. I don’t know what it is today, you may have the numbers better. But the price of CO2 depends, for example for enhanced oil recovery, it depends on where you are. It’s roughly in the order of $30, $40 you know a ton of CO2 that people would pay to do enhanced oil recovery.

That numbers may have changed I don’t know what the numbers are in your --

Greg Dalton: David Crane, are we close to -- it all depends on having a price on carbon which we don’t.

David Crane: Well, yeah, so I mean because that’s -- I mean people have to understand that the carbon capture problem is a two -- it has two critically important parts of it, you know, you have to capture the carbon at an affordable price. And we would say based on current technology, that’s about $40 to $50 a ton. But the second thing is then you have to figure out what to do with the carbon. And as long as there’s no price on carbon, the capitalist system, you know, I’m sure I’m as big a capitalist as anyone in this room, the capitalist system will not solve for something that does not have a price on it. So right now, the only way you can use capture carbon in volume and you can only do this in certain locations is to turn it into oil, you know, through carbon flooding of oil fields which I think it’s a good thing but, you know, it has its own environmental consequences.

So, the second part of the solution is turning carbon, either putting a price on carbon or turning carbon into something the society can use. You know a general area which at least you would know but I think that’s the area that’s called materialization. Can we embed carbon in building materials and road materials and things like that or put it and capture it in a way that it just doesn’t go in the atmosphere, but it has a price that the capitalist system.

Greg Dalton: There was a company called Calera a while ago, put a --

Greg Dalton: -- carbon into cement, carbon into this or that. Lot of those companies are very exciting for a little while then they go away, you don’t hear about them so much.

Katie Fehrenbacher, about on this in terms of these companies have great promise and yet they have trouble getting to scale, getting to market, panning out in the real world, they look great in the lab or the bathtub, not so great out in the real world.

Katie Fehrenbacher: Right. Well, sometimes it’s the technology, right, going from the lab to a commercial scale. But sometimes it’s the financing also, you know, there was a startup who moved to China who’s now commercializing its technology in China. Their name escapes me right now, yeah, but like there’s a lots of issues on the road from those little startups to get to commercialization.

I mean you guys are using internally built technology for carbon capture?

David Crane: No, it’s Japanese technology that comes out the chemical industry -- you mean for the actual capture process?

Greg Dalton: Let’s pick up on that in terms of what’s the role of the US government here? A lot of these technologies maybe developed overseas.

Arun Majumdar, is there a role for the United States government to push more on these technologies because we might lose an edge to China or India or Japan?

Arun Majumdar: Absolutely. I mean I think, you know, so -- what’s the role of the government is, you know, perennial question in Washington, right? And but I think this universally disagreement that in terms of research the R&D, where it is too risky for the private industry to initiate, not to pick up later on. It is absolutely critical, just to give you an idea, if I develop a new technology today for it to be fully scaled in the industry for industrial use, it can take anywhere from 10 to 20 years. And, you know, if I take or come up with the new battery chemistry today, and I -- if I want Tesla to adopt it, it’s going to take longer than how it -- where they can write a software and get it out on the internet, it takes longer.

And so for that length of time, you know, sometimes the industry is not willing to take the risk. And so the government has to play the role of the early stage, and not just going down existing learning curves and make lithium ion battery safe, or some other carbon capture using means better and better to make it cheaper. But also the disruptive technologies, the disruptive ones that could be even more -- even cheaper than what to today’s technology and better than today’s technology. So that’s really the goal -- role of the government in the R&D.

Then the question is what happens on the other side on the policy side, whether there should be a carbon price and all, and that’s where the controversy really starts. But I think in the R&D, there’s a general agreement that’s where the government has to play a role.

Greg Dalton: David Crane, everyone likes R&D but the question is whether tax payers are going to accept some risks. Solyndra didn’t turn out so well, although that overall loan program did pretty well for the government, some would say better than some venture capitalists, the government did some better than some VC funds in that. But taxpayers don’t like to invest in companies that go bust.

David Crane: Well, I mean I don’t know how taxpayers feel that but certainly the political opposition of the day likes to make a big deal of it. And, you know, our company is the single biggest recipient of the Department of Energy loan guarantee program. And you’re right, for all of you taxpayers out there, your money is safe with us because all of our loans will perform but --

Greg Dalton: How much you get paid back?

