Drilling in the Amazon and Arctic

Guests

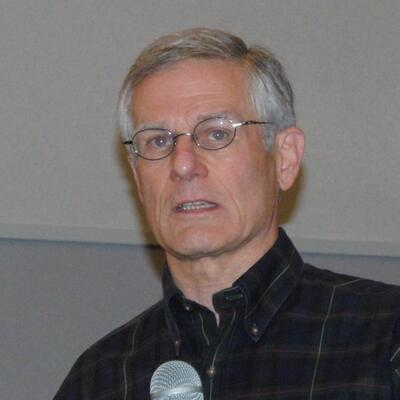

Lou Allstadt

Danielle Fugere

René Ortiz

Leila Salazar-Lopez

Summary

Big Oil spends billions to squeeze fossil fuel from every nook and cranny of the globe. But is drilling in the Arctic and Amazon as profitable as they’d hoped?

Lou Allstadt, Former Executive Vice President, Mobil Oil

Danielle Fugere, President, As You Sow

René Ortiz, Former Ecuador Oil Minister; Former OPEC Secretary General

Leila Salazar-Lopez, Executive Director, Amazon Watch

Full Transcript

Greg Dalton: The world is awash in cheap, dirty oil that runs our economy. Today on Climate One we’re talking about petroleum exploration in the Arctic and Amazon and what lies ahead for oil companies and investors. I’m Greg Dalton and my guests today include ardent advocate and oil industry veterans. Over the next hour, we will discuss the future of oil in the era of rising temperatures and falling gasoline prices. Along the way, we’ll include questions from our live audience at the Commonwealth Club in San Francisco. Lou Allstadt is a former executive vice president of Mobil Oil Company who now advocates for a move away from fossil fuels. Danielle Fugere is president of As You Sow, a shareholder advocacy group. She is sitting in for Andy Behar today. Leila Salazar-Lopez is executive director of the environmental group Amazon Watch. And René Ortiz is a former oil minister for Ecuador and a former secretary general of OPEC. Please welcome them to Climate One.

[Applause]

Greg Dalton: Lou Allstadt. I’d like to begin with you.

Shell made headlines recently by pulling out of the Arctic after what, $6 or $7 billion? You spent 30 years looking for oil for Mobil. Tell us what you - when you read that, what did you see?

Louis Allstadt: A lot of mistakes. There were warning signs early. They had problems in the previous drilling season. A couple of problems with rigs. And then they obviously picked the wrong spot to drill when they finally start the drill and hit a dry hole. So that money is pretty well shot, and I think it is probably going to push back drilling in the Arctic for 5 or 10 years. People are going to think really hard if a company that is as good as Shell is, they’re pretty good at what they do. They’re very good at what they do. If they can blow it that badly, I think it’s going to push things back a number of years.

Greg Dalton: Was it low oil prices, regulation, you know, kayakers in Seattle? How do they play a role?

Louis Allstadt: Short-term low oil prices I think, had nothing to do with it. These things are long-term projects. They have to be based on long-term view of what oil prices would be and whether they would bear the cost, but the costs there are very, very high. And I think with the problems that they had, people are going to be thinking that the costs are even higher. So that’s the big problem. I think the kayakers in Seattle probably got a lot of attention. It probably upped the ante, and I think that kind of activism does up the ante for companies in talking to their shareholders and their boards of directors.

Greg Dalton: Danielle Fugere. The stock price of oil companies is largely based on their ability to find new oil, replace today what’s burned yesterday. So tell us your take on the Arctic, I mean really those companies are just going to find it somewhere else, aren’t they?

Danielle Fugere: Well, that’s the question that we as shareholders ask companies -.what is the cost of the next barrel of oil? And what we’re finding and what we see is that the next barrel of oil is more costly. And when you have to go to forefront regions like the Arctic or deep sea or even shale oil, the costs are increasing. And so we’re asking companies – does it make sense to invest the next dollar in this type of high cost, high carbon resources in a world that 80% of the oil or the fossil fuels needs to stay underground? And so that’s the question that shareholders ask of the companies. What make sense in these circumstances as global warming emerges as an increasingly likely policy scenario in terms of taking action? Should the companies be investing their money there? So those are some of the questions that we are asking companies and should they be drilling in the Arctic? That’s a very important question.

Greg Dalton: René Ortiz, there have been some retreats in Ecuador, your country where Shell went in and planned to do some things and they retreated, but those companies can either come back later or find it somewhere else. The environmentalist might take a short-term victory for this, but the world is still addicted to oil and they’re going to get it somewhere.

René Ortiz: Yes, in fact the world is addicted to oil. And what we see the projections to the future is that alarming it might be because on the one hand you have the OECD countries doing a good job --

Greg Dalton: The developed economies. The developed democracies.

René Ortiz: The built economies. This is what they put themselves into OECD category, doing their own and doing almost rapidly to the extent that one could say that by 2035 or 2040, all the scenarios including OPEC scenarios, they all talk about almost a flat growth on energy consumption on these developed countries, which means they are becoming extremely efficient and that is good. However, in the same scenarios, you could see the non-OECD countries which are more than the two-thirds of the entire world, planet population.

Greg Dalton: That’s the organization for economic cooperation and development, OECD.