David Crane: Very little because the plants, you know, because of the lead time of plants, you know, the money that was dispensed in, you know, 2009 and 2010 the plants are just being finished. We just finished our solar -- $6 billion solar building program, most of which is all completely enabled. I mean, the Department of Energy loans have helped, but thankfully the state of California with your renewable portfolio standard is really the driving force. But I would say that, I mean if you dealt with the Department of Energy, and a journalist I think coined this phrase, Katie I don’t think it was you, that “Solyndra-phobia” --

David Crane: -- the minute the Department of Energy started getting beat overhead over what happened with Solyndra, it froze. And you just couldn’t get any, you know, it became very painful to deal with the DOE with the projects. Having said that, our carbon capture project that I just mentioned it’s a billion dollar project but its enabled very significantly by $170 million grant from the DOE.

At least $830 million from the private sector, which had its own challenges but, so the DOE is trying but the government in this current, you know, sort of toxic environment in Washington, it’s very hard to work with people where if they fail, they know they’re going to be in front of, you know, Darrell Issa’s committee, you know, sort of, you know, being accused of things for the next, you know, three years. So people get scared and you got to lose your fear of failure if we’re going to solve this problem because not everything we try is going to work.

Arun Majumdar: Yeah, so let me explain this. Solyndra, which is part of the loan guarantee program that you are referring to, is a late stage investment alone by the government. There’s a difference between something which is low risk, low technology risk that is ready for deployment as opposed to R&D. Where the research money, which is not in the order of hundreds of million dollars, but in a million dollars, sometimes even less, for research to invest in students and post docs in the universities or staff scientists in startup companies and large companies in the R&D to do the research. And I think it’ll be a huge mistake for the United States to mess with that because that is the engine, it’s like Norman Augustine once said that if you try to fly a plane, don’t remove the engine because that is the engine. If you try a light-weighted plane don’t remove the engine. And I think that’s where we need to separate of the two in terms of long guarantee versus R&D.

Greg Dalton: Isn’t it true that United States put a few billion dollars say into the solar sector and China put in $50 billion right? So they put in 10x to that and they’ve essentially cornered the global market now on solar panels. So

Arun Majumdar, what’s the risk of the US losing out to some of these state-run economies that can put more money into these new technologies that have more of an appetite for risks in less political messing around?

Arun Majumdar: Well, I think, you know, if you look at the Chinese investments. Yes, they’ve invested a lot of money. I would say that they have not been always the most thoughtful ones. And some of them of course you luck out. And in fact the Chinese solar industry also went through some really tough times as well, it’s just the global market where -- and there was a block because of what’s happened in Germany and Spain et cetera.

So I think, you know, I would really like to see the markets play. The government has a role to play in the late stage. If you are, you know, building a first of a kind, you know, carbon capture plant or for example a nuclear plant after 30 years. The government has to play some role in it but at some point the market has to play a role. And I think it’s important for creating the policies for not just private capital but public capital to come into the market. So that, you know, there’s, you know, there are market forces at play.

Greg Dalton: If you are just joining us,

Arun Majumdar is professor of the mechanical engineering at Stanford. Other guests here today at Climate One,

Adam Lowry, Co-Founder and Chief Greenskeeper at Method Products.

David Crane, CEO of NRG Energy and

Katie Fehrenbacher, Reporter for GigaOm. I’m Greg Dalton.

Adam Lowry, let’s get your get on here on innovation, does it always require government subsidy, I don’t know if you’ve received any government subsidies or not to try to --

[Laughter]

Greg Dalton: -- just okay. So it’s not always required but it probably helps to--

Adam Lowry: Yeah, certainly I agree with the points they made on. The core need for research and the role that government can play there I think that there are also ways of innovating from the other side of course. And we see that in all sorts of sectors and certainly with our business we’re trying to do that around, you know, I used to very much be in the climate change world. I was a climate scientist 15 years ago, and helped to develop models that helped us to understand what’s really going on. And one of the reasons that I became an entrepreneur is because I wanted to get all of that -- all the people in society that aren’t particularly informed or concerned about climate change, in the movement somehow.

And so what we chose to do with our business Method was to really try to make relevant to a mainstream audience a product that’s very mundane, a bathroom cleaner or a bottle of dish soap. Make it as you said a little bit sexier than it had been. But really build from all of the elements of its sustainability, whether that’s the energy was used to produce it or the chemistry that’s in it or what the bottles made out of. As just part of the quality of that product so that people could just love it for what it was. They could love it if it was purple and they had a purple bathroom or because they love the fragrance. Which alone would be something that would just be perhaps shallow but combined with a deep sustainable sensibility in the product design and all the innovation that’s required to get that done, starts to get more and more people that are on the spectrum between don’t care at all and mildly concerned about climate change.

Maybe not to think about climate change but just in their daily lives they start to integrate this. The reason that we chose to do it in the consumer sector is for a lot of the reasons that David highlighted which is, there is tremendous power that comes through.

We’re one of the smallest brands in the cleaning business, but our brand carries a lot of weight. And with that, we can carry a message both for our consumers who buy our products as well as for our competitors that we compete against and the way that we try to hold their kind of status quo-ness against them in the market.

Greg Dalton: David Crane, speaking about the role of businesses and business leaders. You wrote a letter to shareholders that was quite emotional, quite different than most CEO letters, tell us what the letter said and why you wrote it, what you hoped the impact would be?

David Crane: Well, if you get -- I mean I’ve been a CEO for a public company for 11 years. And there’s this formula that goes into shareholder letter that’s part of the SCC filing which is, you know, you sort of talk a bit about all the great things that your company did over the last 12 months. You try and sort of gloss over any stumbles you had unless it was such a bad stumble that you have to address it head on. And then you sort of say, you know, I’m completely myself, the management team, all the employees of the company are completely aligned with your interests and we’ll have a great year next year.

Greg Dalton: It’s probably the algorithm that writes those --

David Crane: That’s right. I don’t know where the first drafts come from but every year it sounds the same and I look at that and, you know, after 10 years and, you know, I’m not the first to try and actually use the letter for a greater purpose. I think Jeff Bezos I think that his 1998 letter with Amazon where he said look, our shareholders deserve to know where we stand as a company. And so we had the idea that, you know, we should talk about where NRG stands and if there’s one thing that you remember about my view of the world right now is, you know, it’s time to take a stand right now on this issue. Whether you’re a public corporation, for profit, a not for profit, a member, you know, a thought leader in society, the time is now.

You know, the science is beyond dispute. The excuse that we don’t have the technology is just not true anymore, we have the technology. And across the business world and maybe think, I think we are starting to see a series of leaders in very large companies much more powerful than ours, than mine, that really believe this not only because they want to position their company in a particular place, but this is what they want their personal legacy to be is a commitment to sustainability.

And for me, I mean that sort of how I feel so I wrote the letter and I said -- and I was really because the employees read the letter more than your shareholders. I was really trying to motivate the 10,500 people that work at NRG is that, yeah, you know, we’re trying to make money all that, but we’re basically trying to, you know, save the world. I mean what does NRG stand for, yeah, we want to save the world. Who wants to come to work and save the world? And --

Greg Dalton: Versus be part of the problem --

David Crane: Yeah, well that’s the thing. I mean if you ask me the electricity industry in the context of climate change, I would say in, you know, elevator speech, we are currently the biggest part of the problem but we are an even bigger part of the solution.

Because if electricity can make itself zero carbon, then we can turn and solve the transportation industry and we can solve the industry. And then all we need is someone doing agriculture and deforestation and we’re done.

[Laughter]

And --

Greg Dalton: Simple as that.

David Crane: Yeah, it’s a simple formula. So, you know, I want to position us as a leader but the other aspect the part that gets emotional as a father of five and, you know, wrote another letter today to university students is, this is very much an intergenerational issue. And when I think about my generation of American leadership and sort of say did we solve the defining issue of our time the way virtually every other American generation succeeded at the defining issue of their time.

And I would say, we haven’t done that. We not only haven’t done, we haven’t actually made a good start on it so that the next generation, you know, can solve the issue. And so, you know, part of it is to say, look Americans will spend an endless amount of money to educate their children to the highest, you know, the best education that money can buy, if Americans can afford they’ll send their kids to the school. But, you know, when it comes to -- well, if you care about your child’s education so that 30 years from now your child has a great life, don’t you think we should equally be a steward of what the world is going to be like, you know, in the year 2050. So the letter I tried to frame is like we owe our children this and to try and like make it resonate with what I’m assuming that I’m going to feel like when I’m sort of sitting there in my, you know, in my declining years. And I don’t want my children come to you and say, “You know dad, you were in a position to do something and you didn’t do anything, you know, why?” and --

Greg Dalton: The day of reckoning. How many other CEOs, what’s been the response? Are there any CEOs at the golf club say, “Yeah, David shouldn’t have wrote that, you know.”

David Crane: Well, I’m actually been shocked and maybe and this is always of course the problem that the environmental movement has is that we all just talk to each other. And CEOs who are really on the progressive side of this issue tend to talk to each other. And I’ve been surprised at the number of CEOs that have read it. And say, you know, “I really, you know, your letter really resonated with me because I’ve never read the annual shareholder letter of any other companies”

[Laughter]

Because, you know, because I know the formula and I could recite it without -- anyway, but so -- but no, so it had a very good impact I mean it had the desired, you know, impact.