René Ortiz: Yes. They are climbing almost exponentially to the extent that, according to those scenarios, by 2025 or 2030, the world may need production in the order of 110 or 111 million barrels a day from where we are which is 92. It’s almost 20 million barrels extra. I wonder and this is probably the most important question that will be raised in Paris. And in that Summit, they are going to have to address this question –- whether or not it is possible for this developing world. This other is not a half. It’s over two thirds actually. Whether or not to jump in the science and technology; they don’t have it, but they can profit out of it like they did with the cellular phones. Today, a country, an example, Ecuador, of 14 million population, small country. But 16 million cellulars in the hands of the people. In other words, some people have more than one. They feel communicated. They feel themselves that they are in the world. They are part of the world system.

So, in my view, these technological advancements that the world had seen, particularly coming from the OECD countries, the developed countries, has got to come downwards to their world. In order to actually achieve what we were looking for which is a less and less fossil fuel consumption economy.

Greg Dalton: Let’s ask Leila Salazar-Lopez. There’s a lot of oil in the ground in Ecuador in the Amazon. You think it should stay there; but couldn’t some of that extraction help the people in the local economies there if it’s done properly, if it’s done well?

Leila Salazar-Lopez: If it’s done properly? That’s the question. But I think we really have to step back a second and look at, you know, you just mentioned the global climate conference that’s going to be taking place in Paris and it makes me think of Copenhagen and what our global leaders, our global governments have committed to. They committed to keeping our planet under 2 degrees.

Greg Dalton: That’s 2 degrees Celsius warmer.

Leila Salazar-Lopez: 2 degrees Celsius.

Greg Dalton: From pre-industrial levels.

Leila Salazar-Lopez: So, in order to do that, in order to keep our planet under 2 degrees Celsius, we must keep 80%, three quarters of fossil fuels in the ground and we must transition to 100% renewables by 2030. So talking about technology, we need to advance and increase the technological advances of renewable energy. The technology is available, but where is the political will? We need our global leaders, our local leaders, we, all of us, need to push for an advance renewable energy technologies and kick our addictions to fossil fuels.

And, you know, there are some places, we’re not going to do that overnight. There are some places that where we should start. The Arctic is one of those places we should start. The Amazon is another, and since I work at Amazon Watch where we’re dedicated to protecting the Amazon rain forest and advancing indigenous people’s rights. And indigenous peoples are the ones who are leading the way in protecting forests, and so we’re working with them to protect the world’s remaining forest and keeping fossil fuels in the ground. And the Amazon is one of those places that, you know, indigenous people say it’s a sacred place. It’s also the source of a fifth of our fresh water. A third of plants and animal species come from the Amazon. The world’s largest river and the world’s largest carbon sink. And the amount of oil that we’re looking at and we’re thinking about actually getting out of the Amazon, Yasuni ITT for example.

The proposed plan by the Ecuadorian government to drill in the most biologically diverse place on the planet, the home to uncontacted indigenous people. The plan to drill there would be about 10 days’ worth of oil. Is that worth it? I don’t think it’s worth it and almost 800,000 people in Ecuador don’t think it’s worth it and the planet definitely cannot afford for that to happen.

Greg Dalton: René Ortiz, you’re a former secretary general of OPEC, do you agree that three quarters of the hydrocarbon the oil needs to stay in the ground to meet this global commitment for stabilizing the climate?

René Ortiz: Maybe that is the number. And if one can look at the statistics – I like to work on numbers. Take your country, the United States. From year 2005, the United States is producing more oil and today, from 2005 to 2015, 10 years, is the largest producer of oil and liquids. Last year 2014, 14-1/2 million barrels of oil and liquids is produced in the United States. It is the world’s largest oil producer over and above Russia, over and above Saudi Arabia. However, from the statistics, from 2005 on United States is consuming less and less oil. It sounds like a contradiction, produces more, consumes less, but that is a reality.

Greg Dalton: Something we never thought would happen that turned the world upside down.

René Ortiz: Absolutely.

Greg Dalton: We thought the US would import -- we produced less --

René Ortiz: And that is why this oil industry and the way the world will move in displacing oil and natural gas and coal, all these fossil fuels, the way to displace it will take some time but it’s working.

Greg Dalton: Lou Allstadt, --?

René Ortiz: And part of that displacement has been taken over by natural gas. And natural gas comes from the first Summit meeting in Rio because Rio qualified in that Summit meeting natural gas as the most environmentally friendly fuel.

Greg Dalton: Lou Allstadt, fracking is a common way to get natural gas now. Does the industry have a handle on the environmental impacts of fracking and the methane released in the process of fracking?

Louis Allstadt: I think there are two aspects of these and it goes back to the question you asked Leila as well. One is what you see at the site, the area right around it, the emissions that affect people living nearby, and things like that. You can -- thinking that you’re taking care of that by shutting something down but just having it reproduced someplace else, doesn’t really do anything to climate change. And I’m going to disagree with René on his comment on methane. Methane is by far a more powerful greenhouse gas than carbon dioxide. If you look over a 100-year period, it’s something like 35 times worse than carbon dioxide. Over a 20-year period which is the critical time that we’re dealing with, it’s about 86 times worse than carbon dioxide.