Greg Dalton: But do investors care, Wall Street just wants quarterly earnings, compounded quarterly earnings that’s nice. I’ve had Dan Hesse, former chairman of Sprint here.

He would bring up green sustainability on analysts calls, they don’t give a hoot, they just want to know that nobody --

David Crane: Well, I mean I actually think in my -- I was saying to you earlier I probably in my 10 years done a thousand investor meetings. And you’re right to a certain degree but one of the things interesting happening in investor relations after the financial crisis of 2009 which was, if you have good news about the company’s future, investors want to know that you’re going to realize on that good news within the next three months or else they’re not going to give you any value for it. If you have potential bad news, they don’t care if it’s 40 years in the future, they’re going to abuse you about it. So actually for the most part as a company that, you know, makes a lot of electricity and emits a lot of carbon associated with this. Investors are concerned about the risk but not from some sort of, you know, social virtue point of view but from a -- well, you know, you’re going to get shut down or you’re going to have to spend so much money on the back end of your coal plant and said I’ve got to assume that you’re going to spend, you know, $5 billion and we have to work that into the models. So I actually have got a fair amount of support from our big investors for attacking this way, sometimes they think I overdo do it and then I have to, you know, sort of calm down a little bit. But for the most part, investors do see it in dollar and cents terms but they, you know, they see, the most important thing is that they see that the societal trend is towards being going green.

And companies they try and sort of stand and stop societal trends get swamped. So, you know, you better get, you know, you better get on the bus or the bus is going to run you over.

Adam Lowry: I think it’s also really important just to speak their language. I take a couple of examples from the Method business. One, that costs us money and one that saves us money but both framed in the right ways not under the light of an analyst in a public company because Method is a private company, but we have investors nonetheless that want to make sure we’re doing the right thing.

Two very brief examples, we use some secondary biodiesel to do shipping of our products which is actually the largest part of our carbon footprint. And that’s actually cheaper than regular diesel and we save money on that and that was investment we had to make but we now, it’s -- we now save money on every gallon of diesel. And so that’s really easy right, you save money, sustainable, you know, go for it. But another interesting example, we make all of our bottles out of 100% post-consumer material instead of virgin plastic.

And in 2011, when we saw a real big spike in oil prices not surprisingly recycled plastic doesn’t have nearly the carbon footprint of a virgin plastic. And while it still remained more expensive, the cost curves almost crossed and so we’re able to demonstrate to our investors, “Hey, we are insulating ourselves against commodity cost risk in a business that doesn’t, you know, the soap business isn’t a lot of margining. So all soap businesses are very exposed to commodity cost risk. And so if you can frame it in those ways, I think it’s a much easier sell than trying to say even though it maybe motivating to the employees that you are saving the world or whatever it is that motivates them, you just have to speak their language.

Greg Dalton: Let’s talk a little bit about solar panels and electric cars which was some of the most accessible way that individuals and consumers can get in on this.

Arun Majumdar, tell us about the slope of the price curve for solar and where that’s going and how that might impact adoption of solar technology, rooftop solar in particular?

Arun Majumdar: Well, before I do that can I just say that I hope every CEO in this country has the same conviction that David has. And not just conviction but the guts to actually say it and really put the -- put your reputation on the line, so we really appreciate what you’re doing David.

[Applause]

Arun Majumdar: And you know, you’re absolutely right this is an transgenerational issue, it takes time. And I can, you know, I have two daughters who are in their, you know, one is 18 the other is 21. And I remember when they were growing up, if I was a minute late in putting their seat belt, they would, you know, they would ding me. And I think that, I don’t think that was the case 30 years ago. And it’s really important to bring the younger generation into this mix. And the good news, which is not often talked about, is that every university around the country and I’ve gone to many places while I was in Washington. I used to take a trip to the south all over the country and spend an hour with the students.

And every, almost every university has an energy club or sustainability club whatever they call it. And they have a club of clubs and that’s one of the most positive things that has happened around this country. And in fact in RPE we used to have an annual summit, we used to make a point to figure out to raise money to bring these students into Washington and to attend the summit to see what’s going on. So that they would go and educate their, you know, peers and friends that this is what’s going on in Washington, around the country.

So I just want to make that point that it’s really important that we get the people involved in this and especially the younger generation. You asked me something about --

Greg Dalton: Let’s stay on this. Do they feel betrayed by the baby boom generation which was going to change the world and bring peace in the 60s and ended up kind of trashing the planet?