So thinking that you’re solving the problem by replacing oil with gas is just digging yourself a bigger hole. We really have to acknowledge and there is a reason that it hasn’t been acknowledged, and that is that the information on methane leakage is relatively new. We knew it was a large powerful greenhouse gas. What we didn’t know was how much was leaking into the atmosphere. The numbers don’t have to be much more than a few percent before natural gas is worse than coal in terms of being a greenhouse gas. So we actually have to control both oil and gas at the same time and reduce them both and move to renewables as quickly as we can and we’ve got to create the financial incentives to move in those directions.

Greg Dalton: And let’s talk about that because a lot of the oil companies have sold off their renewables business. Chevron moved out of Chevron Energy Solutions. Shell has sold a lot of things. They don’t play there well. It’s not what they do. So what is the path for oil companies in the clean energy economy?

Louis Allstadt: I was on a previous panel with you where someone from Shell said they lack the competencies to move into renewable energies and I think that it’s largely true. I think there are some segments of the oil industry where people do have competencies and can move into renewables, but the oil and gas extraction side of the business is an extractive industry. It’s something where you go and you find oil or gas, you find the best spot, you drill that first, and then the next spot is less productive. Right now, we’re drilling the best spots and actually with the best rigs because there’s been such a slowdown in production that there are more rigs available, so the best rigs are out there and drilling the best spots.

And the cost of oil is probably as low as it’s going to be. Once you pick up demand at all and once you start drilling more, you’re going to be drilling less attractive spots with less capable rigs and the costs are going to start moving up again.

Greg Dalton: So it’s hard to turn football players into tennis players is what you’re saying.

Louis Allstadt: Yes.

Greg Dalton: There’s not many people can make that switch.

Louis Allstadt: And that’s partly because the renewable processes tend to be more a manufacturing type processes where the more you produce, the more you lower cost, the more efficient you get. So there is room for an exponential growth. The cell phones that were mentioned before have grown exponentially. You are seeing that same kind of growth in solar panels and in wind turbine installations and in other forms of renewable energy. So that’s where we have to kind of push toward.

Greg Dalton: And Danielle Fugere, you work inside companies trying to pressure them to think about these things move in that direction. Tell us about some of the recent resolutions inside oil companies, looking at their risk and their future profits.

Danielle Fugere: Right. So shareholders have been asking these questions. There have been two very recent votes from Shell and BP and those asked companies to look at risk to adopt greenhouse gas emission limits and two other issues. Those got very high votes because management agreed that they were appropriate and they were 98% and 99% in favor. Now, in the US, we are bringing resolutions, asking many of the same questions, and the votes are much lower. We just had a resolution asking Chevron to provide instead of investing in a high cost oil or high carbon oil to provide those dividends back to shareholders. That got a very low vote, but I think the issue is these producers, the oil majors, are the highest cost producers.

75% of the oil is held by nationals and a lot of that oil is in much cheaper conventional reserves. So the question we’re asking these companies is what are you going to be? You are the high-cost producers. Saudi Arabia now has increased production which has driven, in addition to the shale oil, OPEC has decided that it’s not going to keep prices high and it’s allowed and it has increased its production. So what is that say to the oil majors if you’ve got Saudi Arabia that can drill at $10 per barrel? Why would companies like Shell go into the Arctic and drill for $100 per barrel of oil? And these are incredibly important questions and so these are energy companies. Are they energy companies or they are oil companies? Right now, they are oil and gas companies. And this could be like Kodak who, you know, went under because it did not change.

And so these companies have to grapple with their situation. They’re the highest cost producers. Every barrel is going to be high cost, so that drives the market for renewables. Renewables are increasingly lower cost. We’re starting to see renewables leap frog. I mean you were talking about developing nations and what are they going to do. Well, they’re leap frogging fossil fuels. They’re heading to solar. And so once you have widespread solar, what’s the next issue.? Even Exxon has admitted that 30% of the gas or oil will be used to fuel cars and light-duty commercial vehicles and they’re looking at India and China as the biggest markets for that oil. So right now, we’re seeing China moving to electric vehicles, funding electric vehicles, creating and working on infrastructure, bringing subsidies to bear because one, they don’t want to be oil importers anymore and two, the pollution in these countries are amazing and they are being forced to take action by citizens.

So there is one scenario that would say, “Well, we can actually satisfy demand.” People can move around and they can purchase cars, but those may well be electric vehicles. And if that’s the case, then the need for oil reduces dramatically. And again, you can’t sustain high price of oil. So there’s a lot of threads in there but these are important questions that investors are thinking about.

Greg Dalton: If you’re just joining us, we’re talking about the future of oil industry at Climate One. I’m Greg Dalton and my guests are Danielle Fugere, president of As You Sow; Louis Allstadt, a former oil executive at Mobil Oil; Leila Salazar-Lopez from Amazon Watch; and René Ortiz, a former oil minister from Ecuador.

I’d like to go to our lightning round with our guests here at Climate One a brief yes or no question. So starting with Leila Salazar-Lopez, this is a yes or no. Fossil fuels have helped lift hundreds of millions of people out of poverty?

Leila Salazar-Lopez: Oh, that’s a hard one.

[Laughs]

Greg Dalton: Yes or no.

Leila Salazar-Lopez: Yes and no.

Greg Dalton: Louis Allstadt.

Louis Allstadt: Yeah.

Greg Dalton: ExxonMobil could be the next Kodak.

Louis Allstadt: Yes.

Greg Dalton: Danielle Fugere, divesting from fossil fuels makes those stocks cheaper for others to buy?

[Laughter]

Danielle Fugere: Yes and no.

[Laughter]

Greg Dalton: Leila, you started some bad habits there.

Danielle Fugere: She started them.

[Laughter]

Greg Dalton: René Ortiz, oil drilling in the United States is safer and cleaner than it is in countries that are poor and less regulated. More oil drilling should happen in the United States.

René Ortiz: I think the scenario is yes.

Greg Dalton: Also for René Ortiz. Courts in Ecuador are often corrupt.

René Ortiz: Yes.

[Laughter]

Greg Dalton: Lou Allstadt. Reforms after the BP oil disaster in the Gulf of Mexico protect coastal economies and make the oil industry more accountable?

Louis Allstadt: No.

Greg Dalton: René Ortiz, would you like to buy an electric car?

René Ortiz: By all means, yes.

[Laughter]

René Ortiz: As a matter of fact, if I may, I was the first to have solar panels in Quito when I finished my Tenure of Office. That is 35 years ago. The first to have solar panels but it was for water heating. Okay, now I said it’s my turn to move into solar foldable type panels which I’m going to transfer my house so it could become the showcase and of course, the electric car.

Greg Dalton: All right. Maybe one made here in California or at least the United States. Danielle Fugere, fossil fuels will run most economies for decades?

Danielle Fugere: For the next decade, yes.

Greg Dalton: Decade, take off the s?

Danielle Fugere: Alright.

Greg Dalton: Louis Allstadt. Energy executives who knowingly deceive investors about climate risks should be personally accountable?

Louis Allstadt: Yes.

Greg Dalton: Alright. That’s the end of our lightning round. How did they do? I think they did pretty well.

[Laughter]

[Applause]

[CLIMATE ONE MINUTE]

Announcer: And now, here’s a Climate One Minute.

Oil prices are the lowest they’ve been in over five years. That could spell trouble for oil producers, and give Americans another excuse to rev up their engines. But when Kate Gordon of the Risky Business Project came to Climate One, she reminded us that the only sure way to protect ourselves from the vagaries of gas prices is to curb our appetite for fossil fuels.

Kate Gordon: The one thing that is predictable in oil markets is that they're volatile. And we will see unpredictability going forward. And we'll see that because of a range of things, it's not just about production and demand. It's also as we know from Katrina about extreme events. It's about political instability, there's a number of things that affect these markets. So for consumers I think the key is to keep our eye on -- and policy makers, our eye on reducing vulnerability to that kind of volatility. Doing that through reducing vehicle miles traveled, that's absolutely happening in the US. So whether that's pushing electric vehicles, trying to move the vehicle fleet more into the electricity side, which has become far more renewable. Whether it's getting upgrades to vehicles that are newer and more efficient, that's the whole cash for clunkers thing. There's lots of people especially here in California driving 25-year or older cars which are huge smog contributors as well as being incredibly inefficient. So thinking about those transitions to new models of driving and to getting ourselves away from this model of having one kind of engine and one kind of fuel is incredibly important.

Announcer: Kate Gordon, senior policy advisor for Risky Business, spoke with Climate One in February. Since then, after a summer vacation bump, the price of crude oil has dropped by fifteen percent. Now, back to Greg Dalton and his guests at the Commonwealth Club.

[END CLIMATE ONE MINUTE]

Greg Dalton: Leila Salazar-Lopez. I’d like to ask you about the strategy for the environmental movement is often to attack supply, to try to keep it in the ground, to go after the companies. That didn’t work so well for the war on drugs, to try to keep it, you know, down south, not coming into United States. As long as there’s demand, someone’s going to meet that demand and maybe the price goes up. So I’d like to question you on the strategy of attacking supply rather than looking at the demand side of energy.

Leila Salazar-Lopez: Well, it is about supply and demand, but, you know, we have to think beyond the short term. We have to think in the long term and you know, to the question that you just asked Danielle -- is it a decade or is it decades? We were talking about between now -- for the Amazon we’re talking about between now and 2020 to stop deforestation. We need zero deforestation for the Amazon, which means we need to keep fossil fuels in the ground because fossil fuels exacerbate deforestation. When we talk about our dependence on fossil fuels, we need to transition in the next 15 years. That’s the amount of time that we have. When we’re thinking not the short term or thinking long term, we’re thinking about our kids and our grandkids and the future that they’re going to live on this planet. We are heading towards an unlivable planet if we don’t make drastic change now. We have to. We don’t have a choice really but to transition away from fossil fuels in the next 15 years.

Here in California, our state has committed to 50% by 2030 and that’s an applaudable goal, but we need to be calling for a 100%.

We need to think about, you know, what has already resulted from, you know, a 150 years of industrial development and dependence on fossil fuels. You know, the first thing I can think of when I think of, you know, our dependence on fossil fuels and the Amazon, I think of Chevron. I think of Texaco in Ecuador. I think of the toxic legacy that this company left in the Amazon. This is the company that set the stage for how oil development should be done, not only in Ecuador but across the Amazon. And this company intentionally and deliberately violated industry standards, went into Ecuador and drilled and dumped 18 billion gallons of toxic wastewater into unlined pits.