Arun Majumdar: I don’t think -- frankly, from what I have interacted with them, I don’t think they really care. What they really care about is that can we solve this problem? And can we do something about it?

And I’m not sure how much -- I hope my kids don’t find out what I was doing in the 60s, 70s [Laughter] I really hope so. But I think they care about what’s going to be in the future. And I think that’s the most important thing. And they do care about how to get others thinking and they realized it’s a global issue, it’s not just a United States issue. And I think you can get kids really excited about the fact that they can leave a legacy and leave a dent in this universe, as Steve Jobs used to say, by doing something about not just for the United States but for the rest of the world because there are one and a half billion people that don’t have access to electricity today. And there’s another one and a half billion who have marginal access to electricity. Now do you really want them to get electricity from the Tesla Edison grid that we have out here or should they leapfrog and really get clean electricity? And I think that’s an opportunity that I find the kids really excited about.

Greg Dalton: This intergenerational issue, I don’t know if you’re the youngest person up here maybe.

David Crane: You guys they’re now looking at you alright.

Greg Dalton: In terms of that perspective on Arun was just saying in terms of that seeing the opportunity, not worrying so much about blame but let’s just get on with this, this is our future we can build it.

Katie Fehrenbacher: I completely agree. And even in the startup entrepreneur Silicon Valley world, you see a lot of the youngest entrepreneurs really excited about trying to change the energy space. It’s an extremely difficult area to launch a company and startup in, but and some of these just kind of fresh out of school kids who are really excited about, you know, if they’re on the science space trying to build the types of batteries or, you know, if they’re in the internet social media space trying to build more sustainable brands, I completely agree.

And I think your letter is particularly interesting, kind of acknowledging from just a branding perspective that energy company should create these sustainable brands.

You know, and your student letter and your investor letter really are recruiting tools for the next generation. So it is a smart business strategy I think.

Greg Dalton: Let’s talk a little bit about before we go to audience questions. Your own personal carbon footprint,

David Crane, does your private jet fly on biofuels or, you know, let’s talk about what you’re each doing in your own life for your carbon footprint?

David Crane: You know, it’s a very interesting question and I’ve got colleagues out here are going to cringe at my answer so I just get prepared. But, you know, my view and I think the first time I heard sort of like taking a climate activist personal lifestyle and sort of, you know, criticizing them for not practicing what they preach was when people started criticizing Al Gore for the fact that he had a big house in Tennessee and he use a lot of electricity and all that stuff in.

You know, in my view is like what there are very few people on this earth that have the right to throw stones with it comes to their personal behavior. Because we’re all using electricity and you can buy renewable energy and that’s great but one way or another in society right now the way its set up, you’re benefiting from fossil fuels. You’d have to be a hermit in a cave in the United States to not be benefiting from fossil fuels. So why don’t we get past that issue, you know, my view as a company is that we are trying to do sustainable things and sort of focus on our employees’ lifestyle program and all. But when you’re emitting 70 million tons of carbon a year out of your smoke stocks, as NRG has been for a long period of time. Our biggest issue is, you know, yeah, okay bike to work but let’s figure out how we stop emitting 70 million tons of carbon. You know, that’s the biggest thing that our company can do and that I can do as a society. But I will say for the record that NRG does not have a corporate plane and, you know, my corporate plane is row 36 on United Airlines.

I was going to say Continental Airlines but, you know, there have been changes in the airline industry. So but --

Katie Fehrenbacher: In my personal life I think I’m pretty good. I don’t think it’s necessarily because I’ve made a lot of sustainable choices, but just that I’m an urban living person. I live in an apartment, I don’t own a car. I bike to work because my office happens to be within 15 minutes. And I think more and more people are going vegetarian, so my footprint is pretty good I think flying is my worst trait for sure.

Arun Majumdar: Well, this is I get dinged by my kids again on this because, you know, if I leave the lights on for a little while, my kids tell me “Hey, you’re supposed to be the energy guy, why the heck are you keeping the lights on?” So, but, you know, so one of the things we did in our home, we have a house in Orinda which is right across in the other side of the hills, we painted our roof white and we call it the White House.

[Laughter]

And the interesting thing I mean there’s a lot of carbon implications of that but it frankly it’s just cooler. So in the heat of summer, we don’t have to turn on our AC. And that turned out to be a great thing and, you know, so that’s, you know.

Greg Dalton: So simple right. It doesn’t -- it can’t cost very much and yet somehow were attached to the look or the convention of these power and gravel roots.

Adam Lowry, you’re a sailor ,what else do you do to live a clean lifestyle?

Adam Lowry: Well, I probably fit all of the disgusting Northern California stereotype so [Laughter] I’ve got a house with solar panels on the roof and I have an electric car and that I don’t drive very much because I bike to work and eat mostly vegetarian and all of the things that are popular in Northern California. But I think more importantly, you know, I think it’s important to take the opportunity to say that the most powerful changes are the things that people choose to do in their own lives.

And the choices that I personally have made in my own life are -- don’t matter. And what matters is what each individual is going to do in the choices that they are making that are the things that just become normal within their daily lives. And those are different for every type of person all throughout the country, all throughout the world. And I think that we’ll have succeeded when we get to a place where it becomes normal but not the exception to do things like, you know, some of the things that we mentioned today.

Greg Dalton: Generation ago, we threw -- lot of was common to throw trash out the window, driving down the highway until that famous ad with the Indian and the tier and that became socially anathema and now we aren’t wearing seatbelts either and now most people don’t think about doing that, there’s a financial cost to doing so. And that became a new social norm the way that some of these other things are becoming gradually starting here in San Francisco with lifestyle, et cetera, culture is very powerful in support of policy. Let’s go to our audience questions, we’re going to invite your participation right here going up to this microphone. You can go to the microphone right here if you’re on this side, please go over -- through those doors, we invite you to join us with one one-part question or comment and I’m here to help you keep it short if you need some help. And we’ll get as many as we can and we got 15 minutes left, and we’ll get through as many questions as you can. You’re welcome to identify yourself and step right up to the microphone.

We’re talking about energy empowering American economy today at Climate One. Our guests were

David Crane, CEO of NRG Energy.

Katie Fehrenbacher, reporter with GigaOm.

Adam Lowry with Method Products and

Arun Majumdar, Professor of Mechanical Engineering at Stanford, I’m Greg Dalton. Let’s have our first audience question welcome.

Male Participant: Thank you. This is for David. David, what place of heart do you tap into for that emotional strength and moral imagination to do things that will be an imaginable for Fortune 250 CEOs?

And how difficult was your coming out journey like and [Laughter] how do you see and what can we do as a society to help other CEOs to come out of the closet too?

[Laughter]

Greg Dalton: You didn’t know you were going to come out in San Francisco did you?

[Laughter]

David Crane: No, no. Although it’s interesting I mean, this does not answer your question but since you sort of, you know, sort of gay -- being gay like I have a son, my oldest son is gay and he -- I just have to brag out he became the first openly gay person to climb the seven summits. And so I could say, you know, it’s for him and my other four children but one of the things that are... actually, sticking with the gay thing for a second. One thing that I find very interesting and you may not notice this in Northern California is what’s happened in the gay marriage movement over the last 10 years is what we need to have happen in climate change.

If you think about the, you know, it’s widely believed that John Kerry lost the 2004 election because he refused to come out against gay marriage and he lost Ohio in 2004 because of it. And he lost Ohio, he lost the election. And in 10 years’ time, gay marriage has been -- has expanded from being supported by innovators and early adopters, to being supported by during the Vietnam War we used to call the silent majority. That’s the exact same thing we have to have. Right now, if you put yourself in, you know, Simon Sinek’s, you know, early adopter, innovator category what we need to do is, we got 15% of the population, there’s 15% of the population that will never get the laggers.

We have to win the silent majority. And if I could figure out how in 10 years’ time the gay marriage movement caught, you know, middle America then we would win this climate change thing. So I think about that all the time. To your question, it’s no personal courage at all for my perspective. I mean, you know, I’m an American Fortune 250 CEO, I’m paid a lot of money. The worst thing that could happen to me is that they fire me and if they fired me, they would have to pay me even more money. [Laughter]. So there’s no personal courage in this at all on my part I’m just calling them like I see them. And, you know, I wish there were other parts of society -- I wish the financial institutions would get in, in there. But, you know, they don’t want to antagonize people on the other side of this issue, but every day there are less and less people in the corporate world on the other side of this issue. And I think two -- and I promise to be quiet after this.

I think two things happened in April of this year that were not given a lot of significance that I think in the corporate world were very important on this issue. One, Exxon Mobil finally came out and said it’s happening, it’s caused by humans and the time to do something about it is now. And, you know, those words from any other normal person would have been, you know, just, you know, obvious but coming from Exxon Mobil that was huge. The second thing was Amazon was picketed because they had the audacity to use system grid-based power in their data centers unlike, you know, Google, Facebook, Apple who are trying to create all green data centers. Amazon is just like man, you know, I just want a data center I’m going to buy power from the grid and people got antagonized by that.