Now, there’s a toxic legacy that remains to this day and this company, you know, says that it’ll fight this until hell freezes over. The Ecuadorian courts actually ruled - after 20 years, the Ecuadorian courts ruled that this company was guilty, was liable for environmental destruction, and they face a $9.5 billion judgment, but they said they’re going to fight it until hell freezes over. That’s why we were so disappointed frankly to see that Chevron’s CEO was winning an award by the Commonwealth Club back in April. And you know, this is a company that has a toxic legacy on its hands, and you know, we can’t afford that kind of legacy to continue.

This is a company that says they use best practices. They will, you know, use top industry practices. They have policies to avert destruction, and the reality is -- there is no real safe way to drill in the Arctic or the Amazon.

Greg Dalton: Let’s ask René Ortiz. You are oil minister in Ecuador during some of that time. Did bad things happen and who should be responsible?

René Ortiz: If we look at the past, we will always have costs to blame on us and our grandparents and our great grandparents. But in my term of office, I could assure you that we used the same technology that you use in the offshore drilling. For us, the general days are all offshore, really offshore. Of course and it’s kept that way.

Greg Dalton: But you had less environmental regulations at that time and Ecuador was less developed and the state oil company --

René Ortiz: Today there are enough environmental rules and of course, they are not perfect. They can’t be, of course. For the ongoing business that is there because you cannot stop that. It is an ongoing business but you can make it more perfect. In other words, you can move from these good practices to best practices. And best practices in my view -- and this is what I have been advocating in the last 5 years -- best practices is commitment, ethical commitment. You cannot rule that in written. There are no laws for that. It is ethical commitment of the oil industry to do their best. No other good. The good is you apply the law, you pay your taxes, and you develop relationships with the communities, and so on and so forth. No, no, no. We don’t need that. We need the oil industry. For this remaining part of their history which is not going to be a short one. Of course, it’s going to be a long term. But we need that industry to be in the best practices. Because we can’t tolerate another explosion in the Gulf of Mexico like the BP. No we can’t because that was negligence. It was finally negligence. What it means that human beings, we, Lou and I, did not believe each other.

He said, “We need 7 blowout preventers,” and I said as an operator, “No, I don’t think. With 2 is enough.” They cost about $200,000 or $ 250,000 each blowout preventer. I was looking at the cost and Lou was looking at the engineering science. My decision as an operator was 2 and it blow up.

Greg Dalton: I want to ask Leila Salazar-Lopez. There’s something called Equitable Origin and that is sort of a certification. The idea that that oil can be green, sort of like we have LEED buildings that are certified or fair trade coffee. There are two fields operating in Columbia that are certified. Can this oil be done responsibly with best practices for the time remaining that we’re using oil?

Leila Salazar-Lopez: Well, I believe and we believe at Amazon Watch that there should be international standards that are abided by, right. So Equitable Origin is working towards standards in the oil industry. Ironically, they began in Ecuador and they’re no longer in Ecuador anymore. And, you know, it’s quite a coincidence in Ecuador there’s actually an oil spill a week. And I would have to completely disagree with Mr. Ortiz about the practices that are currently in operation in Ecuador and that have continued after Texaco that, you know, they’re good or they need to be better or they need to be the best. I don’t think that, we don’t think that the best in the Amazon is good enough. Because drilling in the Amazon, in the most sensitive ecosystem such as Yasuni National Park or even in Columbia where Equitable Origin is certifying. You know, there are some places that need to be off limits.

You know, if Equitable Origin standards abide by international standards, abide by biological or cultural climate change standards, then those are good standards that should be held up for the entire industry to abide by. Unfortunately, there are very, very few cases. I would argue that, you know, places like Yasuni ITT or the areas in and around Yasuni because it’s not just Yasuni --

Greg Dalton: That’s a national park, we should say.

Leila Salazar-Lopez: Yeah. Yes.

Greg Dalton: National Park.

Leila Salazar-Lopez: Yasuni is a national park which is one of the most biodiverse places on the planet, which we have been working to protect and it’s not only Yasuni that’s under threat -- it’s the entire Ecuadorian Amazon that surrounds it. And these are places that are indigenous peoples’ territories. They’re recognized by the government as indigenous peoples’ territories. They have their own special protections including the right to consultation and consent, and most of the communities in the Ecuadorian Amazon, although the government has said they consulted them and most of them in the Southern Ecuadorian have said no and they have a right to say no and that needs to be respected as well.

Greg Dalton: Louis Allstadt. Is it true that the industry doesn’t have a great record of sort of raising the income levels and economic development of the areas where extraction happened? A lot of the money from Nigeria goes out of the country and the locals don’t benefit other than they get some pollution and maybe a few jobs.

Louis Allstadt: This is not only in less developed countries. It’s right here. The industry tends to go through boom-and-bust cycles. During the drilling period, you get a lot of activity and you get some local activity that goes with it. As soon as the drilling is finished, there’s far less activity going on. It takes far fewer people to operate the fields than to drill them, and they go bust. You can see it happened in Pennsylvania when the drilling backed off. Some of the towns that were booming during the shale boom have already subsided and it has happened over and over again. With example after example, drilling is not a great economic boom for the local people.

Greg Dalton: If you’re just joining us, we’re talking about the future of the oil industry. That’s Louis Allstadt, a former executive of Mobil Oil. Our other guests today at Climate One are Danielle Fugere, president of As You Sow and Leila Salazar-Lopez from Amazon Watch and René Ortiz, a former oil minister in Ecuador. I’m Greg Dalton.