And to me, that set the mark that if you want to be a leader in the 21st Century, you got to do better than just what’s average. You’ve got to be, you know, truly green. And I think those two events had a ripple effect and I actually think corporate America maybe for the first time in history can be a leader in this -- a leader in this social movement.

And it’ll be by choice and it won’t take all that much courage because it’s the right thing for the people we serve.

[Applause]

Sorry there are no short answers.

Greg Dalton: David Crane, CEO of NRG Energy. I actually think there’s little more courage in there to go outside the tribe, stretch a little further the club. You are on the leading edge of that.

David Crane: I don’t know if you’ve been on a CEO cocktail parties but they’re really boring [Laughter]. So the fact that I don’t get invited to them anymore is not [Laughter].

Greg Dalton: Let’s have our next audience question. Welcome to Climate One.

Female Participant: Thank you. I want to start by saying that I’m not American. I come from a place where we don’t have running water or electricity all the time. So the first time that I came here is a shock. I need to tell all of you that it’s not necessary to keep the water running while you’re brushing your teeth or soaping the dishes or soaping your body, it’s not necessary. But my question is, you mentioned for example the youth and the new generations and all these things but the people in congress are not young now and they stay there for 50 years. And the US is the only country in the world that hasn’t ratified the Kyoto Protocol many of you mentioned China because you see China as the most polluting but actually the US is the most polluting in the world per capita. So just so you know, that’s not the question.

Greg Dalton: So the question is about?

Female Participant: The question is, is it time to use safe nuclear or when is the time when you are going to have fracking without harming pollutants or would you just focus on solar or something else?

Greg Dalton: Thank you for that question. I think it’s a question about the political process and then the nuclear is a whole thing into itself.

David Crane, you know some politicians, what do you think about policy leadership, a breakthrough in Washington?

David Crane: Well this where -- and I’m a real pessimist about public policy on certainly on the national level, states and municipalities will lead.

But I mean, you know, this is where the gay rights movement again, I think provides us a marker. Right now, it’s one middle America but if you try to pass anything through congress that serve was supportive of gay rights, you’d get nowhere. Because it would never get out of the House of Representatives and that sort of how I feel, we can’t rely on the politicians in Washington to solve this problem. It’s going to be bottoms up, you know, Arun said we need a movement, a youth led movement.

The politicians will lead from behind on this certainly at the Federal level. And I should say, let me just answer the nuclear power question because if California wants to be against nuclear power, I get it. I mean I don’t think we need to build nuclear power plants on fault lines and things like that. But I think nuclear globally is one of the great weapons in the fight against climate change. Having said that, after Fukushima I’m a realist, I’m a business guy, you know, nuclear is dead in this country. It’s dead in Japan, it’s dead in France and those are the three main. So maybe it comes back but, you know, it’s not a tool in the tool chest for this country at this point because it would take a government involvement that you’ll get neither from a Democrats who at best are lukewarm on nuclear. And the Republicans who don’t believe that the government should ever get involved in the private sector. And so I think that nuclear is not going to happen in this country, you know, for the rest of my business life.

Greg Dalton: Next question, welcome to Climate One.

Male Participant: Oh yeah, this question is for Mr. Crane. As you know, I work for a distributor generation based on an energy company here in the Bay Area and a lot of our projects live and die based on levelized cost of electricity. And there’s a lot of push to try to keep driving down the cost curve. But there’s also, doesn’t seem like it’s much of a push to make fossil fuel based electricity reflect their actual impact.

If you could tomorrow, wave a wand what three things would you do to make the true cost of fossil based fuels reflected in the market or if you think my premise isn’t really valid, what would you do to it to better incentivize renewables and distribute generation besides extending the ITC?

Greg Dalton: So we have a few minutes left. You have a magic wand

David Crane.

David Crane: Well, I think it’s a non -- I don’t deny the premise of your question but I think it’s non-startup. The status quo energy industry and the benefits they get mainly at the federal level, you will never shake those. I mean they exist to protect those and you won’t so I think it’s a futile effort. I think the best thing we could do is to get the co -- and you asked this question actually earlier. You wanted to ask this question, we just have to beat the cost as it is and rely on the fact that it’s a status quo energy and it’s pretty greedy. So we just have to get the cost of renewables down and, you know, right now a solar panel bought by us wholesale is 70 cents a watt. Installed cost in California, elsewhere it’s roughly around 350 a watt. That delta is a ripe target and that’s one of the things about the capitalist system, it’s all inefficiencies in the system balance of plan and all that. And so it’s getting that levelized cost down to the point, if we get the all-in cost of distributed solar down to the 225 to 250, it will beat the retail price of electricity in something like 47 states and at that point, you know, we win.

Greg Dalton: Welcome to Climate One. Yes, audience question.

Female Participant: Thank you. And thank you for this wonderful discussion, it’s been very stimulating. So each of you how do we make conservation of water or energy or food sexy for the American public?

Greg Dalton: Adam Lowry, you are our sexy guy up here.

Adam Lowry: Wow. [Laughter]. So we got to bring sexy back is what you’re saying. That’s right.

Greg Dalton: It’s ratings week here at Climate One, yeah.

[Laughter]

Adam Lowry: I’ll give a general answer which is that I think what we’re talking about here is that we’ve got to make it appealing for reasons other than just its quality as a sustainable solution. And Method’s done that in the soap business, but your question is right in that it implies you can do it anywhere. So whether that’s conservation of an area of land or of an endangered species or of water whatever it might be. The answer lies in what that thing that you’re trying to conserve in your question provides us other than just why we should save it just because it needs saving.

And, you know, for issues of water that could be all of the ways that we benefit from that from, you know, in traditional conservation there’s tons of reasons that people are learning about, about how the human connection with nature and how that adds quality to our lives and things like that that are, I think the secrets lie in those niches rather than trying to do what the environmental industry has done so unsuccessfully for decades which is to convince people that we need to do the green thing for sustainability reasons.

Katie Fehrenbacher: Yeah, I mean there’s a lot of tech startups in the Bay Area in the US that are trying to create new ways and services to make energy efficiency in different types of conservation sexy, but it’s a really difficult problem. You know, there’s -- we’re talking about Google buying Nest earlier this year and, you know, Nest made a sexy thermostat.

So that’s one example and I think if you’re looking at from that perspective, it’s companies and entrepreneurs looking at ways to design intelligently designed systems and products in an emotionally well designed way to make these things sexy and make the brands interesting. So I’m not sure we’ve really hit on it other than maybe the Nest thermostat or the Tesla electric car but and that’s not really conservation. But I think that there are companies that are trying this and I think that more will emerge successfully.

Greg Dalton: We’ll go to the very end here. But David Crane, most electric utilities don't want their customers to save because they’ll make less money. At least some of them, right? So quickly on that, is there a financial disincentive for conservation in the electrical system?

David Crane: In various regulated environments, they’ve tried the megawatt thing to pay people not to use or to disconnect consumption from charging and all that. So it’s possible but I just think that we have to keep in mind that I don’t think we can --

Greg Dalton: Can you use this one. I think your battery might have gone out. We’re conserving energy but yeah, your battery went out.

[Laughter]

David Crane: I just -- I think conservation is great but I don’t think we can conserve our way out of this problem when we’re talking about 80% reduction in carbon by 2050. And we have a whole society, a generation that, I mean our economy, our whole life is based on consumers. And maybe this next generation will be the post-consumer society but we are the consumer society and every business is trying to stimulate demand. Every, you know, if you think of the energy that is going in to trying to get you to buy something that you don’t need [Laughter]. I mean that to me is a very multi-generational challenge is to create a world that’s not based on the materialism at our work because the corporate world is geared up to sell stuff and it all has a carbon footprint.

So conservation is great but I think it’s, you know, there are other -- we need non-linear changes in some other things to enable the current lifestyle so.

Greg Dalton: We got less than one minute left. Let’s get a quick question and quick answer.

Female Participant: For all panelists, when will the U.S. get a price on carbon and in what form?

Arun Majumdar: Well California has it. And once it happens in California, it will happen to the rest of the country.

[Applause]

I mean I think we will be living in a carbon constraint world. And it’s a matter of time again, it’s a political issue, all politics is local. We really need to get the local folks energized about this and I think that’s when you get a change if you ask me when, I can’t answer that question, sorry.

Greg Dalton: We have to wrap it up there. Our thanks to

Arun Majumdar, Professor of Mechanical Engineering at Stanford.

Adam Lowry, with Method Products.

Katie Fehrenbacher, reporter with GigaOm and

David Crane, CEO of NRG Energy. I’m Greg Dalton. You can listen to a podcast of this and other Climate One programs for free in the iTunes store. Thank you to our audience here at the Commonwealth Club and listening on the radio and podcast. Thank you all for coming and listening today.

[Applause]

[END]