I’d like to talk about the impact of Iran coming into global oil markets. René Ortiz, you used to be head of OPEC. Is this going to drive prices down? There’s a big deal between the US Western countries and Iran right now. Is that going to drive the prices low or is it going to make it harder for renewables to compete?

René Ortiz: There is always a risk and I think the low price scenario is a risk. It’s a risk for everybody in the sense that it will touch different industries.

I agree with Danielle that -- well, I think it was Lou that said that renewable energy industries are much more manufacture, and that is very important for us to distinguish from the oil extractive industry because manufacture tends to keep employment for instance. It’s important. Nevertheless, when projects are developed, obviously during the construction period, we always have the higher contracting; in other words, a higher employment. But once it becomes operatable, then you come down in numbers. And this is the risk I would like to talk, not in a low price scenario. The risk is that oil companies, not only the US companies -- and the world is full of all these oil companies including the national oil companies -- they will start cutting, and this is a high risk in my view. They will start cutting on the social. They will start cutting on the environmental. And governments should look at that and governments should not really depend on that. They should really continue enforcing environmental and social standards and laws and regulations and telling them, “You do your business at cutting cost elsewhere” and that includes regretfully in that side of the shareholders. And that will lead to obviously other forms of energy which are much more manufacturing and more lasting ones in terms of employment. So it is a risk in this low price scenario, and the oil coming in. There’s already growth.

The growth is approximately 2.5 million barrels per day, which means we are in the last 15 or 18 months of this glut. I mean 2.5 million barrels per day. In 10 days, it’s 25. In 100 days, it’s 250 million glut in the market. In 1000 days, it is 2.5 billion barrels and that exerts a pressure to keep a low price scenario as it is today and probably by 2016, it will be much lower in price.

Greg Dalton: Louis Allstadt. We’ve had William Reilly who was chair of President Obama’s commission after the Deepwater BP Oil spill and he said there was concern that when prices are low, companies cut corners just as René Ortiz just said, on safety, on health and environmental and things like the BP Deepwater Horizon happened. Has that been your experience?

Louis Allstadt: I agree that there’s a huge danger of that. The oil companies have cut their capital budgets 40% to 60% off of what they had been spending, some even more than that, and some of those cuts are simply new wells that they won’t drill. But some of those cuts are in maintenance that is needed to keep the facility safe. So I agree completely. This is the time when government regulators should be extremely vigilant to make sure that all of the safety things are being looked at and held regardless of how much the companies have to cut on their new drilling.

Greg Dalton: Let’s go to audience questions. Welcome to Climate One.

Paul Pasamino: Thank you. My name is Paul Pasamino. I just have a question. You mentioned Chevron specifically and due to the fact that the Supreme Court of Canada recently voted unanimously on behalf of the Ecuadorians to allow them to pursue to seize Chevron’s assets there to cover its $9.5 billion debt it owes for cleanup. How do you think that will affect other companies’ intentions to drill in the Arctic or in the Amazon if their impunity has finally ended and Chevron is forced to pay for the damage it deliberately caused?

Greg Dalton: Louis Allstadt. We should also say that there was a US court that found in 2011 that the Ecuador verdict was obtained by “coercion, bribery, money laundering, and other misconduct.” So lots of courts in lots of different countries deciding things. But a question for Louis Allstadt.

Louis Allstadt: I don’t know much about the specifics of the Ecuadorian ruling or the ability of Canada to enforce it, but I do think that this kind of thing makes companies sit up and take notice and be more careful. So --

Greg Dalton: Danielle Fugere. Does this litigation, you look at a lot of investor risk and disclosure and trying to get companies to disclose their climate risk and their risk of the activities. How do you see that case?

Danielle Fugere: It is an important case, and as Louis said, it will affect how companies operate. At the same time, it has been going on for years, and you know, it’s time that it be resolved and these companies move forward. From a shareholders’ perspective, I think that the bleeding needs to end and the companies need to move forward and address real problems that we have today which is climate change and how these companies are going to be business in 50 years.

Greg Dalton: Louis Allstadt. Why don’t companies just settle? I mean if this was a civil action, there’d be some lawyers would get together, have a few beers, cut a deal --.

Louis Allstadt: Some do.

[Laughter]

That’s the more usual way to settle these things. I don’t know why this one wasn’t.

Greg Dalton: Next question. Welcome to Climate One. We’re talking about the future of oil.

Adam Zuckerman: Great! Thank you. My name is Adam Zuckerman. So there has been a lot of talk about Yasuni ITT. I read that in the EIA -- there’s no plan to re-inject formation waters, there’s no plan to deal with an area that’s almost constantly flooded, and there’s also no plan really to deal with uncontacted indigenous peoples. And there’s even a company Sertecpet, an Ecuadorian company, which is proposing to build roads there.

So my question is both for Leila and Minister Ortiz. Do you think that this lack of real regulation around the most biodiverse place in the planet is due to the pressure that China is putting on Ecuador? Minister Ortiz, I know you’ve been critical of the role of China in oil prices in Ecuador.

Greg Dalton: So let’s let Minister Ortiz take that first. China is hungry for energy. They’re looking for it wherever they can get it and they can push some little countries around to get it.

René Ortiz: Well, I think what we ought to do is to have the leadership of government pressuring or with incentives or the oil industry that is there to move into best practices, to move into certification, like the EO certification. But if you set an example because this government have national oil companies which compete with private sector oil companies. And actually, they have different kind of looking at. They look at the national oil companies in one way and the private sector oil companies in another way. This is so biased. And I think if we can actually come out from Paris, for instance, with a decision, with a recommendation, with whatever is suggesting that says government companies should lead certification because that a step forward. You agree with that Leila?

Leila Salazar-Lopez: Uh-huh.

René Ortiz: It is a step forward because this will lead into better and better regulation, better and better behavior of the industries, not only the oil industry -- all the industries are behaving better.

So I think if these national oil companies take the leadership in complying with standards like these best practices, am I associated with them? Yes and I’ve been advocating on these best practices because it’s more ethical and it comes as a commitment from the oil companies, the oil industry in general I would say. So if the government companies are actually taking the leadership as it happened exactly as Leila said in Columbia. Well, this government company in Ecuador is disregarding this opportunity, because it is an opportunity.

The indigenous are also working on this and they’re even working much further along. They are looking at something that I had proposed to them which is property rights. Because when the property is owned by the government, they just disregard their behavior in managing those properties. But when property is in our hands as it happens in some places, here in the United States and Canada, so you have a different ball game. You will have communities looking after their property if they have some rights in that property.

Greg Dalton: Let’s ask Leila Salazar-Lopez to get on that question. We’ll go to our next one.

Leila Salazar-Lopez: Well, indigenous peoples have been looking over after their ancestral territories for thousands of years and I would agree with you; when they have -- they have the most to lose from any destruction or any disturbance or any increased oil expansion into their territory.

So that’s why most indigenous federations and indigenous nationalities in the southern part of Ecuador have said no development. No to new oil development. And that’s what we’re talking about when we say keep fossil fuels in the ground. We’re talking about -- let’s start somewhere and say, you know, let’s start with the places where people - the most biodiverse places on the planet where indigenous people are saying, “We don’t want oil development here. We want to protect our forest.”

And in the Oriente in the northern part of the Ecuador in the Amazon, that’s where Texaco was. That is where there is oil development. That’s where a massive reserve has already been found. That’s where there are roads. There’s oil infrastructure already there. That is actually where some indigenous peoples and some nationalities and organizations are saying, “Hey, we’re already surrounded by this. We’ve already lost most of our forest. We’ve actually already lost most of our cultures. So, you know what, yeah, we want a piece of the pie. If it’s going to continue, we want royalties. We want some control over it.” I would agree with you on that. Well, they should. You know, they’ve lost most of their land and life and culture, so they should get a piece of the pie. And they should also get, you know, going back to Chevron, they deserve to have a clean and healthy environment. They deserve that just because it’s right, its’ what is right and that is what we continue to tell Chevron. It’s the right thing to do, stop spending thousands and thousands of dollars on lawyers to avoid justice. Do the right thing and move on and improve practices, and you know, that’s just the right thing to do.

Greg Dalton: And people on the Gulf of Mexico might say the same thing. There a lot of people down who like the industry, they benefit from the industry and that would be a place to continue development rather than go into the Arctic or --

Leila Salazar-Lopez: But in places where the communities are saying, “No. We want our rights respected. We want our territories respected. We want our living forest. This is our solution to climate change.”

We’re not just talking about reducing emissions. We’re talking about reducing and stopping extraction. That’s a message that we’re going to go to COP saying, with not only indigenous people from the Amazon but all across the Americas. We’re building an alliance to keep fossil fuels in the ground from the Arctic to the Amazon and that’s our message.

Greg Dalton: Let’s go to our next audience question, welcome to Climate One.

Martha Turner: I’m curious to hear your perspectives on the advantages of divestment as a means for civic action versus shareholder engagement. Thank you.

Greg Dalton: And Danielle Fugere. We had the person from CalPERS here recently, huge pension fund and she advocated for engagement and not necessarily divestment, but this California legislature forced the state to divest from coal at least.

Danielle Fugere: Right. The divestment movement has been very important in starting dialogues and asking important questions and raising issues to the forefront. So divestment is extremely important. Divestment is also something that shareholders do when they are worried about the performance of companies. This is, you know, shareholders regularly divest from companies and buy other companies. And so divestment although it has become a loaded term, it’s also just what shareholders do when they don’t think a company has sustained value or long-term value if they’re looking for long-term value. Now, shareholder engagement has brought many changes. It’s important to be talking to companies. I think now, you know, there is a move to change boards but the question is really time and how much has engagement done. I think we have for instance gotten Exxon to -- it was the first company that actually looked at this carbon asset risk and stranded assets and they did a report.

That report didn’t say probably things that everybody wanted it to say but it did tell the investors in the world, you know, we think that we are going to continue business as usual for, you know, as far as we can see into the future. We don’t think that at 2-degree policy will be put in place. All of that is important to understand how these companies are thinking. Should we invest in these? Well, now we know more about what the company is doing, what it’s planning, and how it will be operating.

And in regard to the last question, I would just say that, you know, there are currently 490 laws in effect that are already regulating carbon, that are creating efficiencies, that are creating CAFÉ standards which have caused developing nations to actually be using less oil even when they’re growing. And in Paris, there are commitments which don’t get us to where we need to go but they are commitments, and if upheld, they’re moving us in the right direction. So I think all of that is important to understand. And divestment and other movements, keep it in the ground, are incredibly important and things that shareholders pay attention to because they affect policy. They affect what happens on the ground. If the keep it in the ground movement is going to prevent drilling for 5 years or 10 years, that changes the investment issues that are under consideration.

Greg Dalton: Louis Allstadt, have you personally divested from oil stocks?

Louis Allstadt: Yes. I divested all of the Exxon Mobil that I owned and I’ve pulled as much as I can find and get at easily out of mutual funds -- changing mutual funds to funds that have less carbon.

Greg Dalton: And did you do that for moral reasons or because you think it’s a bad bet?

Louis Allstadt: Both.

Greg Dalton: Danielle Fugere. Your current organization has a new tool where investors can see how much oil in their portfolio.

Danielle Fugere: Right. As you were talking, many people hold mutual funds and it’s very hard to understand and know what is in a mutual fund. And so we’ve created, since people were asking us in the divestment movement where people pledged to divest from fossil fuels, but the question is, “If I hold mutual funds, how do I know if I’m holding them” and this tool Fossil Free Funds allows you to type in the name of your mutual fund and understand what is being held in that so that people can make their own decisions. Do I want to exclude oil and gas companies? Do I care about coal companies? Do I care about electric utilities that have coal fired power? So this is just a way to look into what you hold and to take power over what you want to hold. And it also allow you to , it will give us a list of those that are actually fossil free according to what you defined it as, the parameters you set.

Greg Dalton: Fossilfreefunds.org.

Danielle Fugere: Fossilfreefunds.org.

Greg Dalton: Louis Allstadt?

Louis Allstadt: I should just add that what I did also was to take a lot of that money and put it into renewable energy into a number of different diversified renewable energy.

Greg Dalton: And we have to wrap it up, but I want to ask Leila Salazar-Lopez -- what can an average person do listening to this, the take away here when they walk out the door and when they stopped listening to this radio program or podcast? What can a person do to make an impact on these issues moving away from oil?

Leila Salazar-Lopez: Well, I think we mentioned a lot of them already, and you know, we really do have to engage and pressure our governments. We do. We have to, each one of us has the power and the will. If we really do believe that we can make a difference, then we have to engage and pressure our global leaders, but we can’t entrust our global leaders to solve everything for us. I believe in people power.

I believe that those of us, you know, all of us can take action and make change in the world. We can divest from fossil fuels. We can look into our investments. We can change our investments. We can put solar on our houses. We can buy electric vehicles. We can take individual action and we can take, you know, global action. We can’t entrust our political leaders to solve everything for us. We have to take action ourselves as well. So I encourage us all to do that. I encourage us all to take action in any way that we can. And, you know, support organizations like Amazon Watch that we can take these messages to the global leaders in Paris and beyond because it’s not ending in Paris. It’s way beyond that.

Greg Dalton: René Ortiz. What can an average person do to make an impact on this transition that needs to happen very quickly?

René Ortiz: I think we need to discuss more these subject matters. I think many people are not aware of the risks that are involved.

Greg Dalton: So by that, you mean listen to Climate One more frequently? I think that is what you’re saying.

[Laughter]

René Ortiz: Yes, why not? Actually, I think everybody could learn more on how to deal with these problems and learn a little bit more of how the industry is dealing with these problems. Not only the oil industry but the energy industry in general. How they are dealing with those questions. And most likely, this is the way we should deal with the problem.

Greg Dalton: Danielle Fugere?

Danielle Fugere: I think the world is changing. It continues to change and it’s important for everybody to recognize that those changes are not only occurring but they are possible. So when an oil company says I can’t be anything other than what I am, you know, my question is, “Is that really true?” It might be. They might not have the will but maybe they want to change with the world. So, I think change, recognizing that, putting your dollars into the opportunities that exist.

So where are those opportunities? Renewables are certainly one area that as Louis said he took his money and he put it into renewables. So investing in the future, whatever you think that that future might look like. And also politicians follow the people. I mean they often don’t lead change, and so I think that, you know, it’s important when you’re talking to your neighbors and when you’re talking to your politicians and just recognizing that we all have individual power to make change and we should act on that.

Greg Dalton: Louis Allstadt. I’d like to close with you by putting this in the context of a fossil fuel company. You spent 30 years in the oil industry. What can a person working in the industry do to exert individual power to change the system rather than leaving and working in another job?

Louis Allstadt: From inside, it’s pretty hard although you can speak your mind. I know some people that are inside the industry and that are actively with the group that I worked with that is pushing for a tax on carbon. I think the most practical thing that anybody can do is to press for some kind of a fee on carbon, whether it’s a cap and trade or I think better a fee with the proceeds returned either through tax credits or to direct payments to households. That lets the economic incentives take care of driving companies to do less with fossil fuels, to pushing renewables because they are more competitive with fossil fuels. And it’s a way to get at it without having endless, endless discussions and negotiations back and forth of who gets this little piece of that, who gets that. A simple carbon fee.

Greg Dalton: We have to end it there. Our thanks to Louis Allstadt, former executive vice president of Mobil Oil Company; Danielle Fugere, president of As You Saw, a shareholder advocacy group; Leila Salazar-Lopez, executive director of Amazon Watch; and René Ortiz, former Ecuador oil minister and former secretary general of OPEC. I'm Greg Dalton. I’d like to thank you all for coming here in San Francisco. You can listen to podcasts on climateone.org and thanks to our audience listening to on radio and podcast. Thanks for coming.

[Applause]

[END]